Answered step by step

Verified Expert Solution

Question

1 Approved Answer

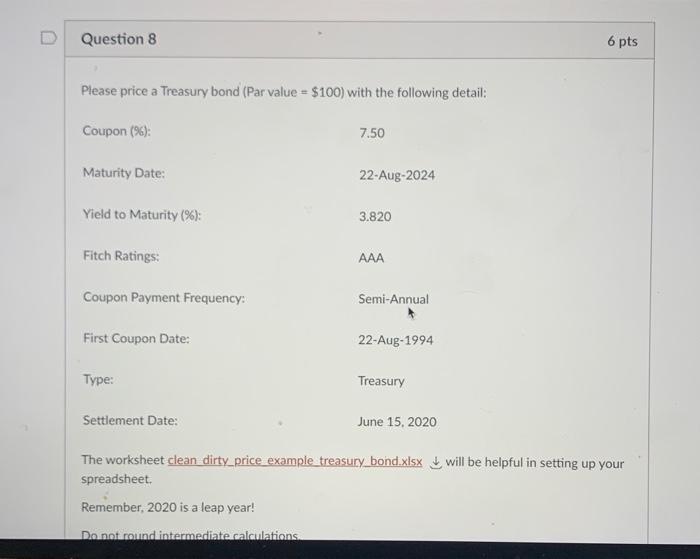

they are both under the dame question Question 8 6 pts Please price a Treasury bond (Par value = $100) with the following detail: Coupon

they are both under the dame question

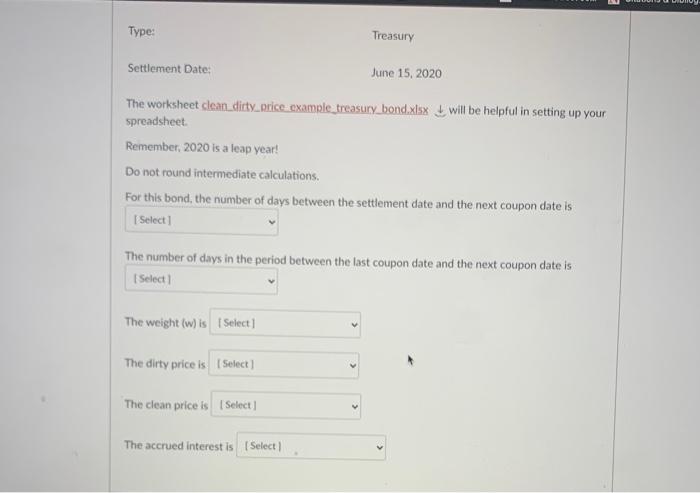

Question 8 6 pts Please price a Treasury bond (Par value = $100) with the following detail: Coupon (96): 7.50 Maturity Date: 22-Aug-2024 Yield to Maturity (%): 3.820 Fitch Ratings AAA Coupon Payment Frequency: Semi-Annual First Coupon Date: 22-Aug-1994 Type: Treasury Settlement Date: June 15, 2020 The worksheet clean dirty_price_example treasury bond.xlsx will be helpful in setting up your spreadsheet Remember, 2020 is a leap year! Do notaround intermediate calculations Type: Treasury Settlement Date: June 15, 2020 The worksheet clean_dirty_price_example_treasury bond.xlsx will be helpful in setting up your spreadsheet Remember, 2020 is a leap year! Do not round intermediate calculations. For this bond, the number of days between the settlement date and the next coupon date is Select The number of days in the period between the last coupon date and the next coupon date is Select The weight (w) is Select The dirty price is Select The clean price is Select) The accrued interest is [Select

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started