Answered step by step

Verified Expert Solution

Question

1 Approved Answer

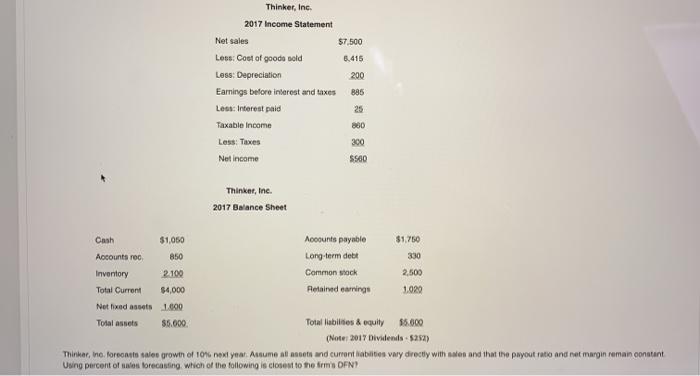

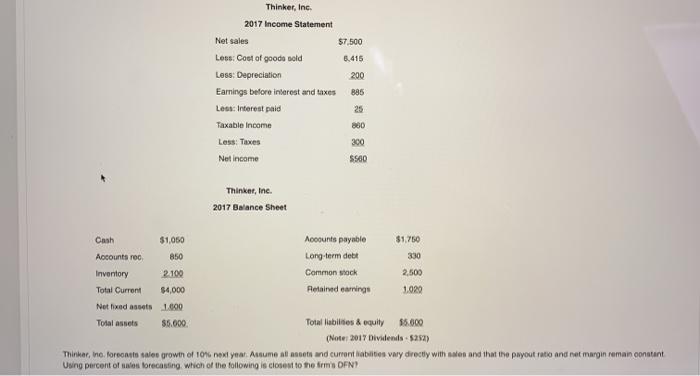

Thinker, Inc. 2017 Income Statement Net sales $7.500 Less: Cost of goods sold 6.415 Less: Depreciation 200 Earnings before interest and taxes 885 Less: Interest

Thinker, Inc. 2017 Income Statement Net sales $7.500 Less: Cost of goods sold 6.415 Less: Depreciation 200 Earnings before interest and taxes 885 Less: Interest paid 25 Taxable income 680 Less: Taxes 300 Net Income Ss60 Thinker, Inc. 2017 Balance Sheet Cash $1,050 Acoounts payable $1,750 Accounts rec 850 Long-term debt 330 Inventory 2.100 Common stock 2,500 Total Current $4,000 Retained earrings 1.020 Net fixed assets 1.600 Total assets 55.000 Total liabilities & equity (Noter 2017 Dividends-5254) Thinker, no fornito sales grown of 10% next year. Assume alets and current liabilities vary directly with sales and that the payout ratio and net margin remain constant Using percent of a forecasting which of the following is closest to the firm's OFN

Thinker, Inc. 2017 Income Statement Net sales $7.500 Less: Cost of goods sold 6.415 Less: Depreciation 200 Earnings before interest and taxes 885 Less: Interest paid 25 Taxable income 680 Less: Taxes 300 Net Income Ss60 Thinker, Inc. 2017 Balance Sheet Cash $1,050 Acoounts payable $1,750 Accounts rec 850 Long-term debt 330 Inventory 2.100 Common stock 2,500 Total Current $4,000 Retained earrings 1.020 Net fixed assets 1.600 Total assets 55.000 Total liabilities & equity (Noter 2017 Dividends-5254) Thinker, no fornito sales grown of 10% next year. Assume alets and current liabilities vary directly with sales and that the payout ratio and net margin remain constant Using percent of a forecasting which of the following is closest to the firm's OFN

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started