Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Think back to a time before the COVID pandemic. Sajeeta is a 'frequent flyer' who traveled regularly by air, in Canada and internationally. She was

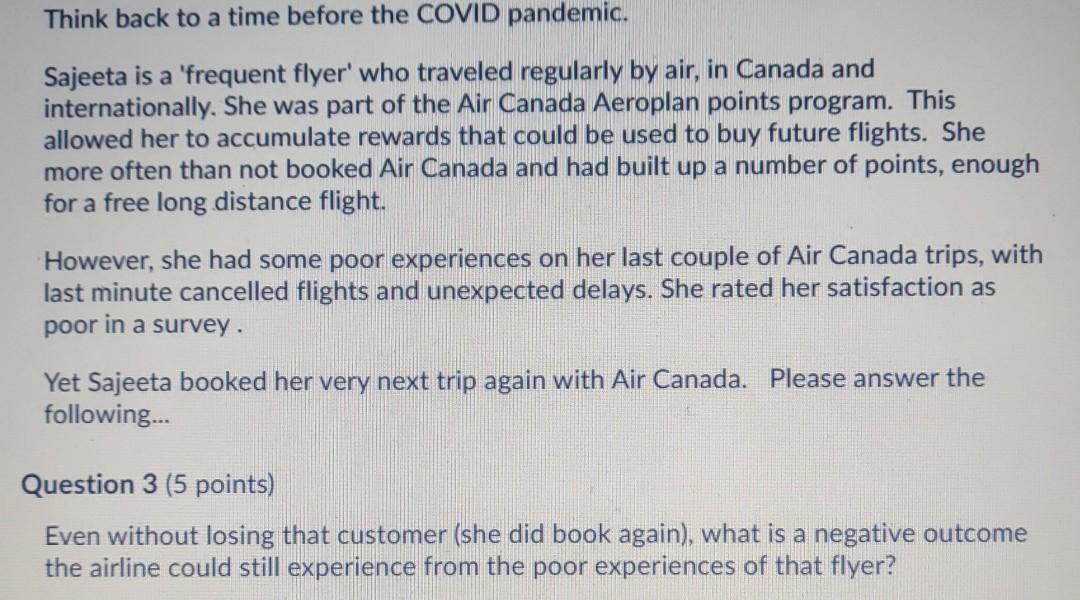

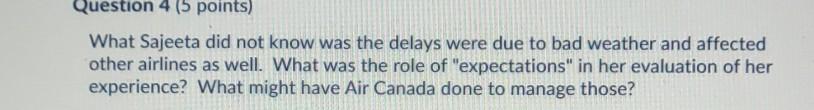

Think back to a time before the COVID pandemic. Sajeeta is a 'frequent flyer' who traveled regularly by air, in Canada and internationally. She was part of the Air Canada Aeroplan points program. This allowed her to accumulate rewards that could be used to buy future flights. She more often than not booked Air Canada and had built up a number of points, enough for a free long distance flight. However, she had some poor experiences on her last couple of Air Canada trips, with last minute cancelled flights and unexpected delays. She rated her satisfaction as poor in a survey Yet Sajeeta booked her very next trip again with Air Canada. Please answer the following... Question 3 (5 points) Even without losing that customer (she did book again), what is a negative outcome the airline could still experience from the poor experiences of that flyer? Question 4 (5 points) What Sajeeta did not know was the delays were due to bad weather and affected other airlines as well. What was the role of "expectations" in her evaluation of her experience? What might have Air Canada done to manage those? Question 5 (5 points) Do you think Sajeeta is displaying Brand Loyalty? Or Brand Inertia? Explain your choice

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started