Answered step by step

Verified Expert Solution

Question

1 Approved Answer

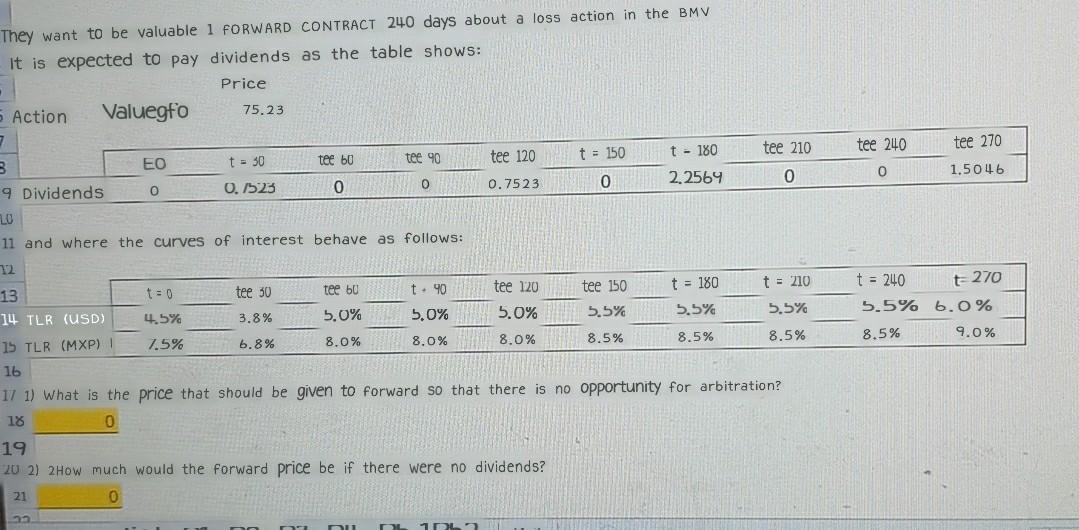

They want to be valuable 1 FORWARD CONTRACT 240 days about a loss action in the BMV It is expected to pay dividends as the

They want to be valuable 1 FORWARD CONTRACT 240 days about a loss action in the BMV It is expected to pay dividends as the table shows: Price Action Valuegfo 75.23 7 3 EO t = 30 tee tee 90 tee 120 t = 150 t - 180 9 Dividends 0 0.7523 0 0 0.7523 0 2.2564 20 tee 210 tee 240 tee 270 0 0 1.5046 11 and where the curves of interest behave as follows: 12 13 t=0 tee 50 tee bu t. 90 tee 120 tee 150 t = 180 t = 210 14 TLR (USD) 4.5% 3.8% 5.0% 5.0% 5.0% 5.5% 5.5% 5.5% 15 TLR (MXP) 7.5% b.8% 8.0% 8.0% 8.0% 8.5% 8.5% 8.5% 16 17 1) What is the price that should be given to forward so that there is no opportunity for arbitration? 18 0 t = 240 t270 5.5% 6.0% 8.5% 9.0% 19 20 21 2How much would the forward price be if there were no dividends? 21 n ni 1 Nu

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started