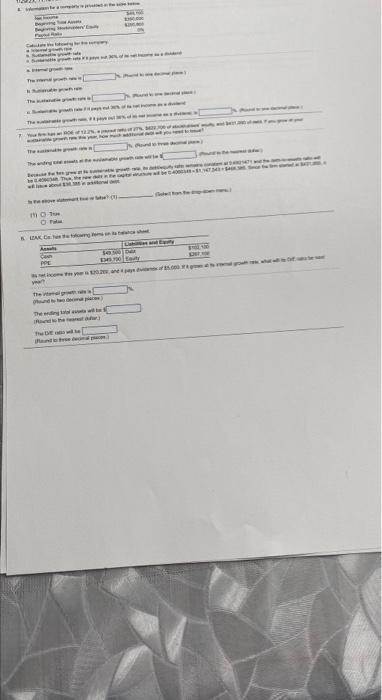

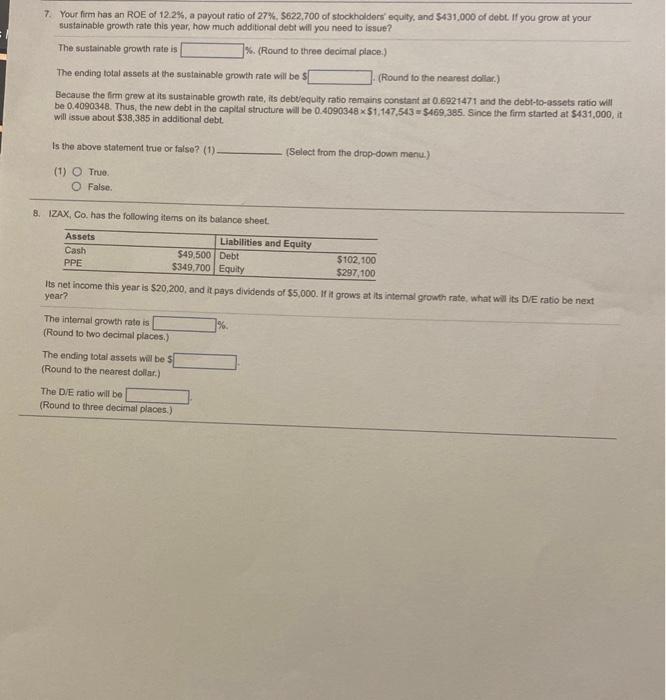

Thewataide3,+tera 7. Your firm has an ROE of 122%, a payout ratio of 27%,$622,700 of stockholders' equily, and 5431,000 of debe if you grow at your sustainable growth rate this year, how much additional debt will you need to issue? The sustainable growth rate is \%. (Round to three decimal place.) The ending total assets at the sustainable growth rate will be s (Fiound to the nearest dollar.) Because the firm grow at its sustainable growth rate, its debtequity ratio remains constant at 0.6921477 and the debt-to-assets ratio will be 0.4090348. Thus, the new debt in the capital structure will be 0.4090348$1,147,543=$469,385.5. Since the firm started at $431,000, it. will issue about $38,385 in addisonal debt. Is the above statement true or false? (1) (Select fram the drop-down menu.) (1) True. False. 8. IZAX, Co. has the following items on its batance sheeL. Its net income this year is $20,200, and it pays dividends of $5,000. If it grows at its intemal growth rate, what will its DVE ratio be next. year? The intemal growth rato is (Round to two decimal places.) The ending total assets wil be s (Round to the nearest dollar.) The DIE ratio will be (Round to three decimsi places.) Thewataide3,+tera 7. Your firm has an ROE of 122%, a payout ratio of 27%,$622,700 of stockholders' equily, and 5431,000 of debe if you grow at your sustainable growth rate this year, how much additional debt will you need to issue? The sustainable growth rate is \%. (Round to three decimal place.) The ending total assets at the sustainable growth rate will be s (Fiound to the nearest dollar.) Because the firm grow at its sustainable growth rate, its debtequity ratio remains constant at 0.6921477 and the debt-to-assets ratio will be 0.4090348. Thus, the new debt in the capital structure will be 0.4090348$1,147,543=$469,385.5. Since the firm started at $431,000, it. will issue about $38,385 in addisonal debt. Is the above statement true or false? (1) (Select fram the drop-down menu.) (1) True. False. 8. IZAX, Co. has the following items on its batance sheeL. Its net income this year is $20,200, and it pays dividends of $5,000. If it grows at its intemal growth rate, what will its DVE ratio be next. year? The intemal growth rato is (Round to two decimal places.) The ending total assets wil be s (Round to the nearest dollar.) The DIE ratio will be (Round to three decimsi places.)