Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Third part of the chapter involves in the preparation of financial position of the enterprise in terms of Liabilities and Assets 1 is first financial

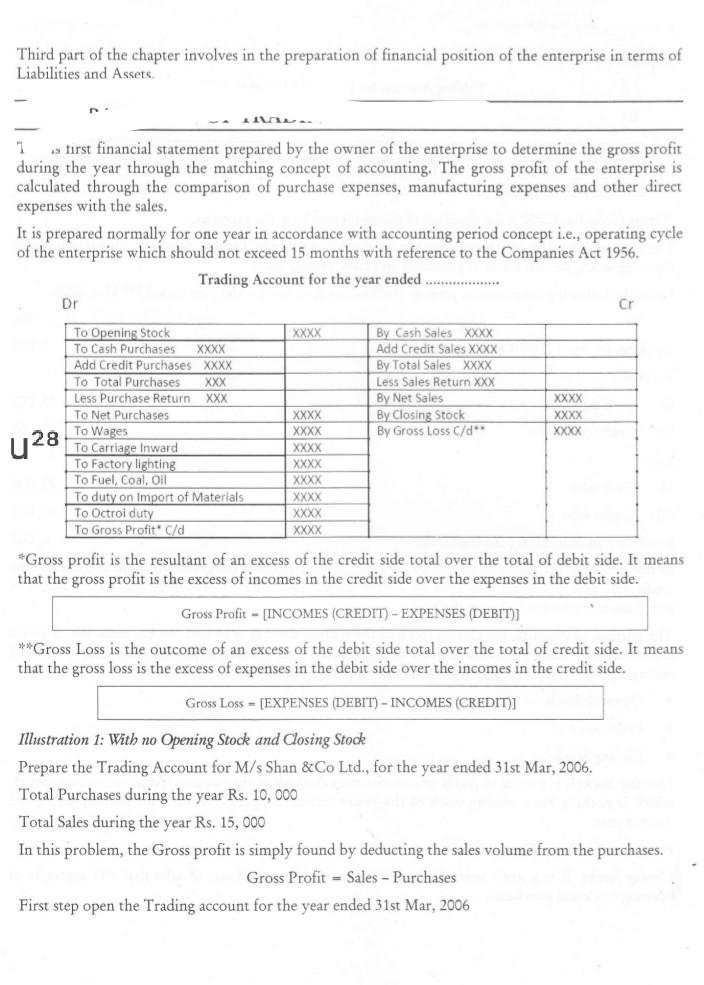

Third part of the chapter involves in the preparation of financial position of the enterprise in terms of Liabilities and Assets 1 is first financial statement prepared by the owner of the enterprise to determine the gross profit during the year through the matching concept of accounting. The gross profit of the enterprise is calculated through the comparison of purchase expenses, manufacturing expenses and other direct expenses with the sales. It is prepared normally for one year in accordance with accounting period concept i.e., operating cycle of the enterprise which should not exceed 15 months with reference to the Companies Act 1956. Trading Account for the year ended ................ DI Cr XXXX By Cash Sales XXXX Add Credit Sales XXXX By Total Sales XXXX Less Sales Return XXX By Net Sales By Closing Stock By Gross Loss C/d" To Opening Stock To Cash Purchases XXXX Add Credit Purchases XXXX To Total Purchases XXX Less Purchase Return XXX To Net Purchases To Wages To Carriage Inward To Factory lighting To Fuel, Coal, Oil To duty on Import of Materials To Octroi duty To Gross Profit C/d XXXX XXXX XXXX 28 XXXX XXXX XXXX XXXX XXXX XXXX XXXX XXXX *Gross profit is the resultant of an excess of the credit side total over the total of debit side. It means that the gross profit is the excess of incomes in the credit side over the expenses in the debit side. Gross Profit - [INCOMES (CREDIT) - EXPENSES (DEBIT)] ** Gross Loss is the outcome of an excess of the debit side total over the total of credit side. It means that the gross loss is the excess of expenses in the debit side over the incomes in the credit side. Gross Loss = [EXPENSES (DEBIT) - INCOMES (CREDIT) Illustration 1: With no Opening Stock and Closing Stock Prepare the Trading Account for M/s Shan &Co Ltd., for the year ended 31st Mar, 2006. Total Purchases during the year Rs. 10,000 Total Sales during the year Rs. 15,000 In this problem, the Gross profit is simply found by deducting the sales volume from the purchases. Gross Profit - Sales - Purchases First step open the Trading account for the year ended 31st Mar, 2006

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started