Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This all related. Retirement Calculations. An Application of Exponential functions Name One application of exponential functions is the concept of compound interest in this case,

This all related.

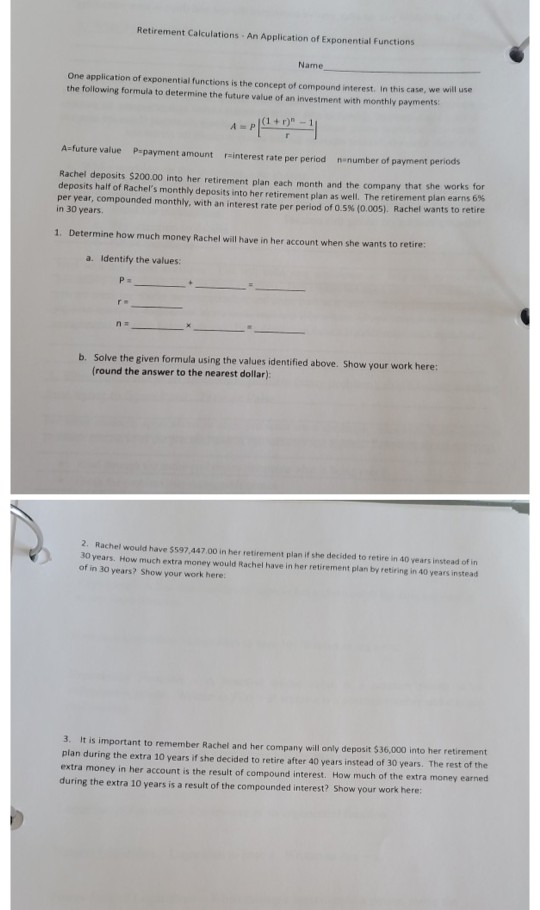

Retirement Calculations. An Application of Exponential functions Name One application of exponential functions is the concept of compound interest in this case, we will use the following formula to determine the future value of an investment with monthly payments As future value Pepayment amount interest rate per period number of payment periods Rachel deposits $200.00 into her retirement plan each month and the company that she works for deposits half of Rachel's monthly deposits into her retirement plan as well. The retirement plan earns 65 per year, compounded monthly, with an interest rate per period of 0.5% (0.005). Rachel wants to retire in 30 years 1. Determine how much money Rachel will have in her account when she wants to retire: a. Identify the values: b. Solve the given formula using the values identified above. Show your work here: (round the answer to the nearest dollar): 2. Rachel would have 5597.447 00 in her retirement plan if she decided to retire in 40 years instead of in 30 years. How much extra money would Rachel have in her retirement plan by retiring in 40 years instead of in 30 years? Show your work here: 3. It is important to remember Rachel and her company will only deposit $36.000 into her retirement plan during the extra 10 years if she decided to retire after 40 years instead of 30 years. The rest of the extra money in her account is the result of compound interest. How much of the extra money earned during the extra 10 years is a result of the compounded interest Show your work hereStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started