Answered step by step

Verified Expert Solution

Question

1 Approved Answer

They all part of the same question but split into different parts. I will upvote, so thank you very much for trying it out! Edman

They all part of the same question but split into different parts. I will upvote, so thank you very much for trying it out!

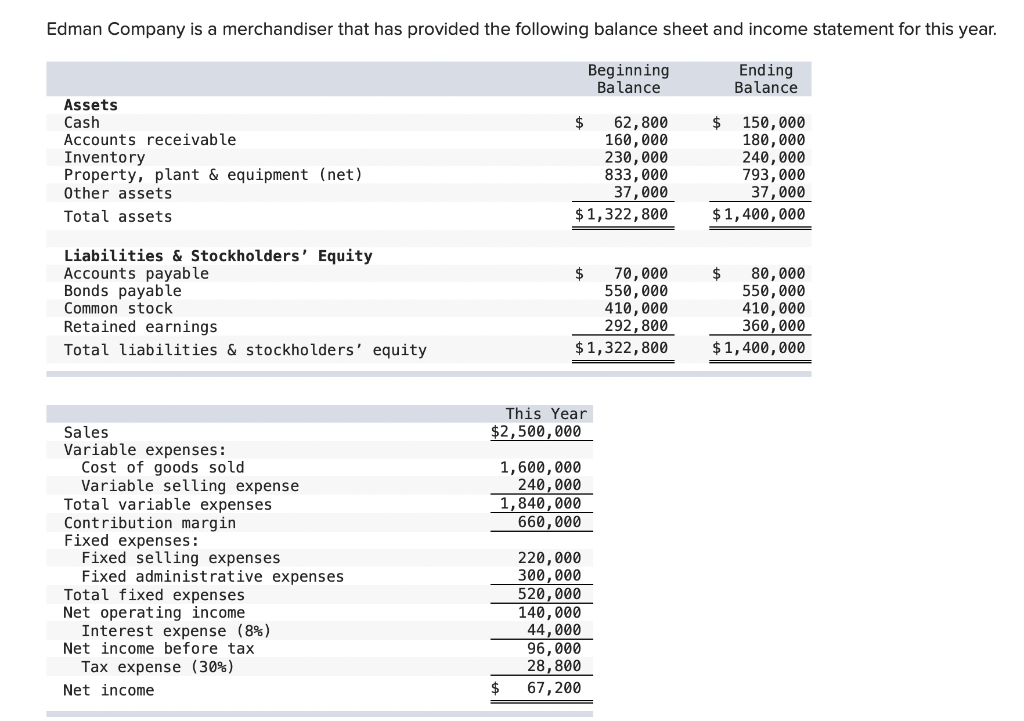

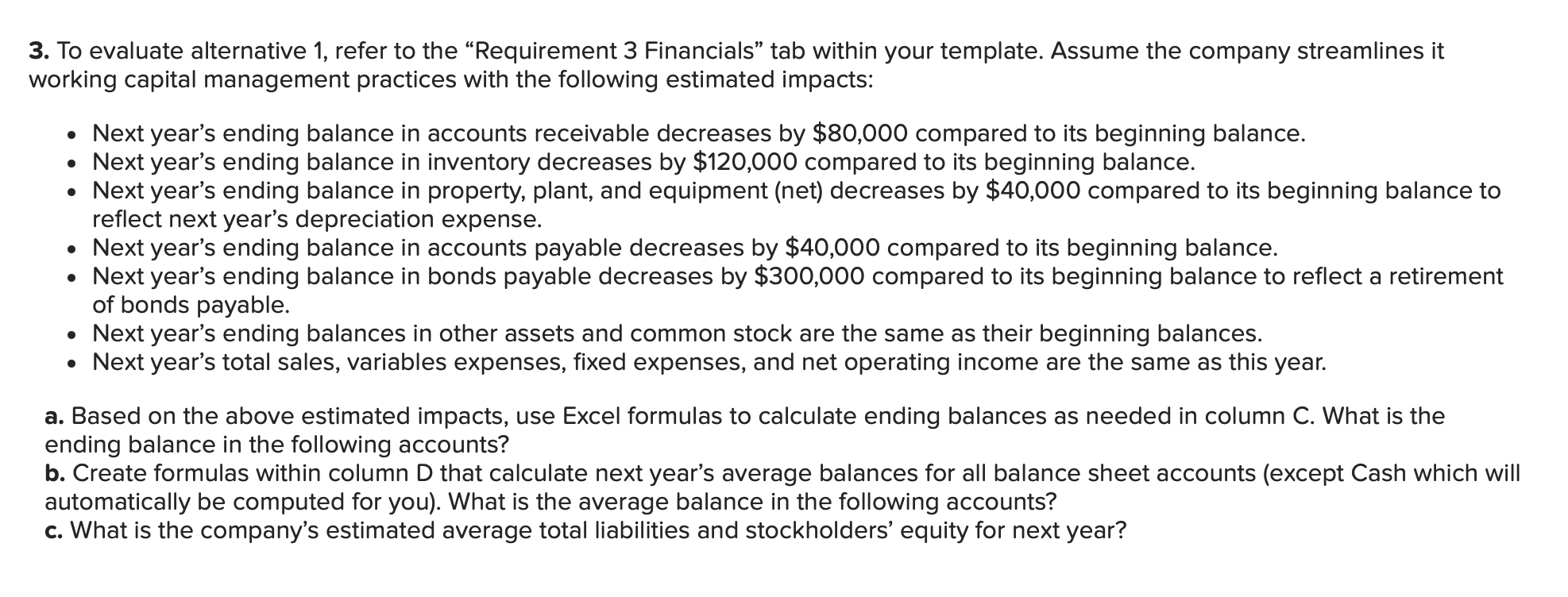

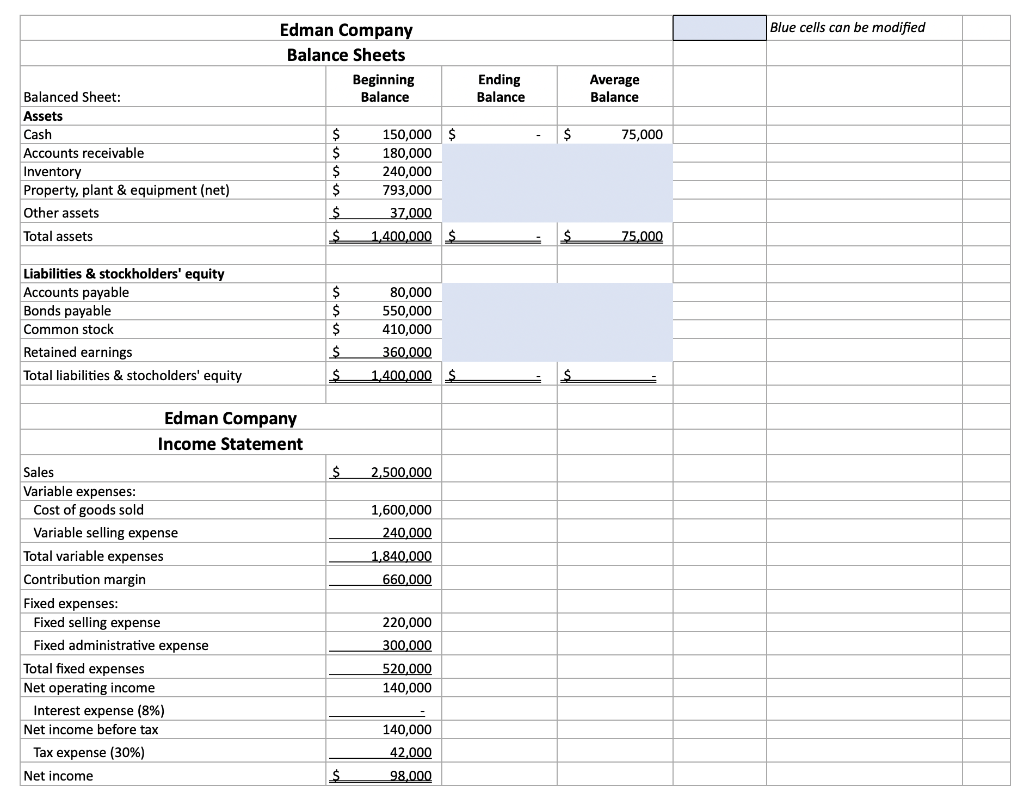

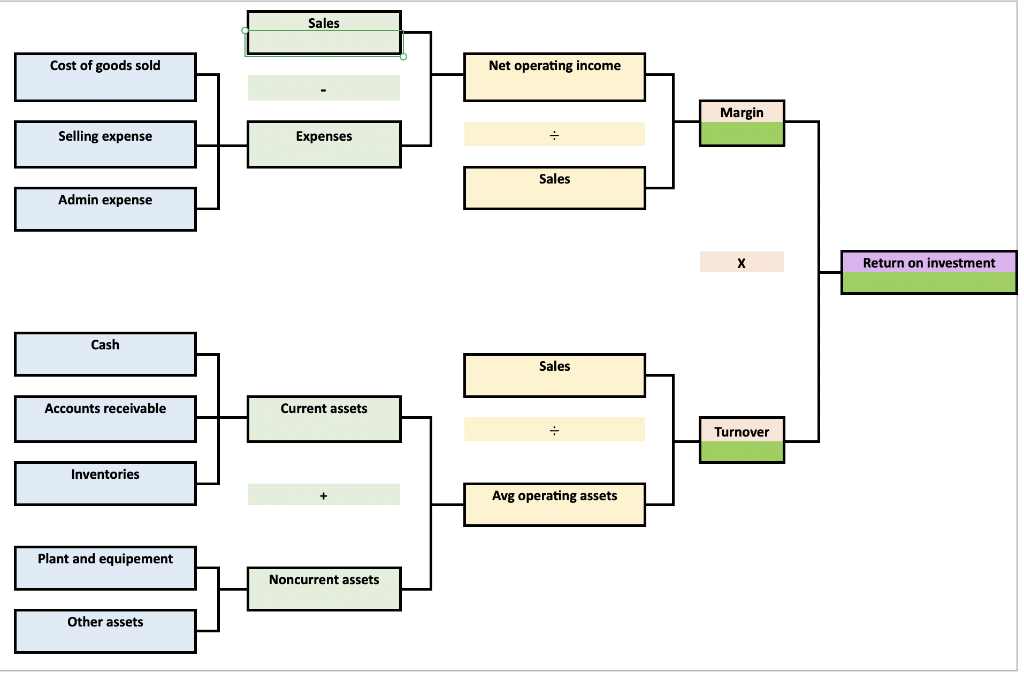

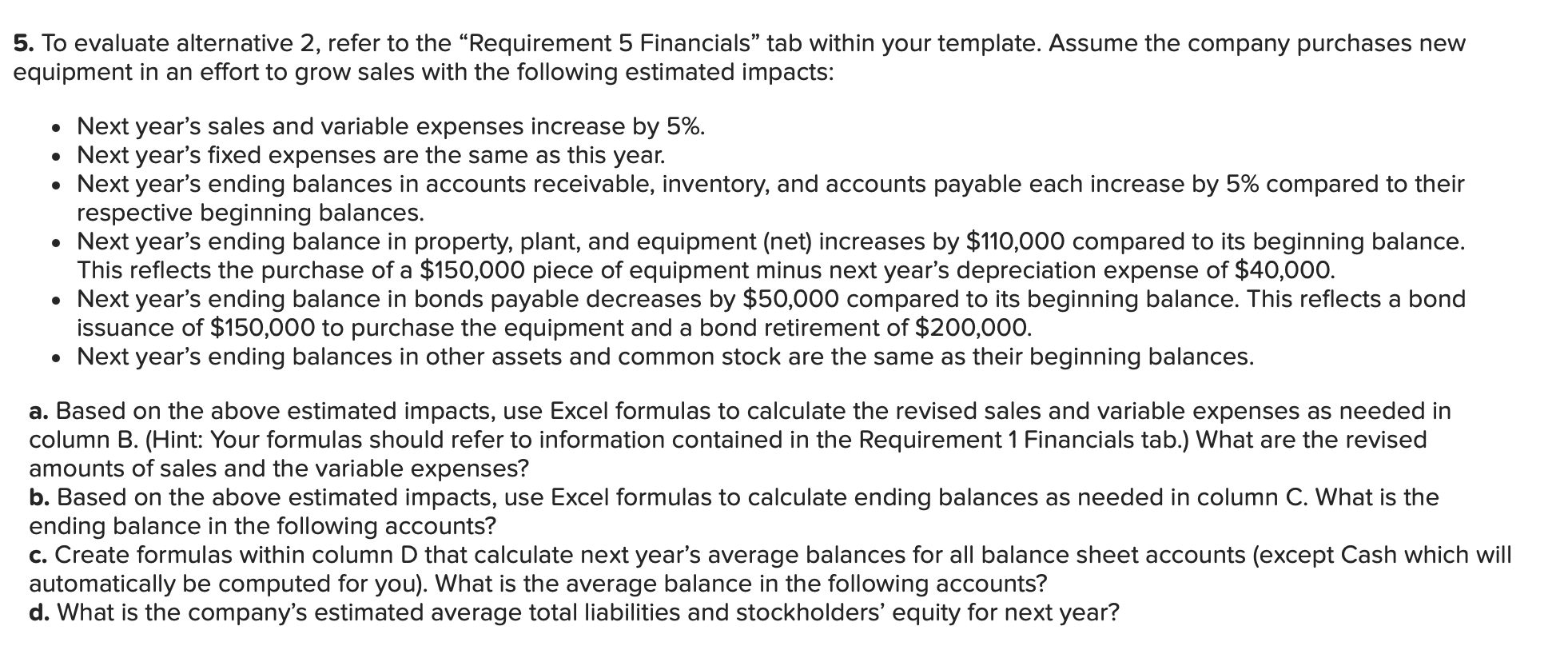

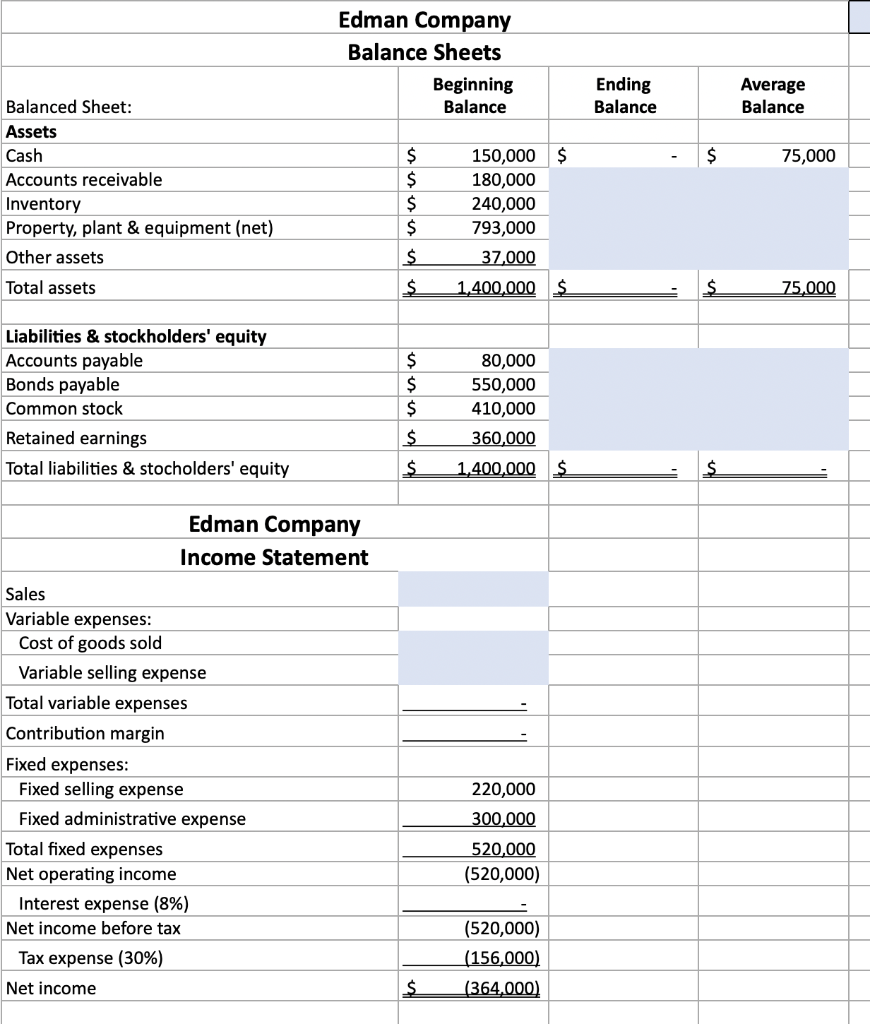

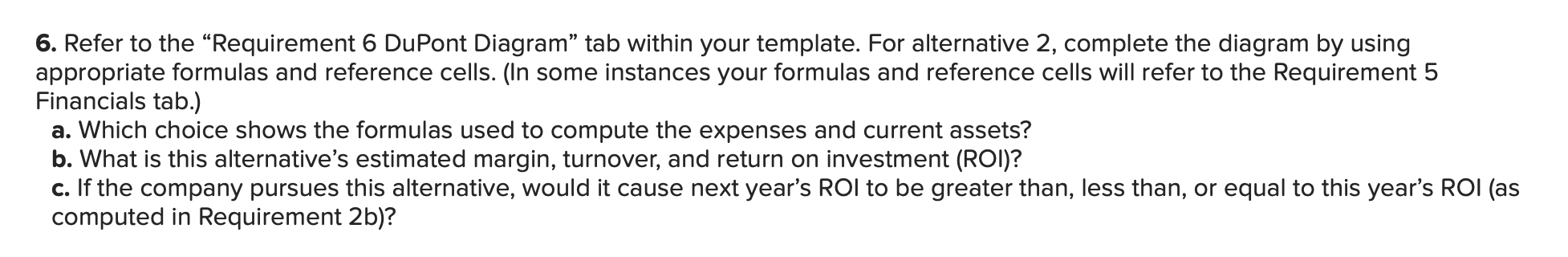

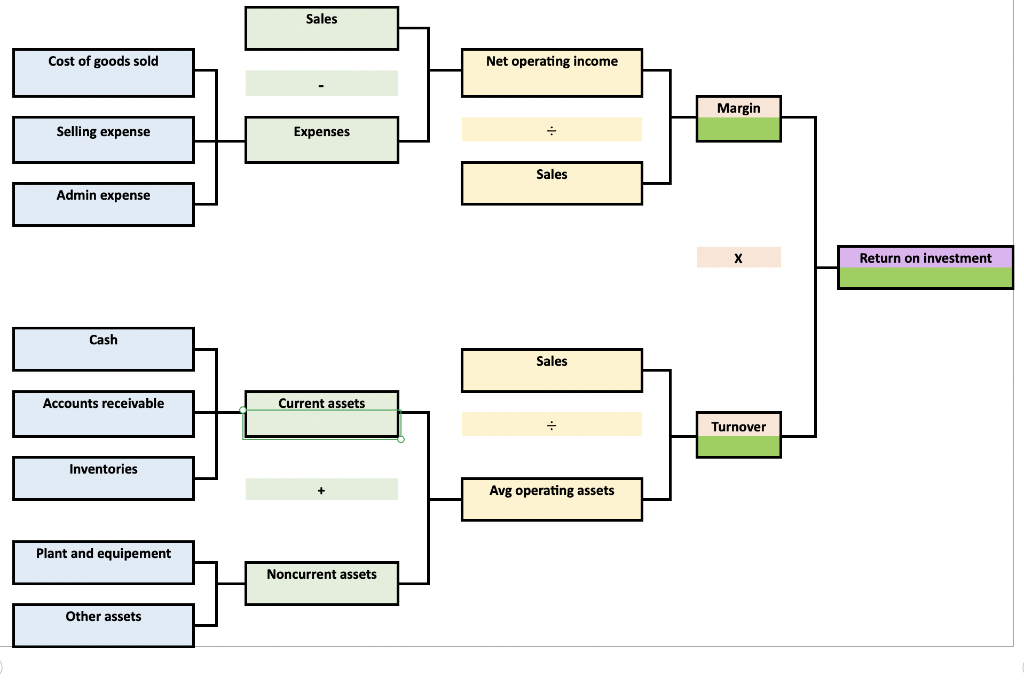

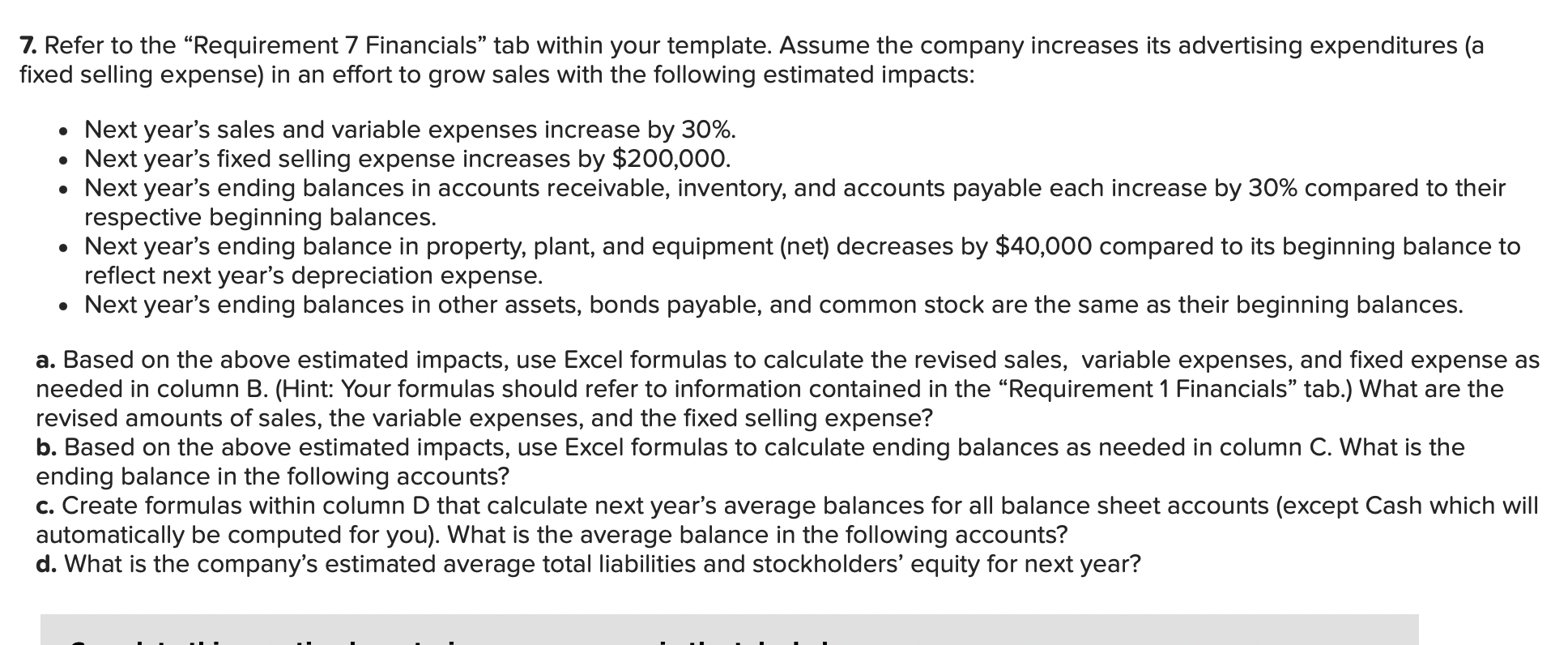

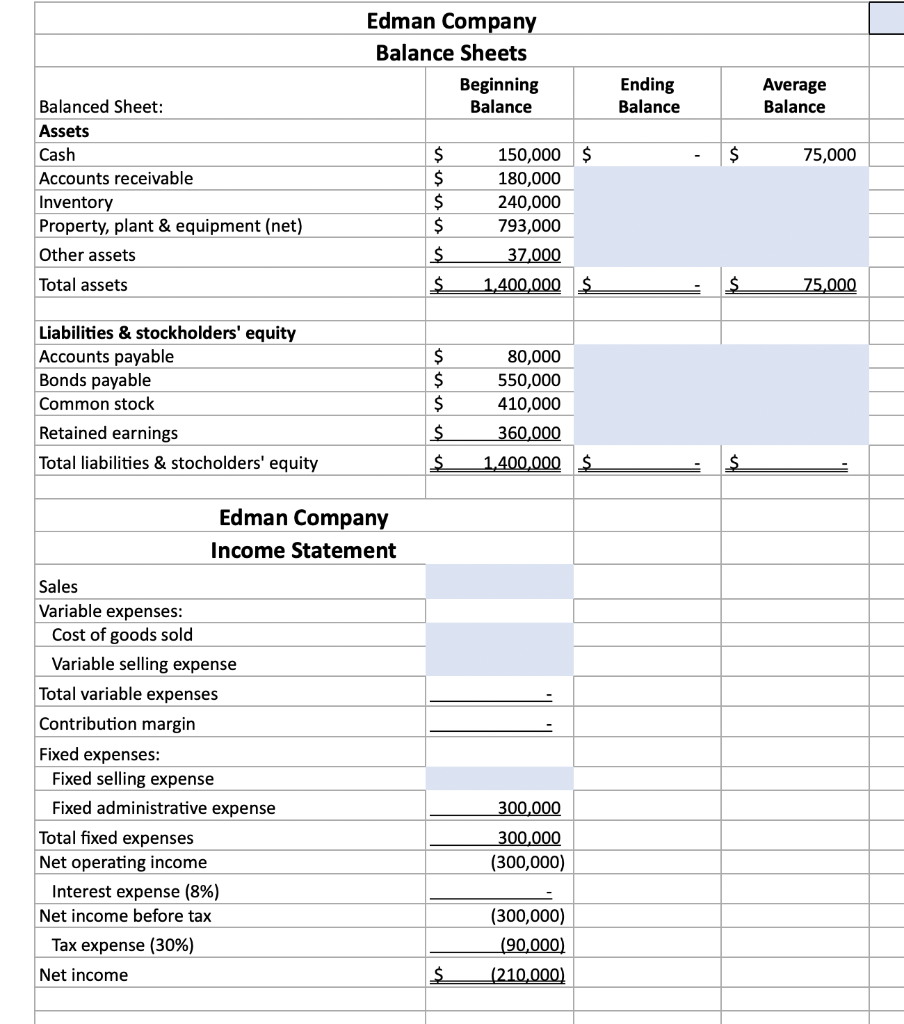

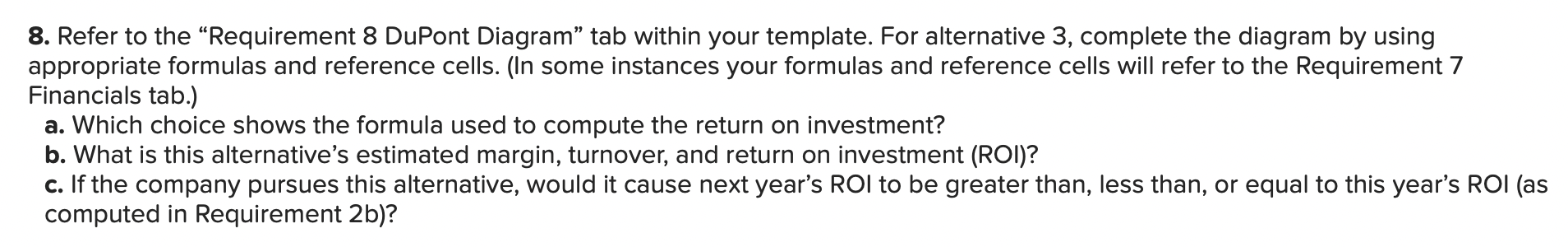

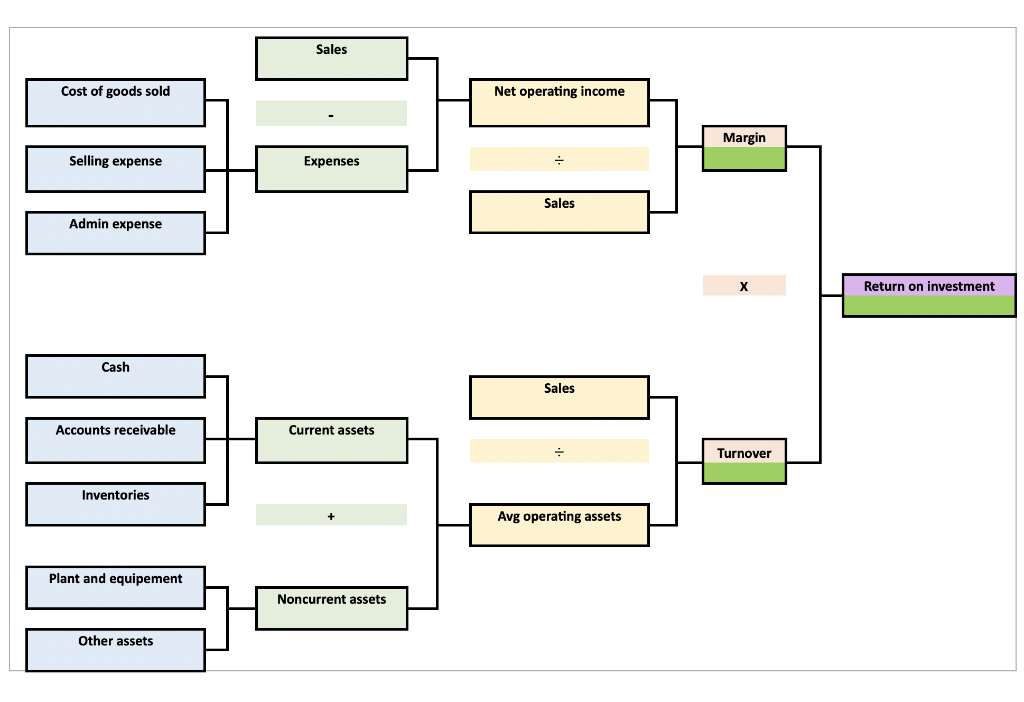

Edman Company is a merchandiser that has provided the following balance sheet and income statement for this year. Beginning Balance Ending Balance Assets Cash 150,000 62,800 160,000 Accounts receivable 180,000 Inventory 230,000 240,000 Property, plant & equipment (net) 833,000 793,000 Other assets 37,000 37,000 Total assets $1,322,800 $1,400,000 Liabilities & Stockholders' Equity Accounts payable $ $ 80,000 Bonds payable Common stock 70,000 550,000 410,000 292,800 550,000 410,000 360,000 Retained earnings Total liabilities & stockholders' equity $1,322,800 $1,400,000 Sales Variable expenses: Cost of goods sold Variable selling expense Total variable expenses Contribution margin Fixed expenses: Fixed selling expenses Fixed administrative expenses Total fixed expenses Net operating income Interest expense (8%) Net income before tax Tax expense (30%) Net income $ This Year $2,500,000 1,600,000 240,000 1,840,000 660,000 220,000 300,000 520,000 140,000 44,000 96,000 28,800 $ 67,200 $ 3. To evaluate alternative 1, refer to the Requirement 3 Financials tab within your template. Assume the company streamlines it working capital management practices with the following estimated impacts: Next year's ending balance in accounts receivable decreases by $80,000 compared to its beginning balance. Next year's ending balance in inventory decreases by $120,000 compared to its beginning balance. Next year's ending balance in property, plant, and equipment (net) decreases by $40,000 compared to its beginning balance to reflect next year's depreciation expense. Next year's ending balance in accounts payable decreases by $40,000 compared to its beginning balance. Next year's ending balance in bonds payable decreases by $300,000 compared to its beginning balance to reflect a retirement of bonds payable. Next year's ending balances in other assets and common stock are the same as their beginning balances. Next year's total sales, variables expenses, fixed expenses, and net operating income are the same as this year. a. Based on the above estimated impacts, use Excel formulas to calculate ending balances as needed in column C. What is the ending balance in the following accounts? b. Create formulas within column D that calculate next year's average balances for all balance sheet accounts (except Cash which will automatically be computed for you). What is the average balance in the following accounts? c. What is the company's estimated average total liabilities and stockholders' equity for next year? Balanced Sheet: Assets Cash Accounts receivable Inventory Property, plant & equipment (net) Other assets Total assets Liabilities & stockholders' equity Accounts payable Bonds payable Common stock Retained earnings Total liabilities & stocholders' equity Sales Variable expenses: Cost of goods sold Variable selling expense Total variable expenses Contribution margin Fixed expenses: Fixed selling expense Fixed administrative expense Total fixed expenses Net operating income Interest expense (8%) Net income before tax Tax expense (30%) Net income Edman Company Balance Sheets Beginning Balance Edman Company Income Statement $ $ $ $ $ $ $ $ $ $ $ $ 150,000 $ 180,000 240,000 793,000 37,000 1,400,000 80,000 550,000 410,000 360,000 1,400,000 $ 2,500,000 1,600,000 240,000 1,840,000 660,000 220,000 300,000 520,000 140,000 140,000 42,000 98,000 Ending Balance $ Average Balance 75,000 75,000 Blue cells can be modified Excel Analytics 11-1 (Static) Part 4 4. Refer to the Requirement 4 DuPont Diagram" tab within your template. For alternative 1, complete the diagram by using appropriate formulas and reference cells. (In some instances your formulas and reference cells will refer to the "Requirement 3 Financials" tab.) a. Which choice shows the formulas used to compute the net operating income and average operating assets? b. What is this alternative's margin, turnover, and return on investment (ROI)? c. If the company pursues this alternative, would it cause next year's ROI to be greater than, less than, or equal to this year's ROI (as computed in Requirement 2b)? X Answer is complete but not entirely correct. Cost of goods sold Selling expense Admin expense Cash Accounts receivable Inventories Plant and equipement Other assets Sales Expenses Current assets Noncurrent assets Net operating income + Sales Sales Avg operating assets Margin X Turnover Return on investment 5. To evaluate alternative 2, refer to the "Requirement 5 Financials" tab within your template. Assume the company purchases new equipment in an effort to grow sales with the following estimated impacts: Next year's sales and variable expenses increase by 5%. Next year's fixed expenses are the same as this year. Next year's ending balances in accounts receivable, inventory, and accounts payable each increase by 5% compared to their respective beginning balances. Next year's ending balance in property, plant, and equipment (net) increases by $110,000 compared to its beginning balance. This reflects the purchase of a $150,000 piece of equipment minus next year's depreciation expense of $40,000. Next year's ending balance in bonds payable decreases by $50,000 compared to its beginning balance. This reflects a bond issuance of $150,000 to purchase the equipment and a bond retirement of $200,000. Next year's ending balances in other assets and common stock are the same as their beginning balances. a. Based on the above estimated impacts, use Excel formulas to calculate the revised sales and variable expenses as needed in column B. (Hint: Your formulas should refer to information contained in the Requirement 1 Financials tab.) What are the revised amounts of sales and the variable expenses? b. Based on the above estimated impacts, use Excel formulas to calculate ending balances as needed in column C. What is the ending balance in the following accounts? c. Create formulas within column D that calculate next year's average balances for all balance sheet accounts (except Cash which will automatically be computed for you). What is the average balance in the following accounts? d. What is the company's estimated average total liabilities and stockholders' equity for next year? Balanced Sheet: Assets Cash Accounts receivable Inventory Property, plant & equipment (net) Other assets Total assets Liabilities & stockholders' equity Accounts payable Bonds payable Common stock Retained earnings Total liabilities & stocholders' equity Sales Variable expenses: Cost of goods sold Variable selling expense Total variable expenses Contribution margin Fixed expenses: Fixed selling expense Fixed administrative expense Total fixed expenses Net operating come Interest expense (8%) Net income before tax Tax expense (30%) Net income Edman Company Balance Sheets Beginning Balance Edman Company Income Statement $ 150,000 $ $ 180,000 $ 240,000 $ 793,000 $ 37,000 $ 1,400,000 $ 80,000 $ 550,000 $ 410,000 $ 360,000 $ 1,400,000 $ 220,000 300,000 520,000 (520,000) (520,000) (156,000) $ (364,000) Ending Balance $ $ $ Average Balance 75,000 75,000 6. Refer to the "Requirement 6 DuPont Diagram" tab within your template. For alternative 2, complete the diagram by using appropriate formulas and reference cells. (In some instances your formulas and reference cells will refer to the Requirement 5 Financials tab.) a. Which choice shows the formulas used to compute the expenses and current assets? b. What is this alternative's estimated margin, turnover, and return on investment (ROI)? c. If the company pursues this alternative, would it cause next year's ROI to be greater than, less than, or equal to this year's ROI (as computed in Requirement 2b)? Cost of goods sold Selling expense Admin expense Cash Accounts receivable Inventories Plant and equipement Other assets Sales Expenses Current assets Noncurrent assets Net operating income Sales Sales Avg operating assets Margin X Turnover Return on investment 7. Refer to the "Requirement 7 Financials tab within your template. Assume the company increases its advertising expenditures (a fixed selling expense) in an effort to grow sales with the following estimated impacts: Next year's sales and variable expenses increase by 30%. Next year's fixed selling expense increases by $200,000. Next year's ending balances in accounts receivable, inventory, and accounts payable each increase by 30% compared to their respective beginning balances. Next year's ending balance in property, plant, and equipment (net) decreases by $40,000 compared to its beginning balance to reflect next year's depreciation expense. Next year's ending balances in other assets, bonds payable, and common stock are the same as their beginning balances. a. Based on the above estimated impacts, use Excel formulas to calculate the revised sales, variable expenses, and fixed expense as needed in column B. (Hint: Your formulas should refer to information contained in the "Requirement 1 Financials tab.) What are the revised amounts of sales, the variable expenses, and the fixed selling expense? b. Based on the above estimated impacts, use Excel formulas to calculate ending balances as needed in column C. What is the ending balance in the following accounts? c. Create formulas within column D that calculate next year's average balances for all balance sheet accounts (except Cash which will automatically be computed for you). What is the average balance in the following accounts? d. What is the company's estimated average total liabilities and stockholders' equity for next year? Balanced Sheet: Assets Cash Accounts receivable Inventory Property, plant & equipment (net) Other assets Total assets Liabilities & stockholders' equity Accounts payable Bonds payable Common stock Retained earnings bilities stocholders' equity Sales Variable expenses: Cost of goods sold Variable selling expense Total variable expenses Contribution margin Fixed expenses: Fixed selling expense Fixed administrative expense Total fixed expenses Net operating income Interest expense (8%) Net income before tax Tax expense (30%) Net income Edman Company Balance Sheets Beginning Balance Edman Company Income Statement $ $ $ $ $ $ $ $ $ $ $ $ 150,000 $ 180,000 240,000 793,000 37,000 1,400,000 $ 80,000 550,000 410,000 360,000 1,400,000 $ 300,000 300,000 (300,000) (300,000) (90,000) (210,000) Ending Balance $ $ $ Average Balance 75,000 75,000 8. Refer to the "Requirement 8 DuPont Diagram" tab within your template. For alternative 3, complete the diagram by using appropriate formulas and reference cells. (In some instances your formulas and reference cells will refer to the Requirement 7 Financials tab.) a. Which choice shows the formula used to compute the return on investment? b. What is this alternative's estimated margin, turnover, and return on investment (ROI)? c. If the company pursues this alternative, would it cause next year's ROI to be greater than, less than, or equal to this year's ROI (as computed in Requirement 2b)? Cost of goods sold Selling expense Admin expense Cash Accounts receivable Inventories Plant and equipement Other assets Sales Expenses Current assets Noncurrent assets Net operating income + Sales Sales Avg operating assets Margin X Turnover Return on investment

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started