they should contain the formula as well

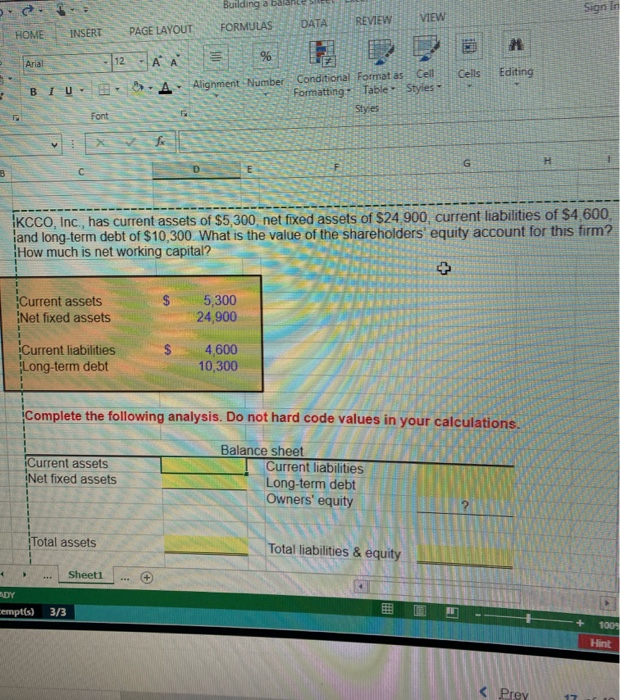

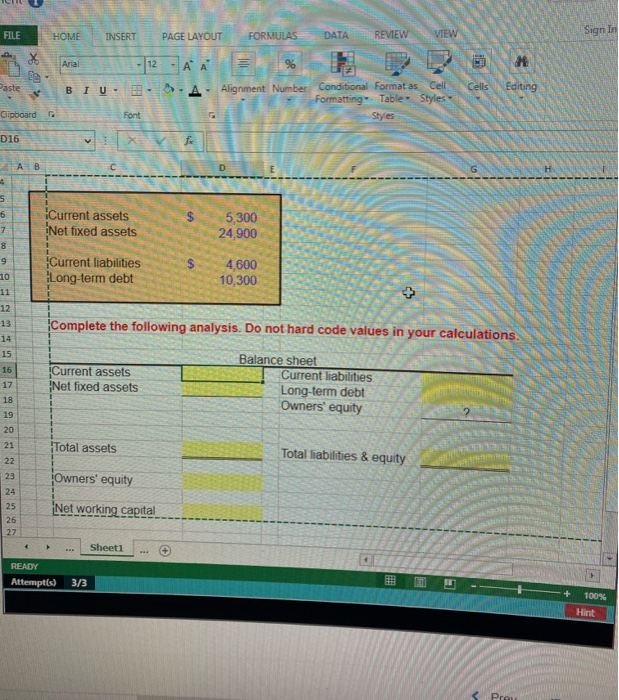

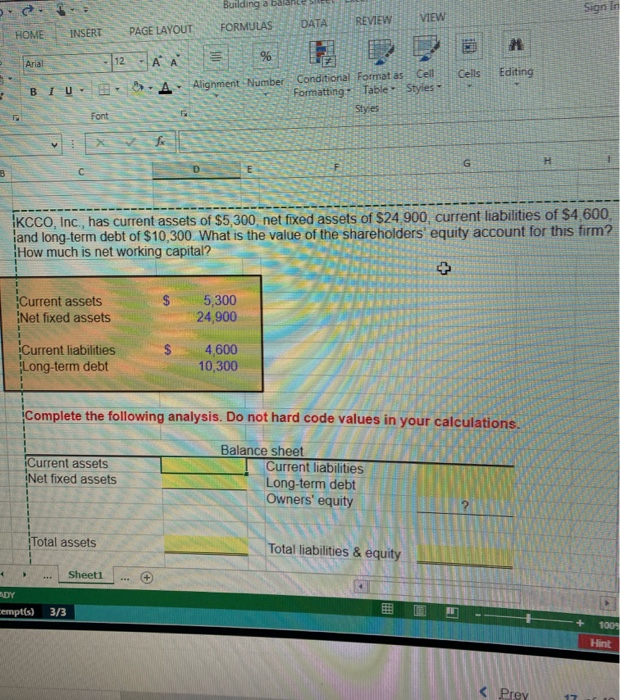

Building a bales Sign la REVIEW VIEW DATA INSERT FORMULAS HOME PAGE LAYOUT M Arial % Cells Editing BIU. A Alignment Number Conditional Format as Cell Formatting Table Styles Styles Font v F G B KCCO, Inc., has current assets of $5,300.net fixed assets of $24.900, current liabilities of $4,600, and long-term debt of $10,300. What is the value of the shareholders' equity account for this firm? How much is net working capital? Current assets INet fixed assets 5,300 24,900 Current liabilities Long-term debt 4,600 10,300 Complete the following analysis. Do not hard code values in your calculations. Current assets Net fixed assets Balance sheet Current liabilities Long-term debt Owners' equity Total assets Total liabilities & equity Sheet1 DY empt(s) 3/3 1000 fint Prey Building a bales Sign la REVIEW VIEW DATA INSERT FORMULAS HOME PAGE LAYOUT M Arial % Cells Editing BIU. A Alignment Number Conditional Format as Cell Formatting Table Styles Styles Font v F G B KCCO, Inc., has current assets of $5,300.net fixed assets of $24.900, current liabilities of $4,600, and long-term debt of $10,300. What is the value of the shareholders' equity account for this firm? How much is net working capital? Current assets INet fixed assets 5,300 24,900 Current liabilities Long-term debt 4,600 10,300 Complete the following analysis. Do not hard code values in your calculations. Current assets Net fixed assets Balance sheet Current liabilities Long-term debt Owners' equity Total assets Total liabilities & equity Sheet1 DY empt(s) 3/3 1000 fint Prey FILE Sign In HOME INSERT PAGE LAYOUT FORMULAS DATA REVIEW VIEW Arial - 12 -AA H Paste BIU- % Alignment Number Conditional Format as Cell Formatting Table Styles Styles Cells Editing Clipboard Font D16 fo AB D 1 + s 6 Current assets Net fixed assets $ 5,300 24,900 7 8 9 $ Current liabilities Long-term debt 10 4,600 10,300 11 $ 12 13 Complete the following analysis. Do not hard code values in your calculations. 14 15 16 17 18 Current assets Net fixed assets Balance sheet Current liabilities Long-term debt Owners' equity 19 20 21 22 23 Total assets Total liabilities & equity Owners' equity 24 25 Net working capital 26 27 Sheet1 READY Attempt(s) 3/3 LI 100% Pr