They build off each other in order

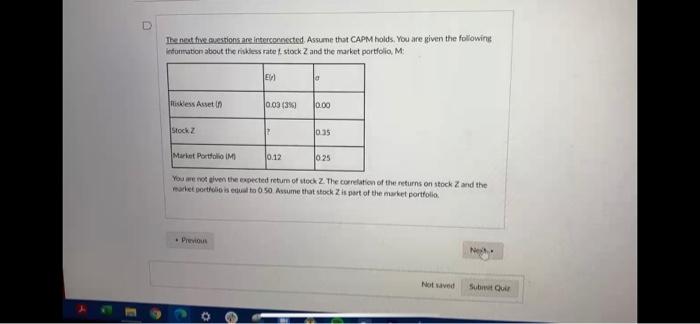

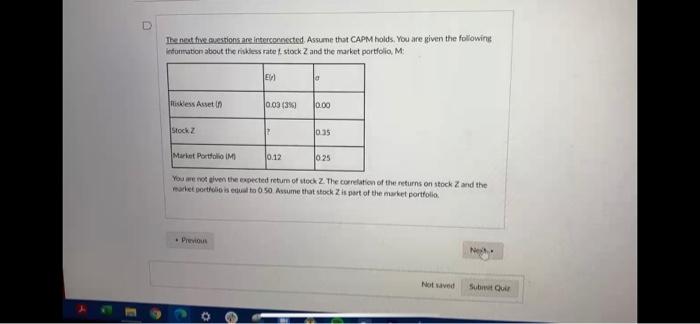

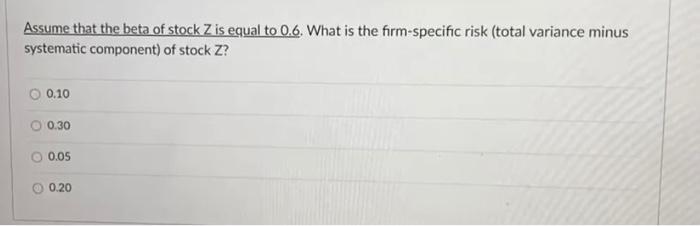

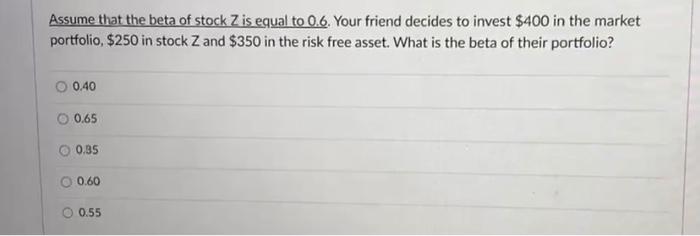

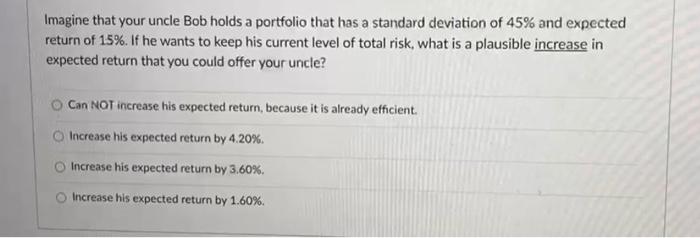

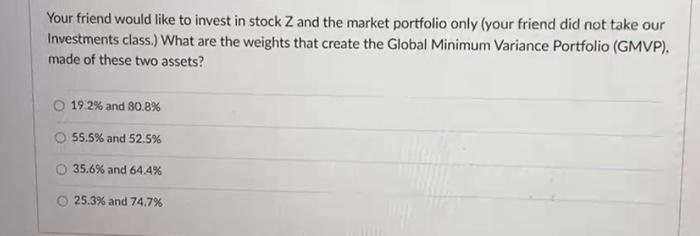

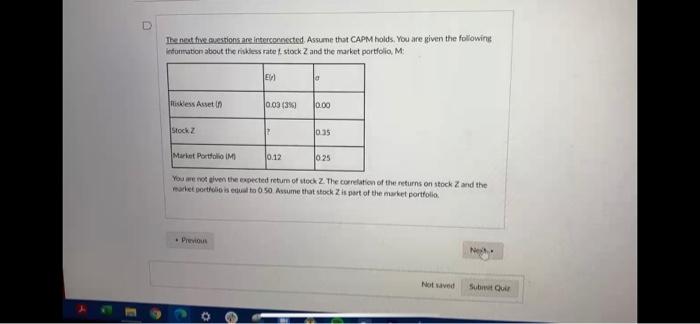

D The next five cestions are interconnected. Assume that CAPM holds. You are given the following Information about the riskless rate stock 2 and the market portfolio M EW nickles Anetin 0.03 (390 0.00 |Stock Z 0.35 Market Portfolio M 012 0 25 You me ven the expected return of stock Z. The correlation of the returns on stock and the marketportfolio isto 50 Assume that stock is part of the market portfolio Previous Not ved What is the beta (B) of stock Z? O 0.5 O 0.9 0.7 0.8 0.65 Assume that the beta of stock Z is equal to 0.6. What is the firm-specific risk (total variance minus systematic component) of stock Z? O 0.10 0.30 0.05 0.20 Assume that the beta of stock Z is equal to 0.6. Your friend decides to invest $400 in the market portfolio $250 in stock Zand $350 in the risk free asset. What is the beta of their portfolio? 0.40 O 0.65 O 0.35 O 0.60 O 0.55 Imagine that your uncle Bob holds a portfolio that has a standard deviation of 45% and expected return of 15%. If he wants to keep his current level of total risk, what is a plausible increase in expected return that you could offer your uncle? Can NOT increase his expected return, because it is already efficient Increase his expected return by 4.20%. Increase his expected return by 3.60%. Increase his expected return by 1.60%. Your friend would like to invest in stock Z and the market portfolio only (your friend did not take our Investments class.) What are the weights that create the Global Minimum Variance Portfolio (GMVP), made of these two assets? 19 2% and 80.8% 55.5% and 52.5% 35.6% and 64.4% 25.3% and 74.7% D The next five cestions are interconnected. Assume that CAPM holds. You are given the following Information about the riskless rate stock 2 and the market portfolio M EW nickles Anetin 0.03 (390 0.00 |Stock Z 0.35 Market Portfolio M 012 0 25 You me ven the expected return of stock Z. The correlation of the returns on stock and the marketportfolio isto 50 Assume that stock is part of the market portfolio Previous Not ved What is the beta (B) of stock Z? O 0.5 O 0.9 0.7 0.8 0.65 Assume that the beta of stock Z is equal to 0.6. What is the firm-specific risk (total variance minus systematic component) of stock Z? O 0.10 0.30 0.05 0.20 Assume that the beta of stock Z is equal to 0.6. Your friend decides to invest $400 in the market portfolio $250 in stock Zand $350 in the risk free asset. What is the beta of their portfolio? 0.40 O 0.65 O 0.35 O 0.60 O 0.55 Imagine that your uncle Bob holds a portfolio that has a standard deviation of 45% and expected return of 15%. If he wants to keep his current level of total risk, what is a plausible increase in expected return that you could offer your uncle? Can NOT increase his expected return, because it is already efficient Increase his expected return by 4.20%. Increase his expected return by 3.60%. Increase his expected return by 1.60%. Your friend would like to invest in stock Z and the market portfolio only (your friend did not take our Investments class.) What are the weights that create the Global Minimum Variance Portfolio (GMVP), made of these two assets? 19 2% and 80.8% 55.5% and 52.5% 35.6% and 64.4% 25.3% and 74.7%