These two problems go together

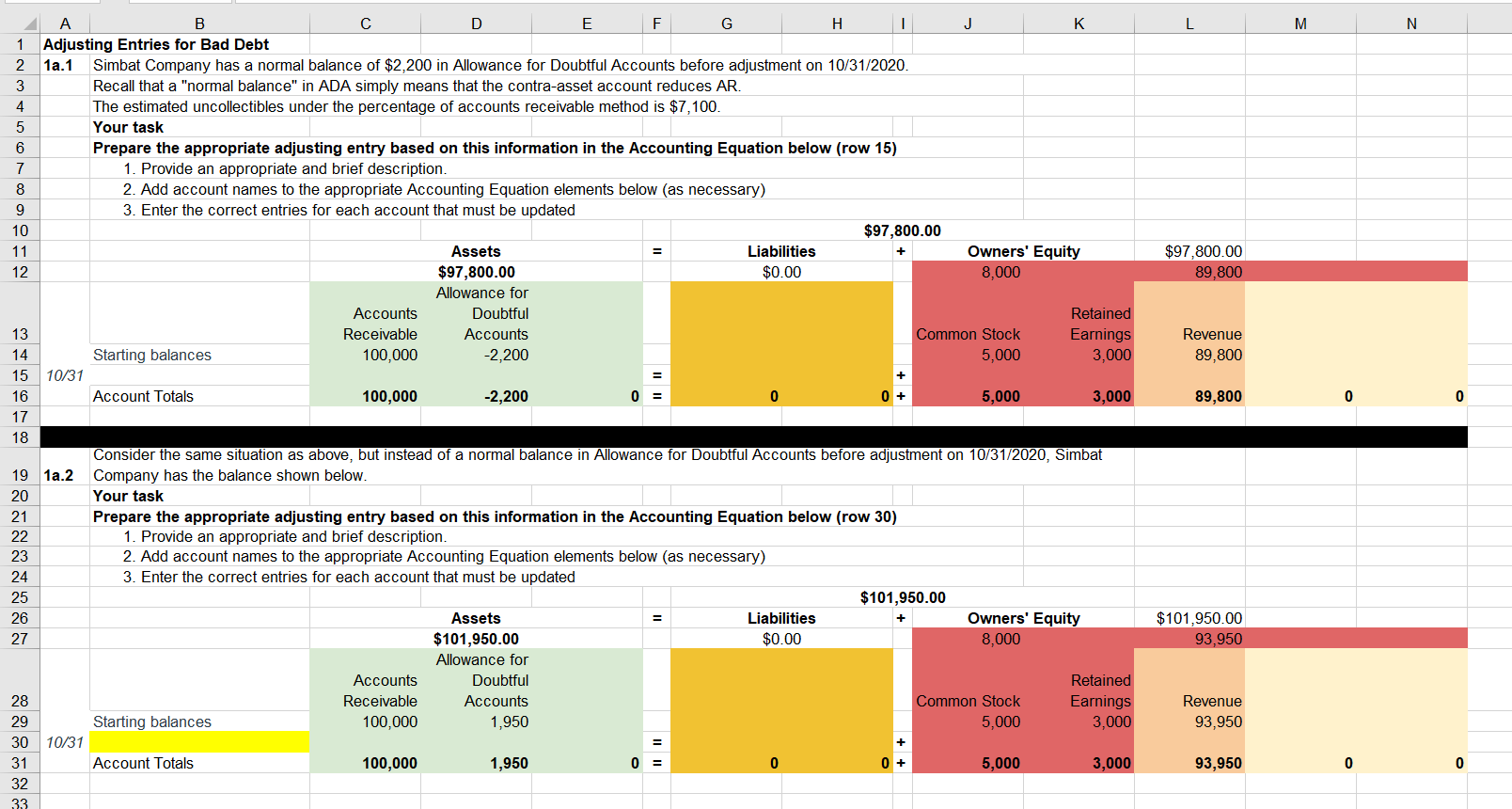

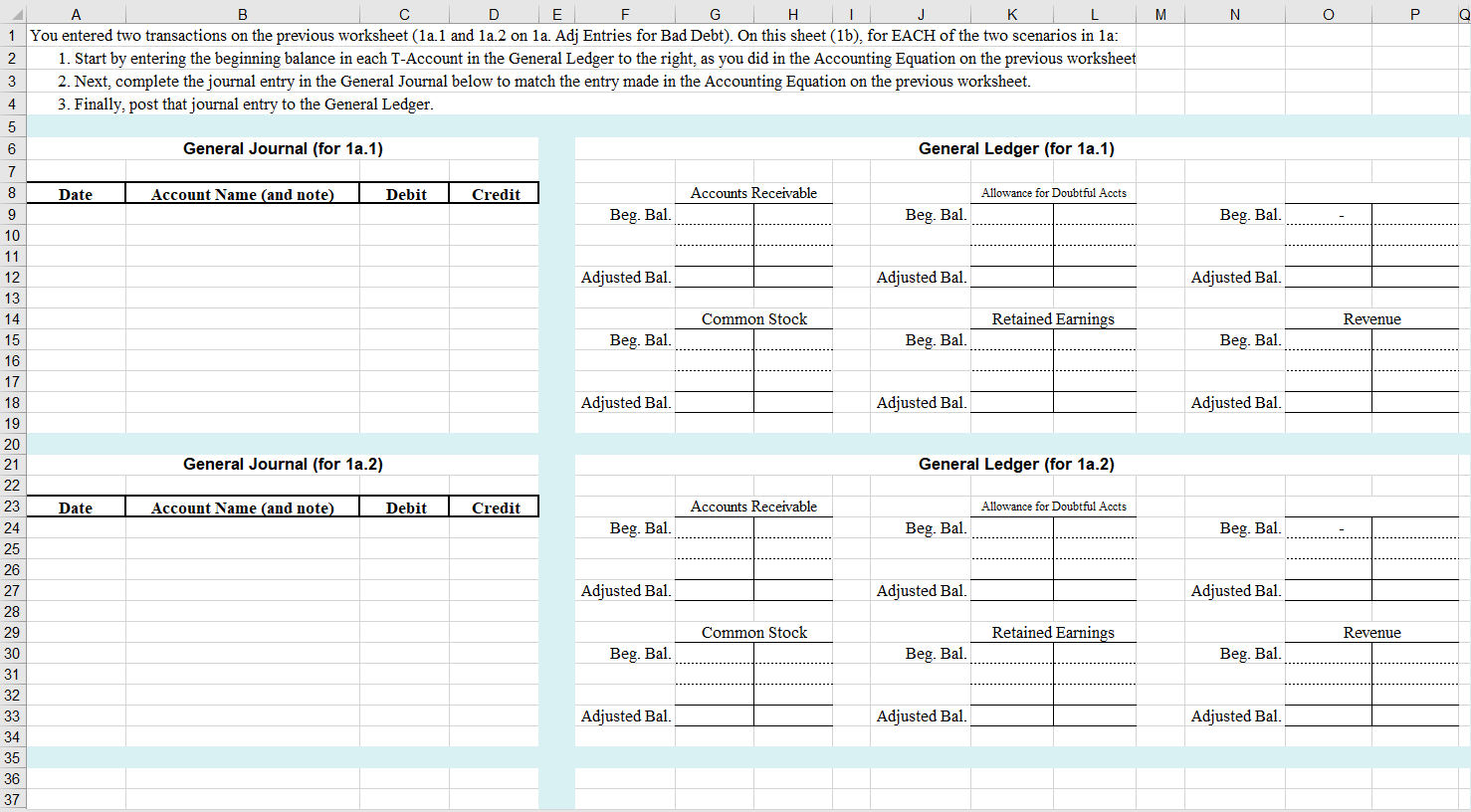

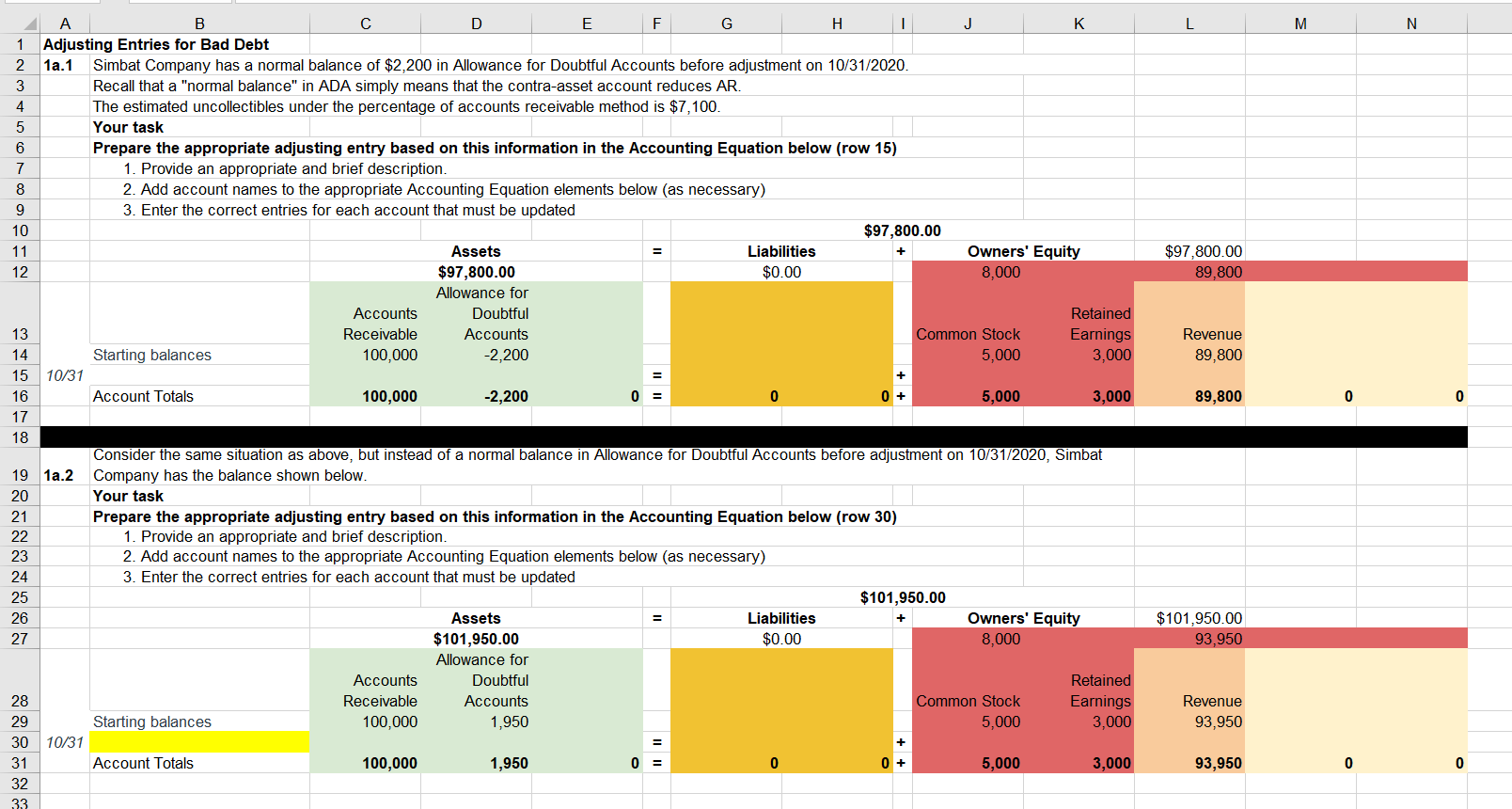

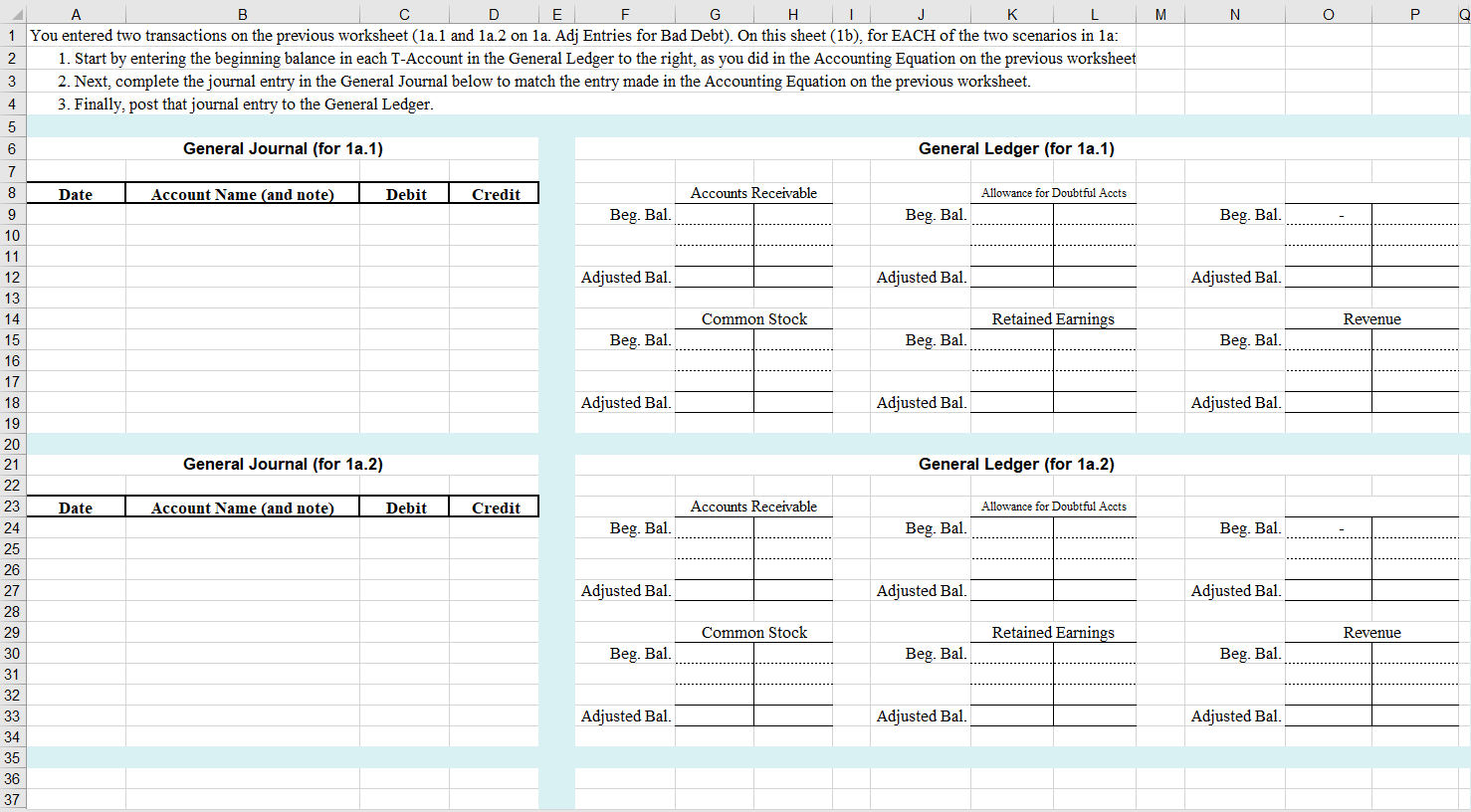

M N 1 2 3 4 5 6 7 8 9 10 11 12 A B D E F G H J K Adjusting Entries for Bad Debt 1a.1 Simbat Company has a normal balance of $2,200 in Allowance for Doubtful Accounts before adjustment on 10/31/2020. Recall that a "normal balance" in ADA simply means that the contra-asset account reduces AR. The estimated uncollectibles under the percentage of accounts receivable method is $7,100. Your task Prepare the appropriate adjusting entry based on this information in the Accounting Equation below (row 15) 1. Provide an appropriate and brief description. 2. Add account names to the appropriate Accounting Equation elements below (as necessary) 3. Enter the correct entries for each account that must be updated $97,800.00 Assets Liabilities Owners' Equity $97,800.00 $0.00 Allowance for Accounts Doubtful Retained Receivable Accounts Common Stock Earnings Starting balances 100,000 -2,200 5,000 3,000 10/31 Account Totals 100,000 -2,200 0 0 0 + 5,000 3,000 + $97,800.00 89,800 8,000 13 14 15 Revenue 89,800 89,800 0 0 16 17 18 19 19.2 20 21 22 23 24 25 26 27 Consider the same situation as above, but instead of a normal balance in Allowance for Doubtful Accounts before adjustment on 10/31/2020, Simbat Company has the balance shown below. Your task Prepare the appropriate adjusting entry based on this information in the Accounting Equation below (row 30) 1. Provide an appropriate and brief description. 2. Add account names to the appropriate Accounting Equation elements below (as necessary) 3. Enter the correct entries for each account that must be updated $101,950.00 Assets Liabilities Owners' Equity $101,950.00 $0.00 8,000 Allowance for Accounts Doubtful Retained Receivable Accounts Common Stock Earnings Starting balances 100,000 1,950 5,000 3,000 = $101,950.00 93,950 Revenue 93,950 10/31 28 29 30 31 32 33 Account Totals 100,000 1,950 0 = 0 5,000 3,000 93,950 0 0 M N O Q Beg. Bal. Adjusted Bal. Revenue Beg. Bal. D E F G . L 1 You entered two transactions on the previous worksheet (1a.1 and 1a.2 on 1a. Adj Entries for Bad Debt). On this sheet (1b), for EACH of the two scenarios in 1a: 2 1. Start by entering the beginning balance in each T-Account in the General Ledger to the right, as you did in the Accounting Equation on the previous worksheet 3 2. Next, complete the journal entry in the General Journal below to match the entry made in the Accounting Equation on the previous worksheet. 4 3. Finally, post that journal entry to the General Ledger. 5 6 General Journal (for 1a.1) General Ledger (for 1a.1) 7 8 Date Account Name (and note) Debit Credit Accounts Receivable Allowance for Doubtful Accts 9 Beg. Bal. Beg. Bal. 10 11 12 Adjusted Bal. Adjusted Bal. 13 14 Common Stock Retained Earnings 15 Beg. Bal. Beg. Bal. 16 17 18 Adjusted Bal. Adjusted Bal. 19 20 21 General Journal (for 1a.2) General Ledger (for 1a.2) 22 23 Date Account Name (and note) Debit Credit Accounts Receivable Allowance for Doubtful Accts 24 Beg. Bal. Beg. Bal. 25 26 27 Adjusted Bal. Adjusted Bal. 28 29 Common Stock Retained Earnings 30 31 32 33 Adjusted Bal. Adjusted Bal. 34 35 36 37 Adjusted Bal. Beg. Bal. Adjusted Bal. Revenue Beg. Bal. Beg. Bal. Beg. Bal. Adjusted Bal