Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Theta measures the impact of time on option values. For reasons you WIII see in this calculation, it often called time decay. The Theta

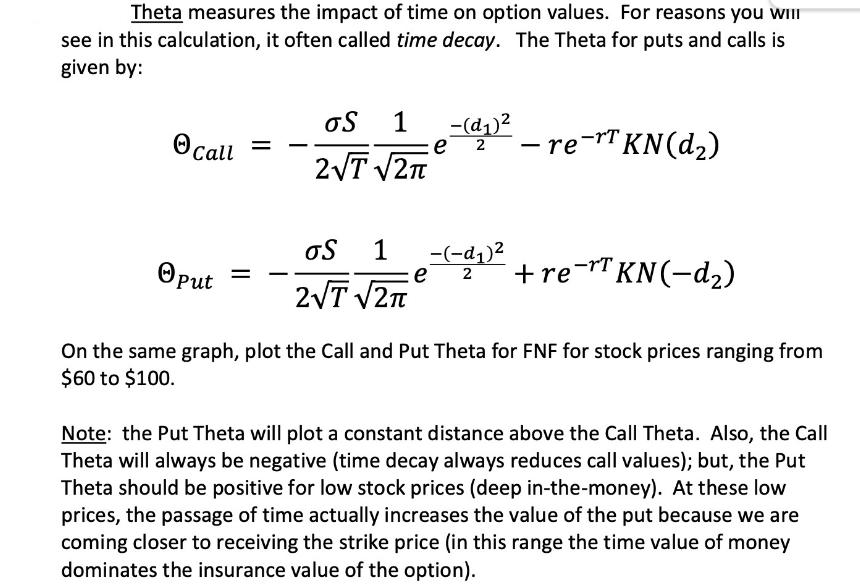

Theta measures the impact of time on option values. For reasons you WIII see in this calculation, it often called time decay. The Theta for puts and calls is given by: Call = - OS 1 2T2 -(d1)2 e 2 - -re-rT KN(d2) 1 -(-d1)2 e 2 +re-T KN (-d) put = 2T 2 On the same graph, plot the Call and Put Theta for FNF for stock prices ranging from $60 to $100. Note: the Put Theta will plot a constant distance above the Call Theta. Also, the Call Theta will always be negative (time decay always reduces call values); but, the Put Theta should be positive for low stock prices (deep in-the-money). At these low prices, the passage of time actually increases the value of the put because we are coming closer to receiving the strike price (in this range the time value of money dominates the insurance value of the option).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Theta also known as time decay measures the rate at which the value of an option decreases as time p...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started