Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Third show was clarified as just the fixed cost according to my professor. I'm assuming all else is the same pricing wise for it too.

Third show was clarified as just the fixed cost according to my professor. I'm assuming all else is the same pricing wise for it too.

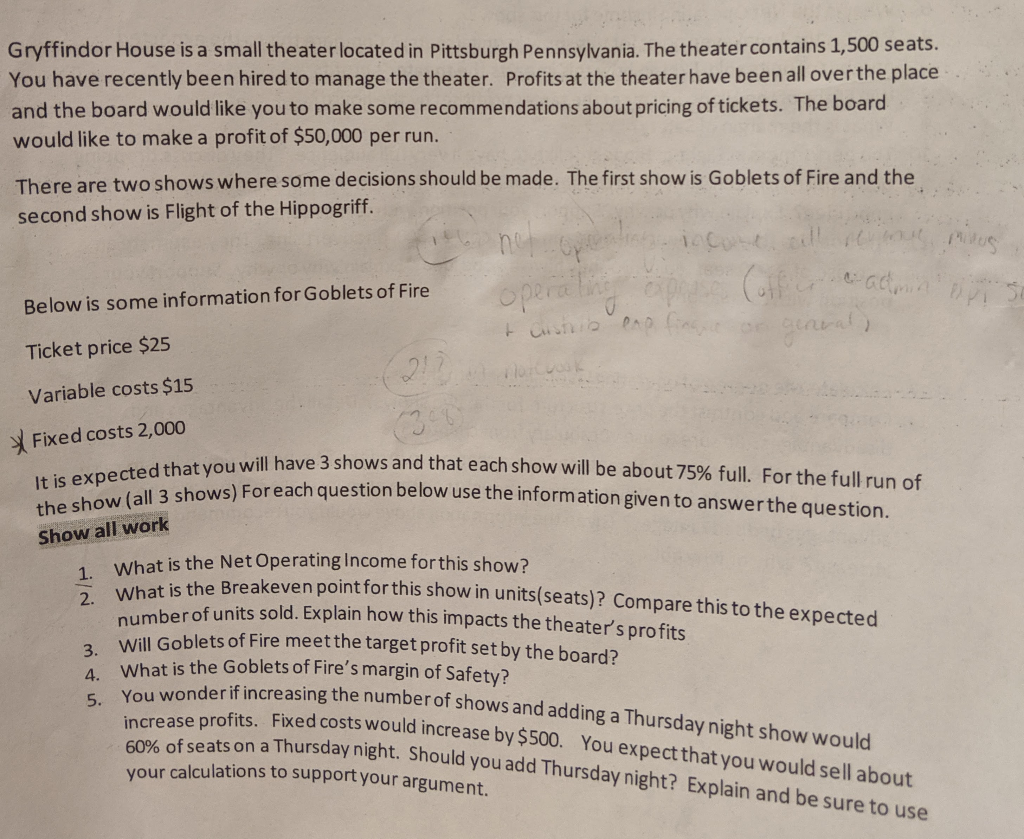

Gryffindor House is a small theater located in Pittsburgh Pennsylvania. The theater contains 1,500 seats. You have recently been hired to manage the theater. Profits at the theater have been all over the place and the board would like you to make some recommendations about pricing of tickets. The board would like to make a profit of $50,000 per run. There are two shows where some decisions should be made. The first show is Goblets of Fire and the . second show is Flight of the Hippogriff. not penting income call seinen maus Coreadmori 5 Below is some information for Goblets of Fire shib 00 or geral) Ticket price $25 Variable costs $15 Fixed costs 2,000 will have 3 shows and that each show will be about 75% full. For the full run of For each question below use the information given to answer the question. It is expected that you will have 3 shows the show (all 3 shows) For each questio Show all work What is the Net Operating Income for this show? bakeven point for this show in units(seats)? Compare this to the expected What is the Breakeven point for this sh of units sold. Explain how this impacts the theater's profits number of units sold. Explain how Will Goblets of Fire meet the target profit set by the board? What is the Goblets of Fire's margin of Safety? You wonder if increasing the number of increase profits. Fixed costs would increase creasing the number of shows and adding a Thursday night show would costs would increase by $500. You expect that you would sell about sday night. Should you add Thursday night? Explain and be sure to use your calculations to support your argumStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started