Answered step by step

Verified Expert Solution

Question

1 Approved Answer

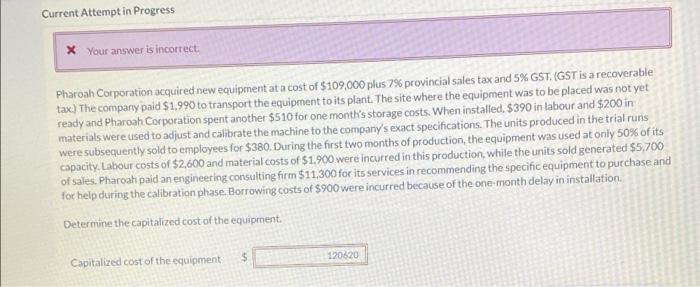

This answer is incorrect and so is the ones posted on this question. Current Attempt in Progress * Your answer is incorrect. Pharoah Corporation acquired

This answer is incorrect and so is the ones posted on this question.

Current Attempt in Progress * Your answer is incorrect. Pharoah Corporation acquired new equipment at a cost of $109,000 plus 7% provincial sales tax and 5% GST. (GST is a recoverable tax) The company paid $1.990 to transport the equipment to its plant. The site where the equipment was to be placed was not yet ready and Pharoah Corporation spent another $510 for one month's storage costs. When installed, $390 in labour and $200 in materials were used to adjust and calibrate the machine to the company's exact specifications. The units produced in the trial runs were subsequently sold to employees for $380. During the first two months of production, the equipment was used at only 50% of its capacity. Labour costs of $2,600 and material costs of $1.900 were incurred in this production, while the units sold generated $5,700 of sales. Pharoah paid an engineering consulting firm $11,300 for its services in recommending the specific equipment to purchase and for help during the calibration phase. Borrowing costs of $900 were incurred because of the one month delay in installation Determine the capitalized cost of the equipment. $ 120620 Capitalized cost of the equipment

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started