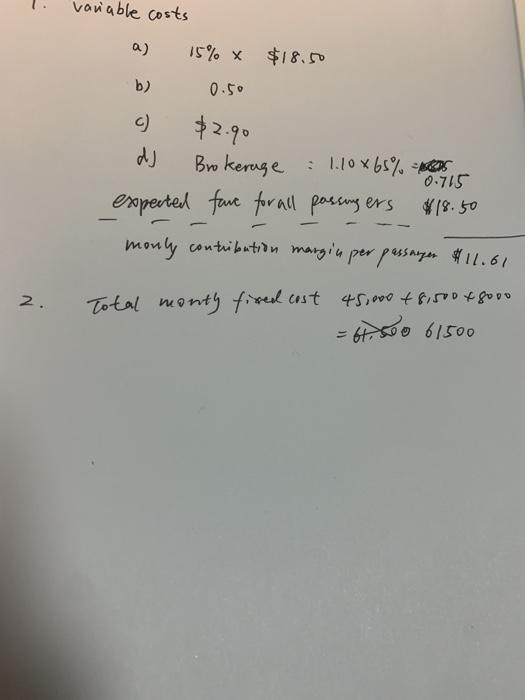

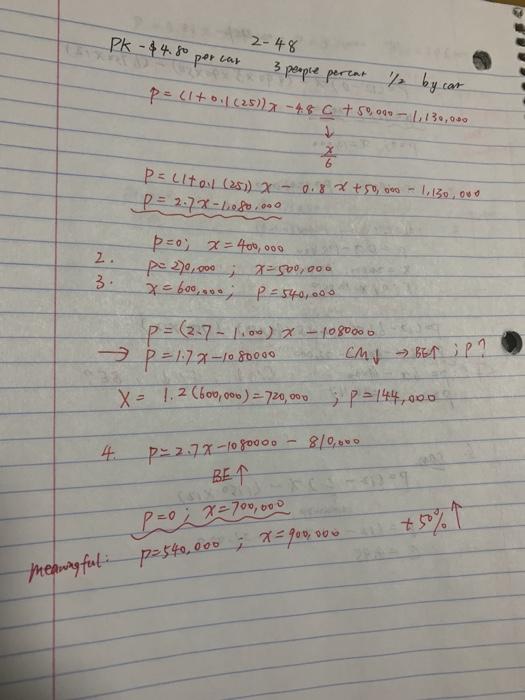

Third photo are my answer on PartA Forth and Fifth are formula and break even example

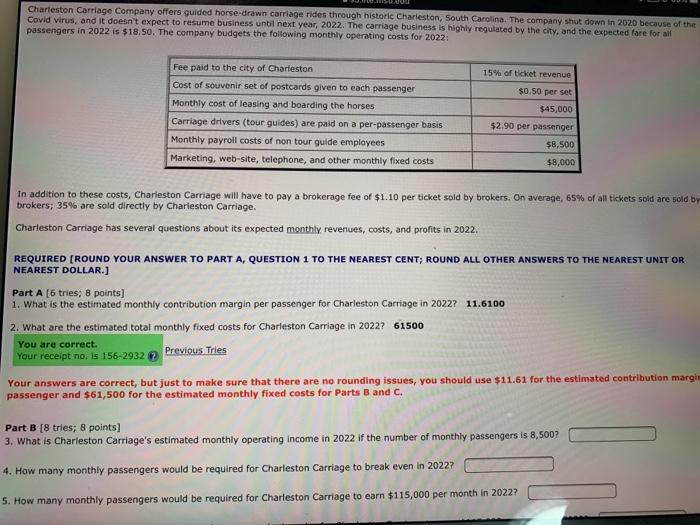

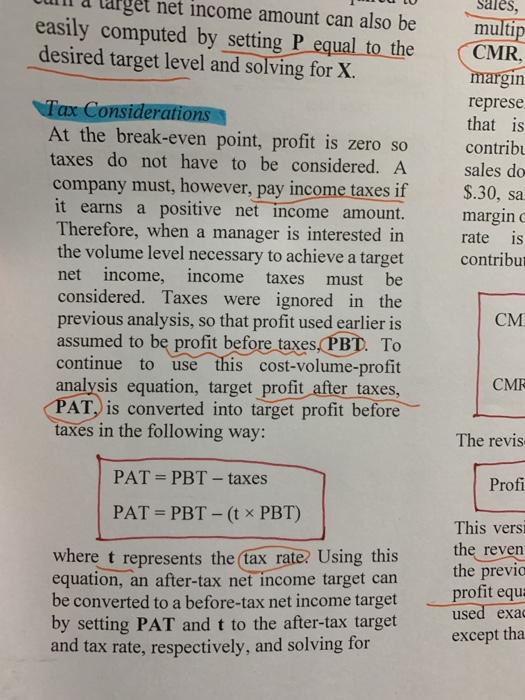

Charleston Carriage Company offers guided horse-drawn carriage rides through historic Charleston, South Carolina. The company shut down in 2020 because of the Covid virus, and it doesn't expect to resume business until next year, 2022. The carriage business is highly regulated by the city, and the expected fare for all passengers in 2022 is $18.50. The company budgets the following monthly operating costs for 2022: Fee paid to the city of Charleston Cost of Souvenir set of postcards given to each passenger Monthly cost of leasing and boarding the horses Carriage drivers (tour guides) are paid on a per-passenger basis Monthly payroll costs of non tour guide employees Marketing, web-site, telephone, and other monthly fixed costs 15% of ticket revenue $0.50 per set 345,000 $2.90 per passenger $8.500 $8,000 In addition to these costs, Charleston Carriage will have to pay a brokerage fee of $1.10 per ticket sold by brokers. On average, 65% of all tickets sold are sold by brokers; 35% are sold directly by Charleston Carriage. Charleston Carriage has several questions about its expected monthly revenues, costs, and profits in 2022. REQUIRED (ROUND YOUR ANSWER TO PART A, QUESTION 1 TO THE NEAREST CENT; ROUND ALL OTHER ANSWERS TO THE NEAREST UNIT OR NEAREST DOLLAR.] Part A [6 tries; 8 points) 1. What is the estimated monthly contribution margin per passenger for Charleston Carriage in 2022? 11.6100 2. What are the estimated total monthly fixed costs for Charleston Carriage in 2022? 61500 You are correct. Your receipt no, is 156-2932 Previous Tries Your answers are correct, but just to make sure that there are no rounding issues, you should use $11.61 for the estimated contribution margim passenger and $61,500 for the estimated monthly fixed costs for Parts B and C. Part B [8 tries; 8 points) 3. What is Charleston Carriage's estimated monthly operating income in 2022 if the er of monthly passengers is 8,500? 4. How many monthly passengers would be required for Charleston Carriage to break even in 2022? 5. How many monthly passengers would be required for Charleston Carriage to earn $115,000 per month in 2022? many monto song 6. Assuming a tax rate of 31%, what must ticket revenue be in order for Charleston Carriage to earn $115,000 per month in 2022? variable costs a) 15% * $18.50 b) 0.50 $2.90 c) d) Brokerage : 1.10x65% -05 0.715 expected fare for all passingers $18.50 monly contribution margin per passarger $11.61 2. Total monty fired cost 45,000 +8,500 48000 61.500 61500 PK - $4.8 per 2-48 3 3 people perent 2 by car p=(1+0.1 (25) -4% +590911130,00 6 P = citol (251) X - 0.8%+50,000 - p = 2.78-1080,000 1,130,000 po) 2 = 400,000 2. pe 270.000 7=500,000 3 x = 600,ooo; p = 540,000 p = (3-7- 1100) X - 1080000 - P=172 -10 80000 X - 1.2 (600,000) = 720,000 pa 144,900 CMJ BET ;P? 4 P=2.7.X-108000 BE 1 P=0=700,000 7 meaningful: p=540,000 ; x = 900,00 get net income amount can also be easily computed by setting P equal to the desired target level and solving for X. sales, multip CMR margin represe that is contribu sales do $.30, sa margin rate is contribu Tax Considerations At the break-even point, profit is zero so taxes do not have to be considered. A company must, however, pay income taxes if it earns a positive net income amount. Therefore, when a manager is interested in the volume level necessary to achieve a target net income, income taxes must be considered. Taxes were ignored in the previous analysis, so that profit used earlier is assumed to be profit before taxes, PBT. To continue to use this cost-volume-profit analysis equation, target profit after taxes, PAT, is converted into target profit before taxes in the following way: CM CMR The revis PAT = PBT - taxes Profi PAT = PBT -(tx PBT) where t represents the tax rate. Using this equation, an after-tax net income target can be converted to a before-tax net income target by setting PAT and t to the after-tax target and tax rate, respectively, and solving for This vers the reven the previa profit equ used exac except tha