Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On 1 January 2020, Summer Plc acquired 80% of the ordinary share capital of Winter Ltd on 1 January 2020 when the balance on

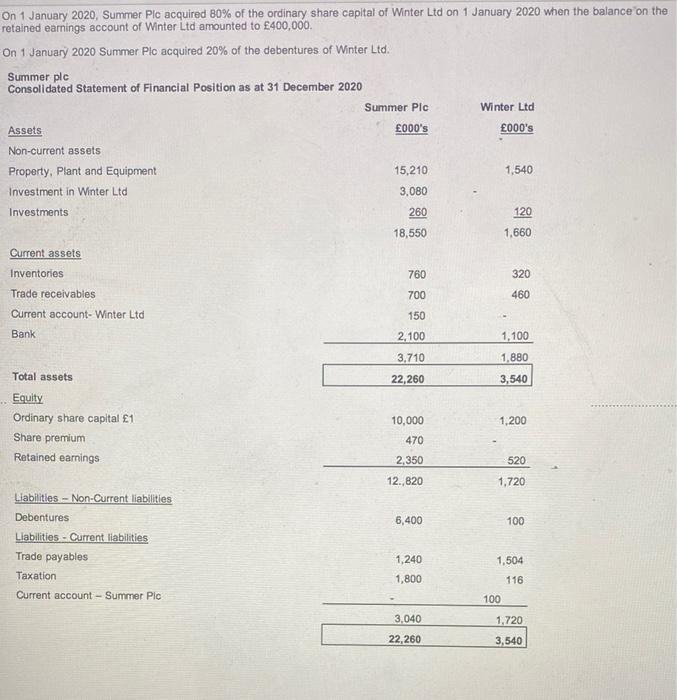

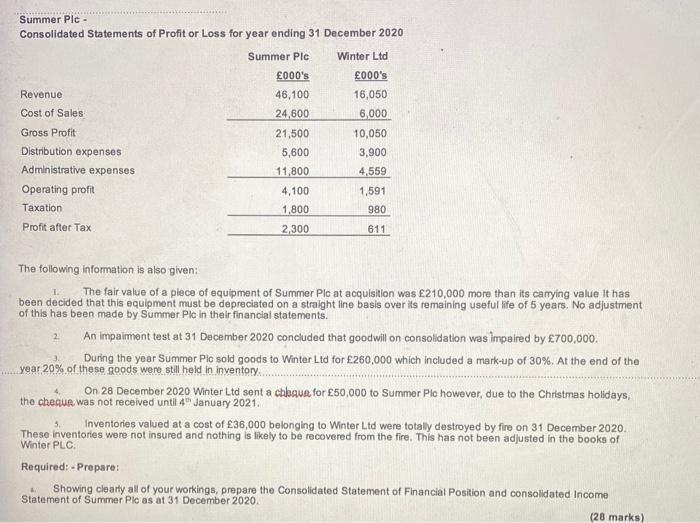

On 1 January 2020, Summer Plc acquired 80% of the ordinary share capital of Winter Ltd on 1 January 2020 when the balance on the retained earnings account of Winter Ltd amounted to 400,000. On 1 January 2020 Summer Plc acquired 20% of the debentures of Winter Ltd. Summer plc Consolidated Statement of Financial Position as at 31 December 2020 Assets Non-current assets Property, Plant and Equipment Investment in Winter Ltd. Investments Current assets Inventories Trade receivables Current account-Winter Ltd Bank Total assets Equity Ordinary share capital 1 Share premium Retained earnings Liabilities - Non-Current liabilities Debentures Liabilities - Current liabilities Trade payables Taxation Current account - Summer Pic Summer Plc 000's 15,210 3,080 260 18,550 760 700 150 2,100 3,710 22,260 10,000 470 2,350 12.,820 6,400 1,240 1,800 3,040 22,260 Winter Ltd 000's 1,540 120 1,660 320 460 1,100 1,880 3,540 1,200 100 520 1,720 100 1,504 116 1,720 3,540 Summer Plc. Consolidated Statements of Profit or Loss for year ending 31 December 2020 Winter Ltd 000's 16,050 6,000 10,050 3,900 4,559 1,591 980 611 Revenue Cost of Sales Gross Profit Distribution expenses Administrative expenses. Operating profit Taxation Profit after Tax Summer Plc 000's 46,100 24,600 21,500 5,600 11,800 The following information is also given: 1. The fair value of a piece of equipment of Summer Plc at acquisition was 210,000 more than its carrying value It has been decided that this equipment must be depreciated on a straight line basis over its remaining useful life of 5 years. No adjustment of this has been made by Summer Plc in their financial statements. An impairment test at 31 December 2020 concluded that goodwill on consolidation was impaired by 700,000. 2 4,100 1,800 2,300 During the year Summer Pic sold goods to Winter Ltd for 260,000 which included a mark-up of 30%. At the end of the year 20% of these goods were still held in inventory.... On 28 December 2020 Winter Ltd sent a chaque for 50,000 to Summer Plc however, due to the Christmas holidays, the cheque was not received until 4 January 2021. B 5. Inventories valued at a cost of 36,000 belonging to Winter Ltd were totally destroyed by fire on 31 December 2020. These inventories were not insured and nothing is likely to be recovered from the fire. This has not been adjusted in the books of Winter PLC. Required: - Prepare: Showing clearly all of your workings, prepare the Consolidated Statement of Financial Position and consolidated Income Statement of Summer Plc as at 31 December 2020. (28 marks)

Step by Step Solution

★★★★★

3.50 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Ans...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started