Answered step by step

Verified Expert Solution

Question

1 Approved Answer

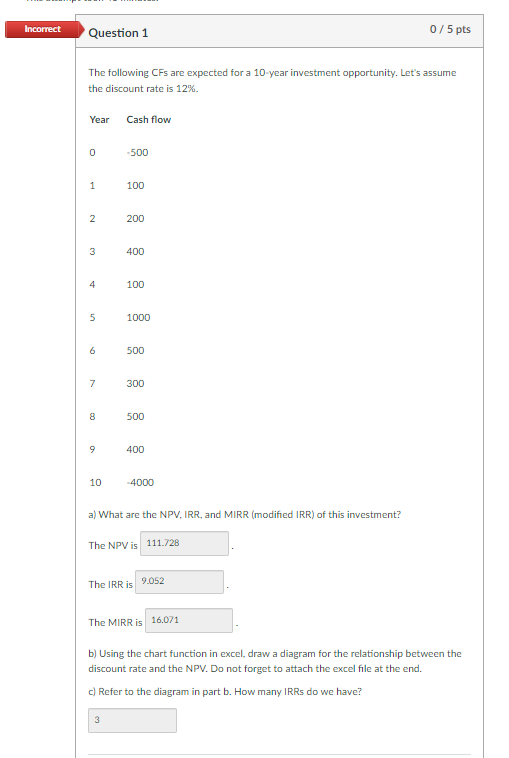

These were all incorrect answers Incorrect Question 1 0/5 pts The following CFs are expected for a 10-year investment opportunity. Let's assume the discount rate

These were all incorrect answers

Incorrect Question 1 0/5 pts The following CFs are expected for a 10-year investment opportunity. Let's assume the discount rate is 12% Year Cash flow 0 -500 1 100 2 200 3 400 4 100 5 1000 6 500 7 300 8 500 9 400 10 -4000 a) What are the NPV, IRR, and MIRR (modified IRR) of this investment? The NPV is 111.728 The IRR IS 9.052 The MIRR is 16.071 b) Using the chart function in excel, draw a diagram for the relationship between the discount rate and the NPV. Do not forget to attach the excel file at the end. c) Refer to the diagram in part b. How many IRRs do we have? 3Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started