these shohld be clearer sorry about that.

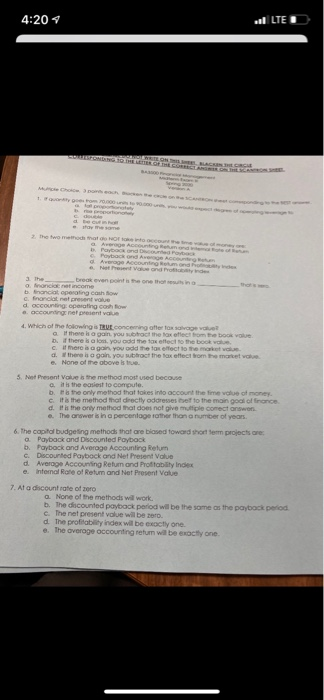

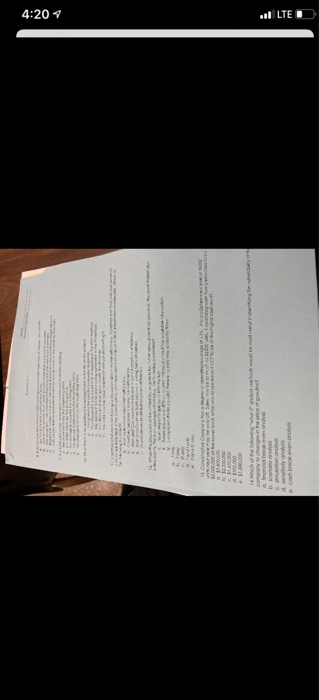

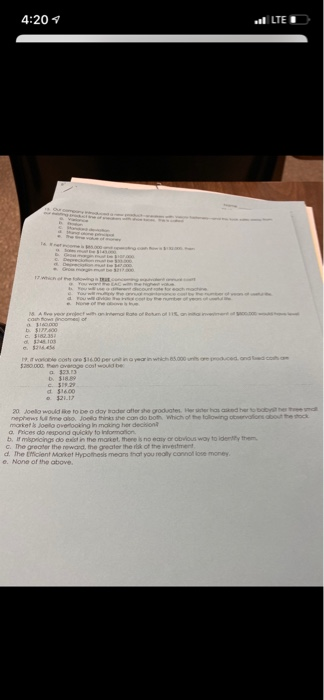

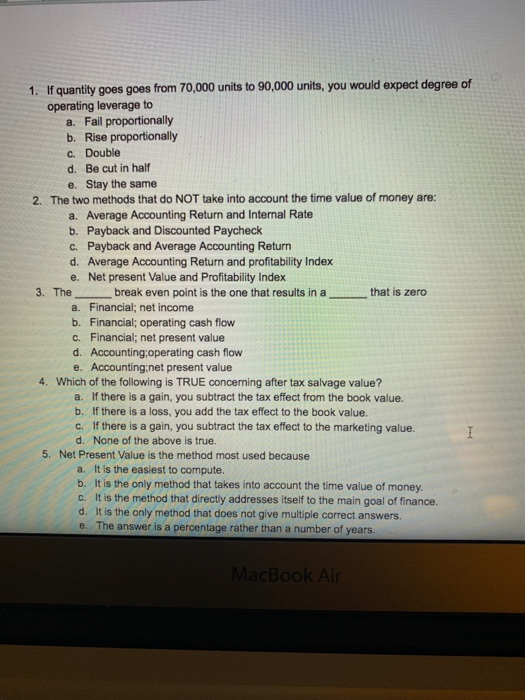

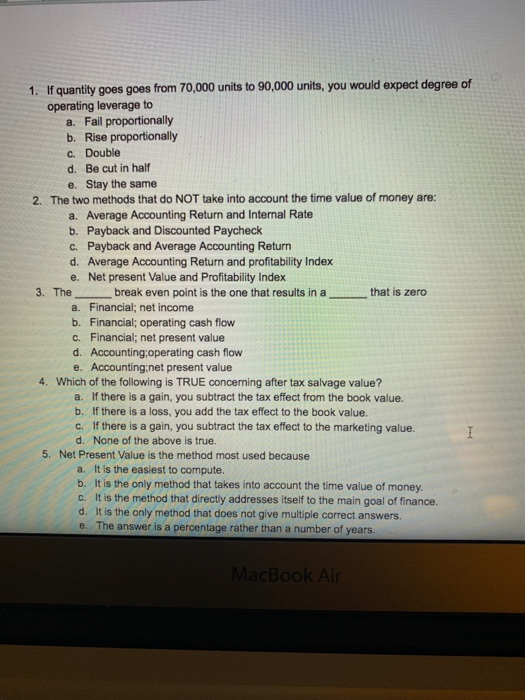

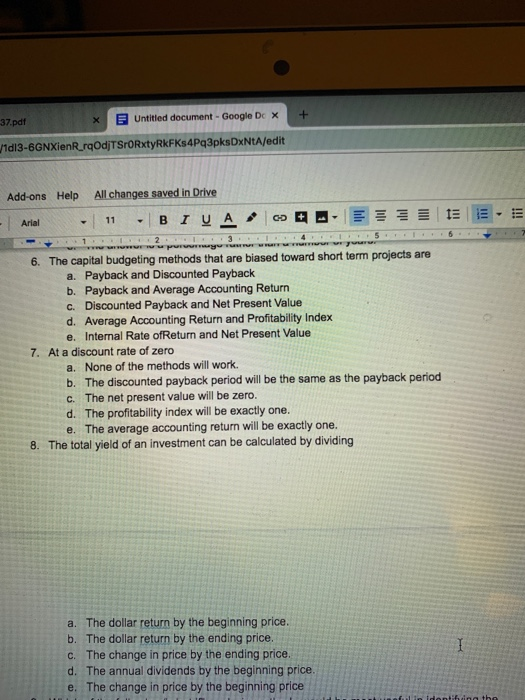

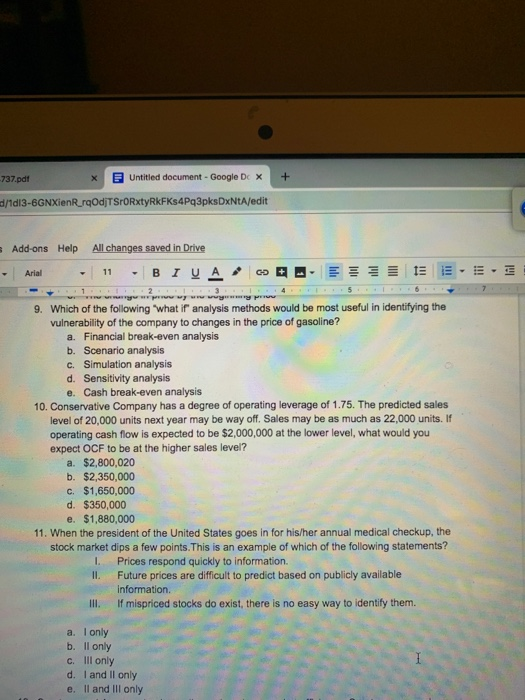

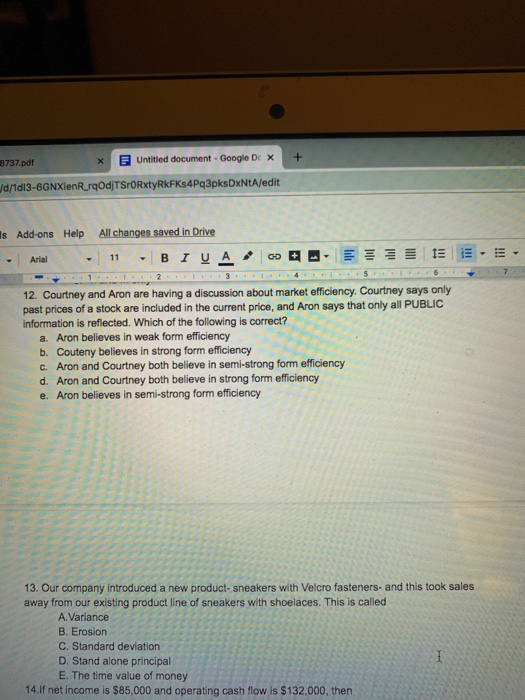

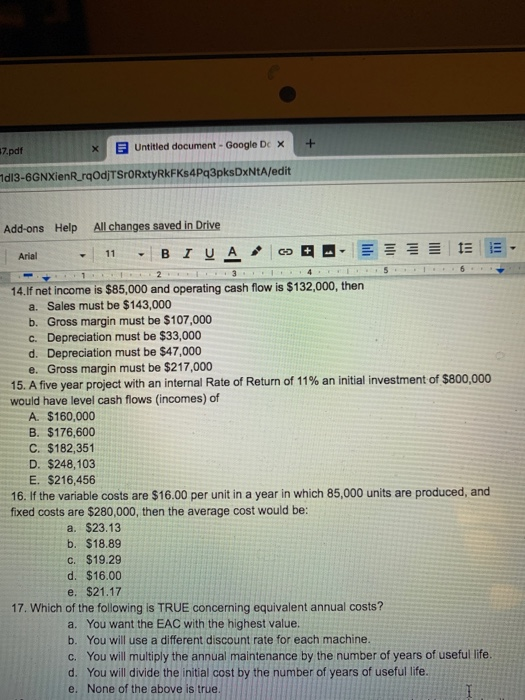

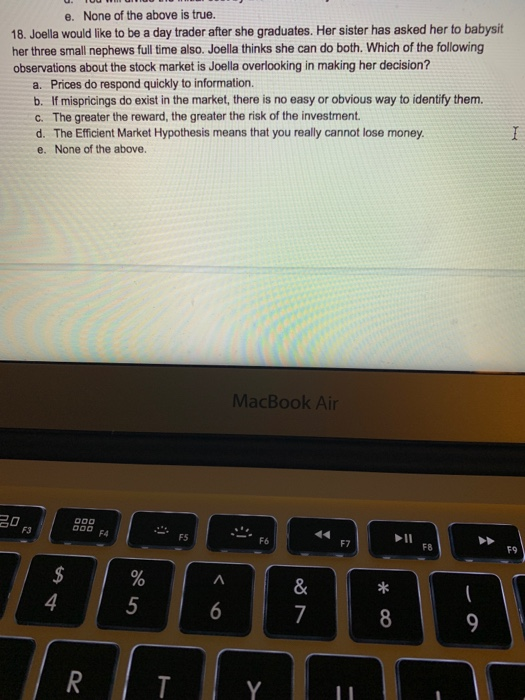

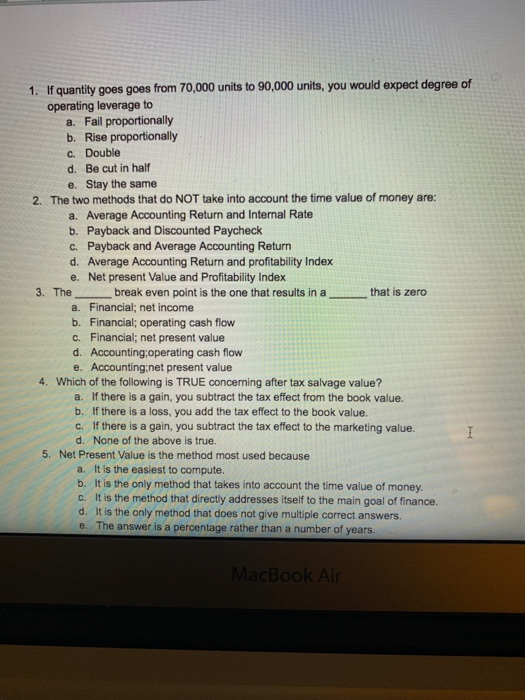

4:20 4 LTE 4. Which one lowing TVE Con g ole to b. torek o gan you react the box oflect to the book ove there is a lon, you co the tax efter he boot cat merisogon you add the tox effect to the d. there again, you wbtract the foxtect bom the market e. None of the above is true 3. Net Present Value the method most used because a. It is the easiest to compute. b. the only method that takes into account the time value of money c. It is the method that directly addresses that to the main goal of finance d. His the only method that does not give multiple comect answer e. The answer is in a percentage other than anumber of years. 6. The capital budgeting methods that are based toward short term projects are: Payback and Discounted Poyback b. Payback and Average Accounting Relum c. Discounted Payback and Net Present Value d Average Accounting Return and Profitability Index e internal Role of Retum and Net Present Value 7. At a discount rate of zero G. None of the methods will work. b. The discounted payback period will be the same as the payback period c. The not present volue will be oro. d the profitability index will be exactly one e. The average occounting return will be exactly one 4:20 4 v LIEU 4:20 4 LTE d 20 delo would to be a day traderator graduate Hers he Deprow Join the condo bom Wolongo marts g oing in her decon Prices de respond quickly to information b. Impricings do in the market there is no enrous woy to identify them C. The greater the word, the greater the risk of the inement d. The hicient Market Hypothesis means that you really connoise money c. None of the above 1. If quantity goes goes from 70,000 units to 90,000 units, you would expect degree of operating leverage to a. Fail proportionally b. Rise proportionally c. Double d. Be cut in half e. Stay the same 2. The two methods that do NOT take into account the time value of money are: a. Average Accounting Return and Internal Rate b. Payback and Discounted Paycheck C. Payback and Average Accounting Return d. Average Accounting Return and profitability Index e. Net present Value and Profitability Index break even point is the one that results in a that is zero a. Financial; net income b. Financial; operating cash flow c. Financial; net present value d. Accounting;operating cash flow e. Accounting;net present value 4. Which of the following is TRUE concerning after tax salvage value? a. If there is a gain, you subtract the tax effect from the book value. b. If there is a loss, you add the tax effect to the book value. c. If there is a gain, you subtract the tax effect to the marketing value. d. None of the above is true. 5. Net Present Value is the method most used because a. It is the easiest to compute. b. It is the only method that takes into account the time value of money. c. It is the method that directly addresses itself to the main goal of finance. d. It is the only method that does not give multiple correct answers. e. The answer is a percentage rather than a number of years. MacBook Air + -37.pdf Untitled document - Google De X 1d13-6GNXienR_rOdjTSFORxTyRkFKs4Pq3pksDxNtA/edit 15 E- S . Add-ons Help All changes saved in Drive - Arial - 11 -BIVA D - E 1. ..... ....... . . . 6. The capital budgeting methods that are biased toward short term projects are a. Payback and Discounted Payback b. Payback and Average Accounting Return c. Discounted Payback and Net Present Value d. Average Accounting Return and Profitability Index e. Internal Rate of Return and Net Present Value At a discount rate of zero a. None of the methods will work. b. The discounted payback period will be the same as the payback period C. The net present value will be zero. d. The profitability index will be exactly one. e. The average accounting return will be exactly one. 8. The total yield of an investment can be calculated by dividing a. The dollar return by the beginning price. b. The dollar return by the ending price. c. The change in price by the ending price. d. The annual dividends by the beginning price. e. The change in price by the beginning price + -737.pdf * Untitled document - Google De X d/1d13-6GNXienRrqOdjTSORxTyRkFKs4Pq3pksDxNtA/edit Add-ons Help All changes saved in Drive - Arial - 11 - BIUA DE - E I E E- ... ..wwwy www 9. Which of the following 'what if analysis methods would be most useful in identifying the vulnerability of the company to changes in the price of gasoline? a. Financial break-even analysis b. Scenario analysis c. Simulation analysis d. Sensitivity analysis e. Cash break-even analysis 10. Conservative Company has a degree of operating leverage of 1.75. The predicted sales level of 20,000 units next year may be way off. Sales may be as much as 22.000 units. If operating cash flow is expected to be $2,000,000 at the lower level, what would you expect OCF to be at the higher sales level? a. $2,800,020 b. $2,350,000 c. $1,650,000 d. $350,000 e. $1,880,000 11. When the president of the United States goes in for his/her annual medical checkup, the stock market dips a few points. This is an example of which of the following statements? I. Prices respond quickly to information. II. Future prices are difficult to predict based on publicly available information III. If mispriced stocks do exist, there is no easy way to identify them. ation s de exist, there is no a. I only b. ll only C. lll only d. I and Il only e. ll and Ill only 3737.pdf * Untitled document - Google De Jd/1dI3-6GNXienRrqOdjTSrORxTyRkFKs4Pq3pksDxNtA/edit Is Add-ons Help All changes saved in Drive - Arial - 11 - BIUAC -- E 13 EE. 12. Courtney and Aron are having a discussion about market efficiency. Courtney says only past prices of a stock are included in the current price, and Aron says that only all PUBLIC information is reflected. Which of the following is correct? a. Aron believes in weak form efficiency b. Couteny believes in strong form efficiency C. Aron and Courtney both believe in semi-strong form efficiency d. Aron and Courtney both believe in strong form efficiency e. Aron believes in semi-strong form efficiency 13. Our company introduced a new product- sneakers with Velcro fasteners and this took sales away from our existing product line of sneakers with shoelaces. This is called A. Variance B. Erosion C. Standard deviation D. Stand alone principal E. The time value of money 14.If net income is $85,000 and operating cash flow is $132,000, then + 17.pdf Untitled document - Google De x 1d13-6GNXienRrqOdjTSFORxTyRkFKs4Pq3pksDxNtA/edit Add-ons Help All changes saved in Drive - 11BI UAGE- 15 E 5 . 1 6 - 14.If net income is $85,000 and operating cash flow is $132,000, then a. Sales must be $143,000 b. Gross margin must be $107.000 c. Depreciation must be $33,000 d. Depreciation must be $47,000 e. Gross margin must be $217,000 15. A five year project with an internal Rate of Return of 11% an initial investment of $800,000 would have level cash flows (incomes) of A. $160,000 B. $176,600 C. $182,351 D. $248,103 E. $216,456 16. If the variable costs are $16.00 per unit in a year in which 85,000 units are produced, and fixed costs are $280,000, then the average cost would be: a. $23.13 b. $18.89 C. $19.29 d. $16.00 e. $21.17 17. Which of the following is TRUE concerning equivalent annual costs? a. You want the EAC with the highest value. b. You will use a different discount rate for each machine. C. You will multiply the annual maintenance by the number of years of useful life. d. You will divide the initial cost by the number of years of useful life. e. None of the above is true. e. None of the above is true. 18. Joella would like to be a day trader after she graduates. Her sister has asked her to babysit her three small nephews full time also. Joella thinks she can do both. Which of the following observations about the stock market is Joella overlooking in making her decision? a. Prices do respond quickly to information. b. If mispricings do exist in the market, there is no easy or obvious way to identify them. C. The greater the reward, the greater the risk of the investment d. The Efficient Market Hypothesis means that you really cannot lose money. e. None of the above. MacBook Air og n