Answered step by step

Verified Expert Solution

Question

1 Approved Answer

theyre part of the same question, please help with steps, thank you ! A pioce of construction equipment (asset class 15.0 ) was purthased by

theyre part of the same question, please help with steps, thank you !

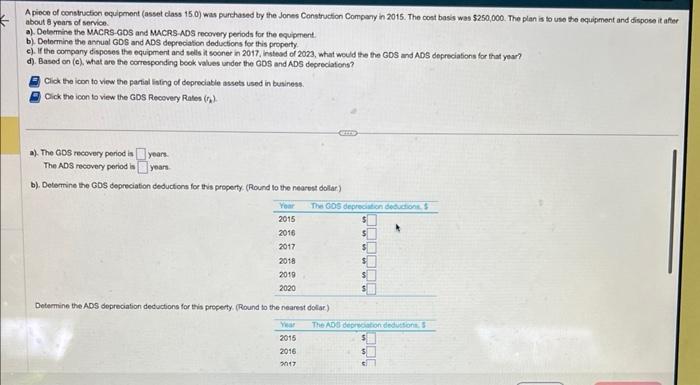

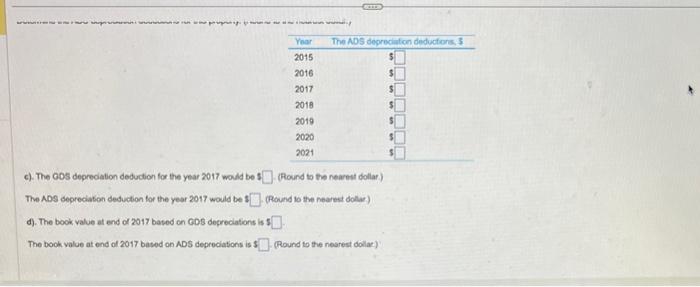

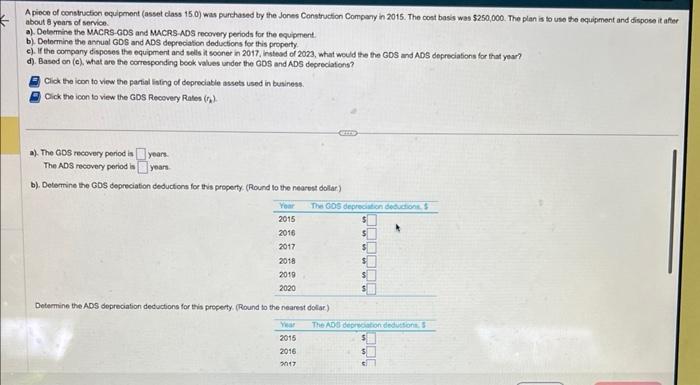

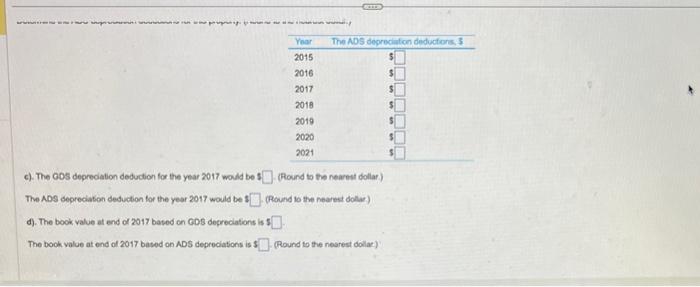

A pioce of construction equipment (asset class 15.0 ) was purthased by the Jones Construction Compary in 2015. The cont basis was $250,000. The plan is to use the oquigment and dispose it after about 8 years of servico. a). Detemine the MACRS-GDS and MCRS NDS recovery periods for the equipenent. b) Determine the anhual GDS and ADS depreciation deductions for this property. e). If the company disposes the equipment and sells it sooner in 2017, instesd of 2023, what would the the GDS and ADS depreciations for that year? d). Based on (c), what are the corresponding book values under the GOS and ADS deprociations? Cick the icon to view the partial listing of depreciable assets used in buriness. Cick the icon to view the GOS Recovery Rates (rk). a). The GOS recevery period is years. The ADs recovery period is years. b). Determine the Gos depreciation deductons for this property. (Round to the nearest dolar) Dotermine the ADS depreciation dectuctions for tris property. (Round to the nearest dolise) c). The COS depredation deduction for the year 2017 would be 5 (Round o the newnet dollar) The ADS deprediation deduction for the year 2017 would be 1 (Round to the nearest dolle) d). The book value at end 2017 based on GDS deprecations is 1 The bock value at end of 2017 based on ADS depreciations is 1 (Round to the nesrest dollar) A pioce of construction equipment (asset class 15.0 ) was purthased by the Jones Construction Compary in 2015. The cont basis was $250,000. The plan is to use the oquigment and dispose it after about 8 years of servico. a). Detemine the MACRS-GDS and MCRS NDS recovery periods for the equipenent. b) Determine the anhual GDS and ADS depreciation deductions for this property. e). If the company disposes the equipment and sells it sooner in 2017, instesd of 2023, what would the the GDS and ADS depreciations for that year? d). Based on (c), what are the corresponding book values under the GOS and ADS deprociations? Cick the icon to view the partial listing of depreciable assets used in buriness. Cick the icon to view the GOS Recovery Rates (rk). a). The GOS recevery period is years. The ADs recovery period is years. b). Determine the Gos depreciation deductons for this property. (Round to the nearest dolar) Dotermine the ADS depreciation dectuctions for tris property. (Round to the nearest dolise) c). The COS depredation deduction for the year 2017 would be 5 (Round o the newnet dollar) The ADS deprediation deduction for the year 2017 would be 1 (Round to the nearest dolle) d). The book value at end 2017 based on GDS deprecations is 1 The bock value at end of 2017 based on ADS depreciations is 1 (Round to the nesrest dollar)

A pioce of construction equipment (asset class 15.0 ) was purthased by the Jones Construction Compary in 2015. The cont basis was $250,000. The plan is to use the oquigment and dispose it after about 8 years of servico. a). Detemine the MACRS-GDS and MCRS NDS recovery periods for the equipenent. b) Determine the anhual GDS and ADS depreciation deductions for this property. e). If the company disposes the equipment and sells it sooner in 2017, instesd of 2023, what would the the GDS and ADS depreciations for that year? d). Based on (c), what are the corresponding book values under the GOS and ADS deprociations? Cick the icon to view the partial listing of depreciable assets used in buriness. Cick the icon to view the GOS Recovery Rates (rk). a). The GOS recevery period is years. The ADs recovery period is years. b). Determine the Gos depreciation deductons for this property. (Round to the nearest dolar) Dotermine the ADS depreciation dectuctions for tris property. (Round to the nearest dolise) c). The COS depredation deduction for the year 2017 would be 5 (Round o the newnet dollar) The ADS deprediation deduction for the year 2017 would be 1 (Round to the nearest dolle) d). The book value at end 2017 based on GDS deprecations is 1 The bock value at end of 2017 based on ADS depreciations is 1 (Round to the nesrest dollar) A pioce of construction equipment (asset class 15.0 ) was purthased by the Jones Construction Compary in 2015. The cont basis was $250,000. The plan is to use the oquigment and dispose it after about 8 years of servico. a). Detemine the MACRS-GDS and MCRS NDS recovery periods for the equipenent. b) Determine the anhual GDS and ADS depreciation deductions for this property. e). If the company disposes the equipment and sells it sooner in 2017, instesd of 2023, what would the the GDS and ADS depreciations for that year? d). Based on (c), what are the corresponding book values under the GOS and ADS deprociations? Cick the icon to view the partial listing of depreciable assets used in buriness. Cick the icon to view the GOS Recovery Rates (rk). a). The GOS recevery period is years. The ADs recovery period is years. b). Determine the Gos depreciation deductons for this property. (Round to the nearest dolar) Dotermine the ADS depreciation dectuctions for tris property. (Round to the nearest dolise) c). The COS depredation deduction for the year 2017 would be 5 (Round o the newnet dollar) The ADS deprediation deduction for the year 2017 would be 1 (Round to the nearest dolle) d). The book value at end 2017 based on GDS deprecations is 1 The bock value at end of 2017 based on ADS depreciations is 1 (Round to the nesrest dollar)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started