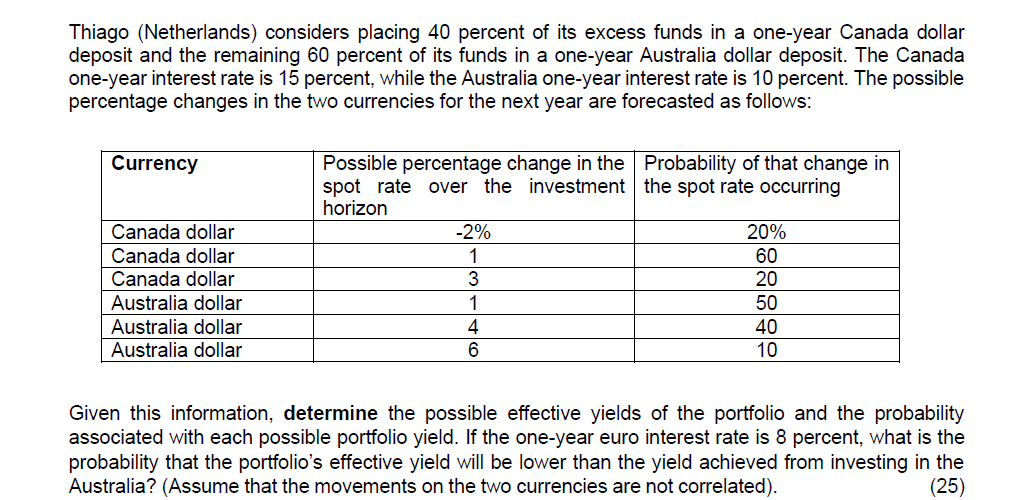

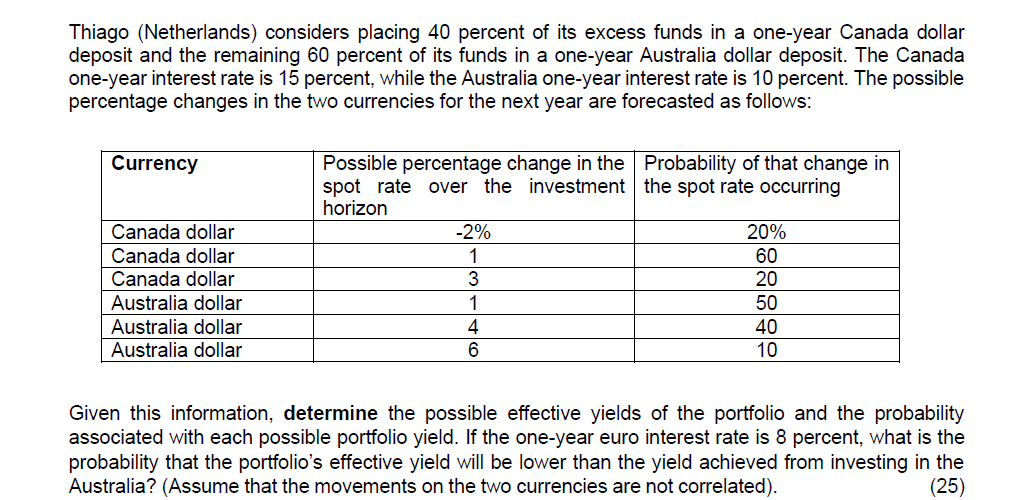

Thiago (Netherlands) considers placing 40 percent of its excess funds in a one-year Canada dollar deposit and the remaining 60 percent of its funds in a one-year Australia dollar deposit. The Canada one-year interest rate is 15 percent, while the Australia one-year interest rate is 10 percent. The possible percentage changes in the two currencies for the next year are forecasted as follows: Currency Canada dollar Canada dollar Canada dollar Australia dollar Australia dollar Australia dollar Possible percentage change in the Probability of that change in spot rate over the investment the spot rate occurring horizon -2% 20% 1 60 3 20 1 50 4 40 6 10 Given this information, determine the possible effective yields of the portfolio and the probability associated with each possible portfolio yield. If the one-year euro interest rate is 8 percent, what is the probability that the portfolio's effective yield will be lower than the yield achieved from investing in the Australia? (Assume that the movements on the two currencies are not correlated). (25) Thiago (Netherlands) considers placing 40 percent of its excess funds in a one-year Canada dollar deposit and the remaining 60 percent of its funds in a one-year Australia dollar deposit. The Canada one-year interest rate is 15 percent, while the Australia one-year interest rate is 10 percent. The possible percentage changes in the two currencies for the next year are forecasted as follows: Currency Canada dollar Canada dollar Canada dollar Australia dollar Australia dollar Australia dollar Possible percentage change in the Probability of that change in spot rate over the investment the spot rate occurring horizon -2% 20% 1 60 3 20 1 50 4 40 6 10 Given this information, determine the possible effective yields of the portfolio and the probability associated with each possible portfolio yield. If the one-year euro interest rate is 8 percent, what is the probability that the portfolio's effective yield will be lower than the yield achieved from investing in the Australia? (Assume that the movements on the two currencies are not correlated). (25)