Answered step by step

Verified Expert Solution

Question

1 Approved Answer

they all go together as one question At age 35, Frugal Frannie started saving $7,000 per year for retirement, with annual deposits being made at

they all go together as one question

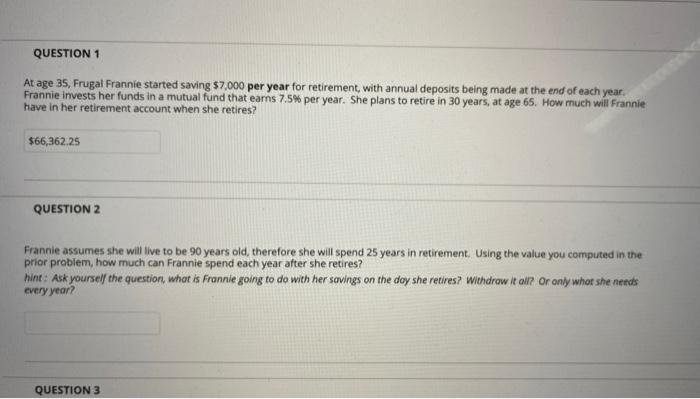

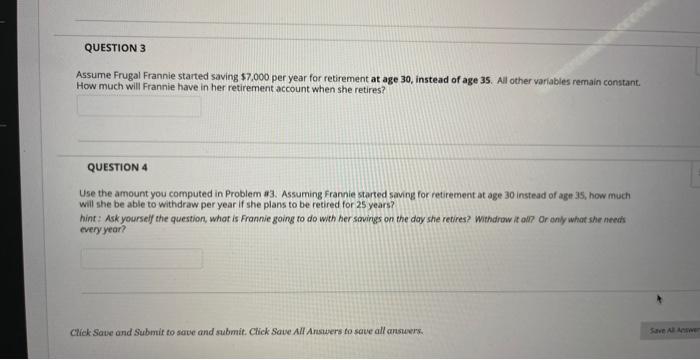

At age 35, Frugal Frannie started saving $7,000 per year for retirement, with annual deposits being made at the end of each year. Frannie invests her funds in a mutual fund that earns 7.5\% per year. She plans to retire in 30 years, at age 65 . How mueh will Frannie have in her retirement account when she retires? QUESTION 2 Frannie assumes she will live to be 90 years old, therefore she will spend 25 years in retirement. Using the value you computed in the prior problem, how much can Frannie spend each year after she retires? hint: Ask yourself the question, what is frannie going to do with her savings on the doy she retires? Withdraw it all? Or only whor she nends every year? Assume Frugal Frannie started saving $7,000 per year for retirement at age 30 , instead of age 35 . Al other variables remain constant. How much will Frannie have in her retirement account when she retires? QUESTION 4 Use the amount you computed in Problem a3. Assuming frannie started saving for retirement at age 30 instead of age 35 , how much will she be able to withdraw per year if she plans to be retired for 25 years? hint: Ask yourself the question, what is frannie going to do with her sovings on the doy she retires? Withdrow it all? Or only what she needs every year? Click Sate and Submif to sate and submit. Chek Save An Answers to save all answers

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started