This assessment addresses the following course objective(s):

Describe the three functions of accounting

Apply the accounting vocabulary

Record various business transactions in accordance with generally accepted accounting principles.

Complete the steps of the Accounting Cycle.

Complete the adjusting entries, post them to the general ledger then prepare a trial balance and financial statements.

NOTE: I JUST NEED THE LAST PARTS THAT IS NOT FILLED UP YET COMPLETED. Thanks

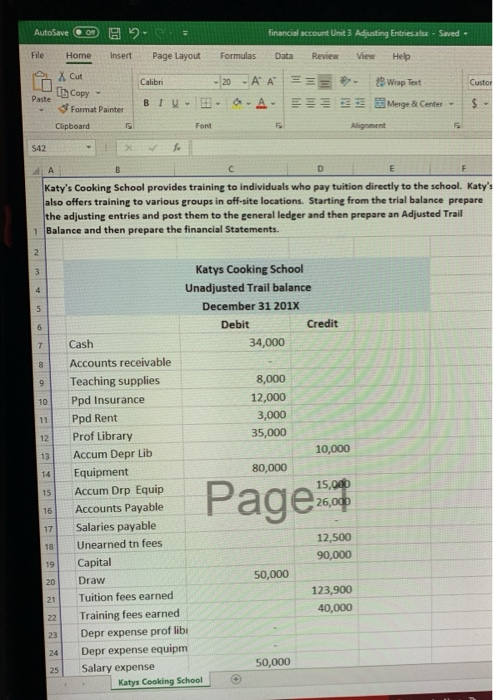

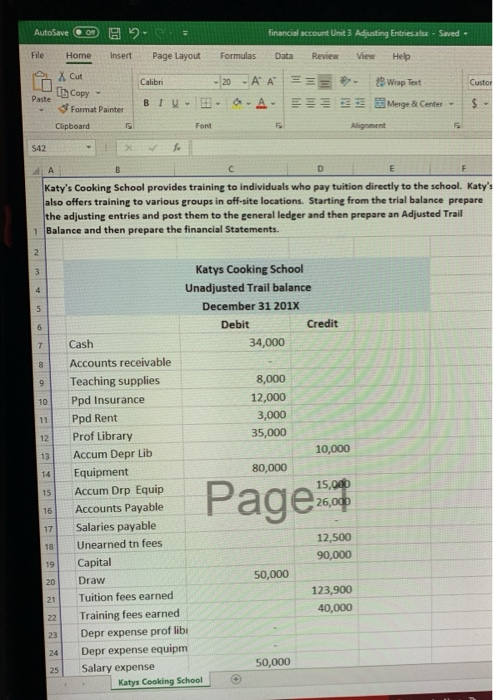

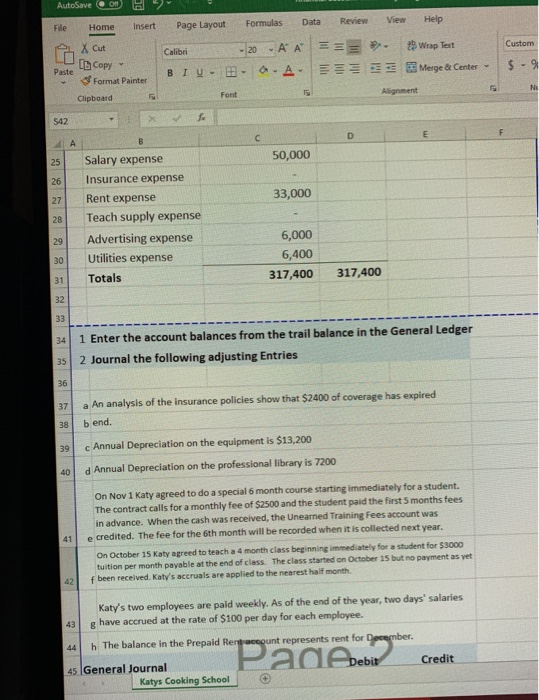

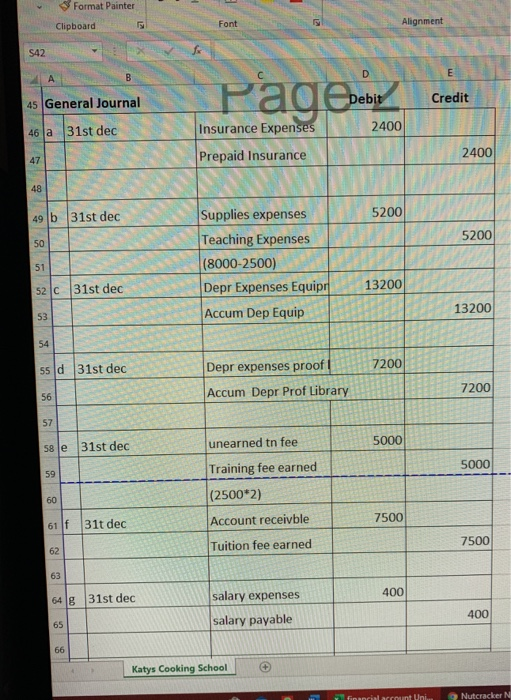

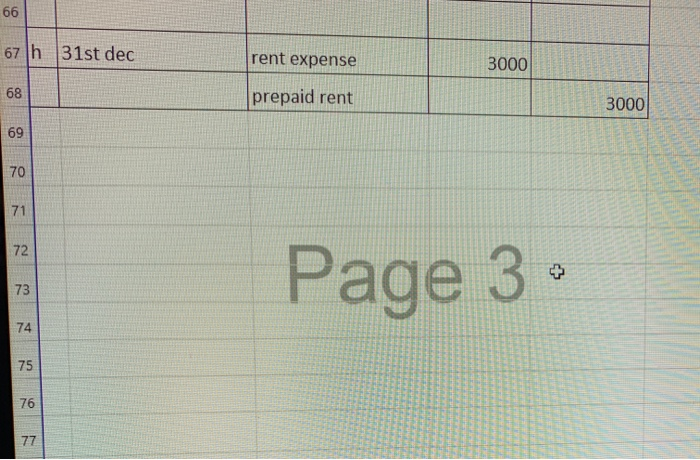

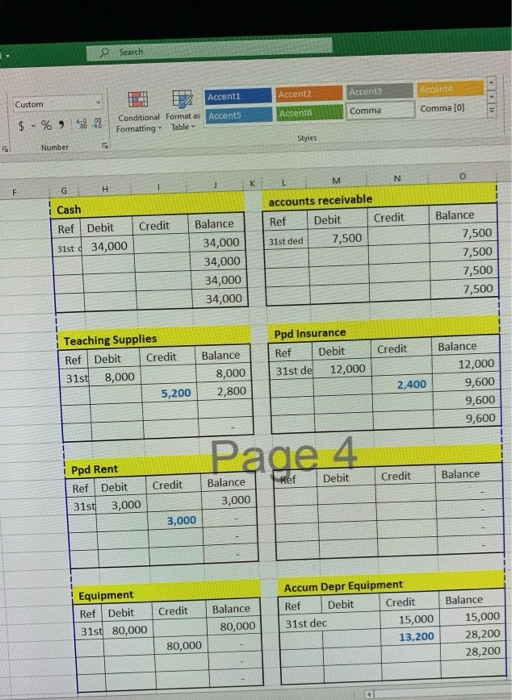

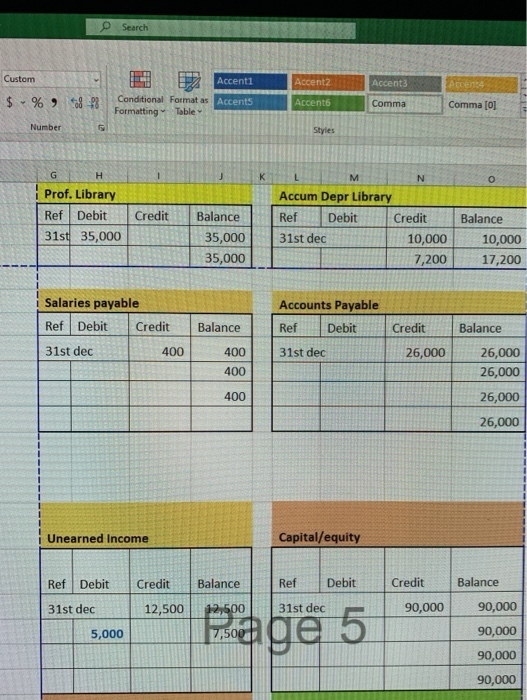

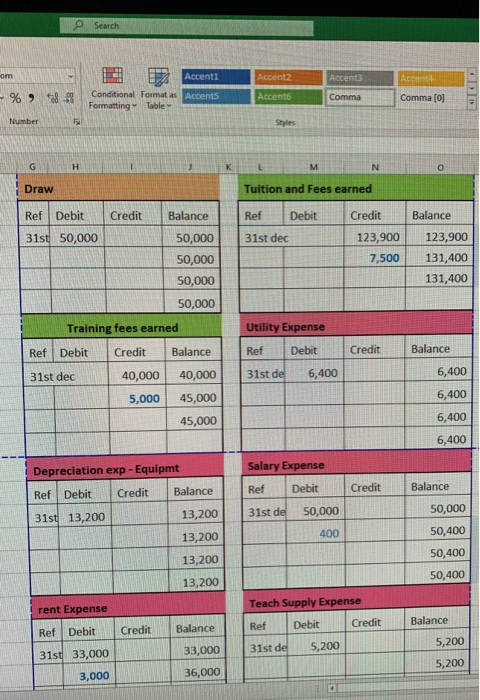

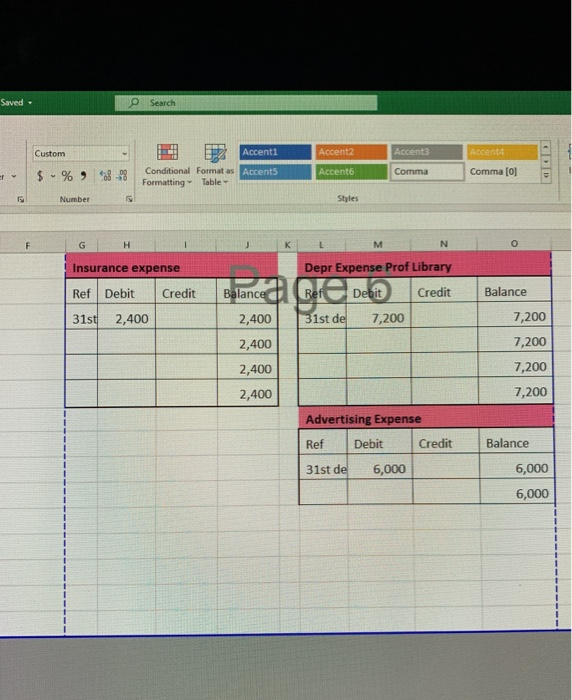

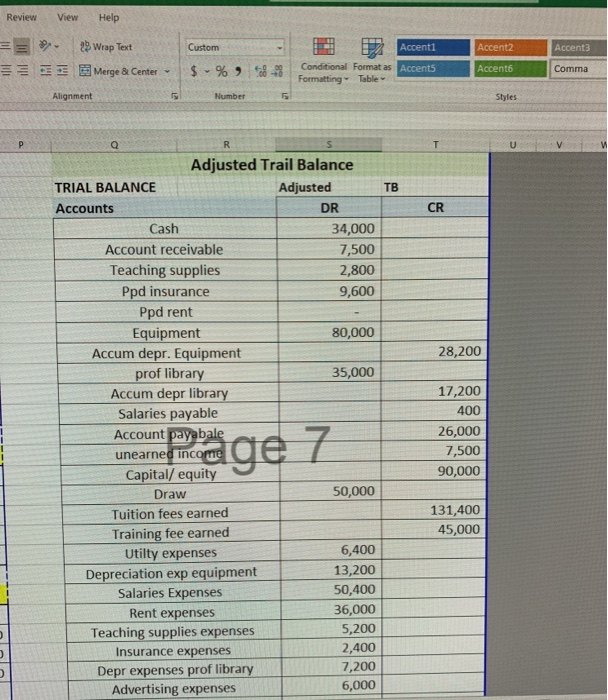

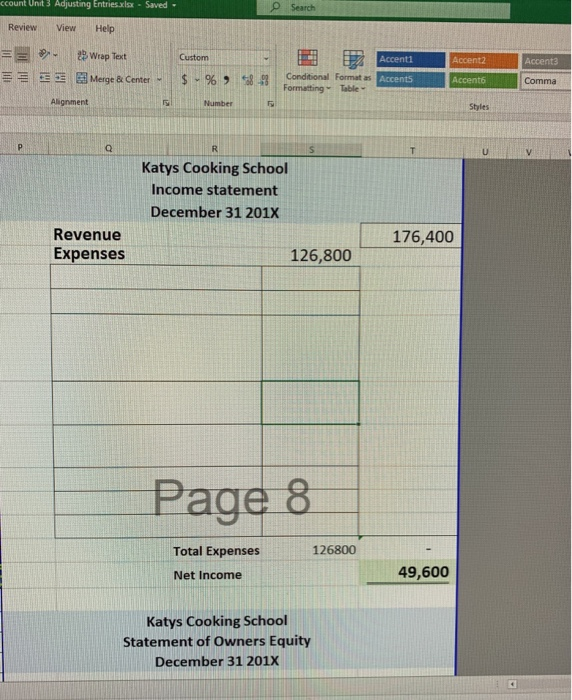

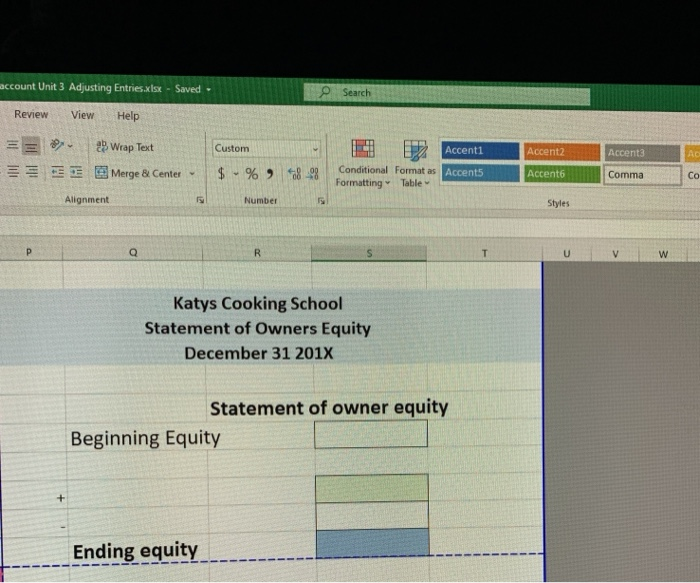

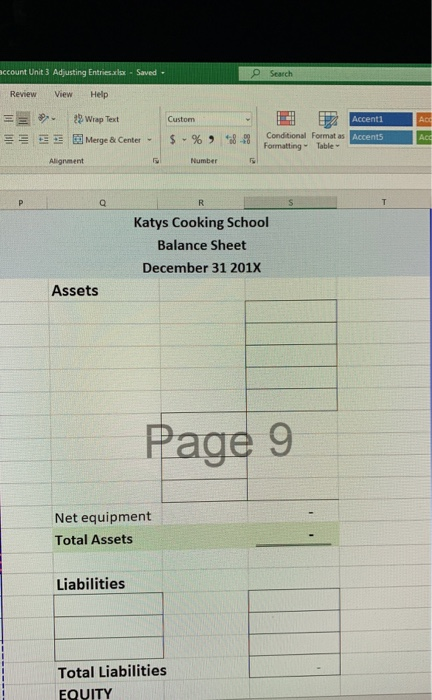

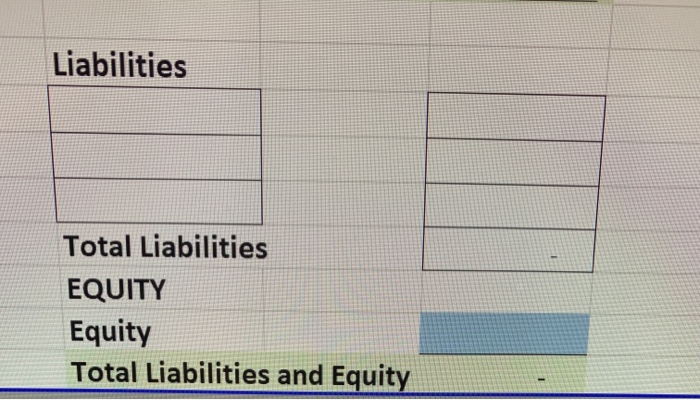

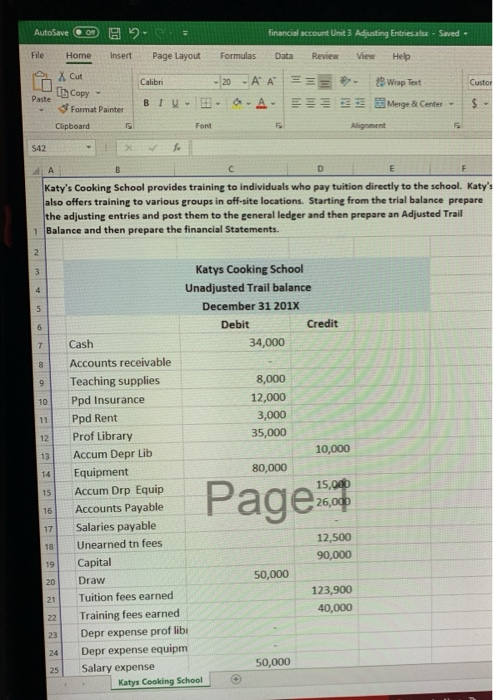

AutoSave OM 2 financial account Unit 3 Adjusting Entriesalsx - Saved. File Home Insert Page Layout Formulas Data Review View Help Calibri Custor X Cut [Copy Format Painter Clipboard Paste - 20 - AA 28 Wrap Text - A E Merge & Center - BIU Font Alignment S42 to 3 5 6 8 9 11 4. B C D Katy's Cooking School provides training to individuals who pay tuition directly to the school. Katy's also offers training to various groups in off-site locations. Starting from the trial balance prepare the adjusting entries and post them to the general ledger and then prepare an Adjusted Trail 1 Balance and then prepare the financial Statements. 2 Katys Cooking School 4 Unadjusted Trail balance December 31 2018 Debit Credit 7 Cash 34,000 Accounts receivable Teaching supplies 8,000 10 Ppd Insurance 12,000 Ppd Rent 3,000 Prof Library 35,000 13 Accum Depr Lib 10,000 Equipment 80,000 Accum Drp Equip 15,000 Accounts Payable 26,000 Salaries payable Unearned tn fees 12,500 90,000 19 Capital Draw 50,000 123,900 21 Tuition fees earned Training fees earned 40,000 Depr expense prof libi Depr expense equipm Salary expense 50,000 Katys Cooking School 12 14 15 Page 16 17 18 20 22 23 24 25 AutoSave COM Data Formulas Review View Help File Home Page Layout Insert Custom X cut In Copy Calibri - 20 AA == 25 Wrap Text BIU-EB A.A. Merge & Center s-9 Paste Format Painter NE Clipboard Font Alignment S42 D B 50,000 25 26 33,000 27 28 Salary expense Insurance expense Rent expense Teach supply expense Advertising expense Utilities expense Totals 29 6,000 6,400 317,400 30 317,400 31 32 33 34 1 Enter the account balances from the trail balance in the General Ledger 2 Journal the following adjusting Entries 35 36 37 a An analysis of the insurance policies show that $2400 of coverage has expired 38 b end. 39 40 c Annual Depreciation on the equipment is $13,200 d Annual Depreciation on the professional library is 7200 On Nov 1 Katy agreed to do a special 6 month course starting immediately for a student The contract calls for a monthly fee of $2500 and the student paid the first 5 months fees in advance. When the cash was received, the Unearned Training Fees account was e credited. The fee for the 6th month will be recorded when it is collected next year. On October 15 Katy agreed to teach a 4 month class beginning immediately for a student for $3000 tuition per month payable at the end of class. The class started on October 15 but no payment as yet fbeen received. Katy's accruals are applied to the nearest half month 42 Katy's two employees are paid weekly. As of the end of the year, two days' salaries 43 8 have accrued at the rate of $100 per day for each employee. 44 h The balance in the Prepaid Rent account represents rent for December. 45 General Journal Credit Katys Cooking School Pad Abebi Format Painter Clipboard Font Alignment S42 E B 45 General Journal Debit Credit 46 a 31st dec 2400 Insurance Expenses Prepaid Insurance 2400 47 48 49 b 31st dec 5200 5200 50 51 Supplies expenses Teaching Expenses (8000-2500) Depr Expenses Equipr Accum Dep Equip 52 C 31st dec 13200 13200 53 54 7200 55 d 31st dec Depr expenses proof Accum Depr Prof Library 7200 56 57 5000 58 le 31st dec unearned tn fee 5000 59 Training fee earned (2500*2) 60 7500 61 lf 31t dec Account receivble Tuition fee earned 7500 62 63 400 64 g 31st dec salary expenses salary payable 400 65 66 Katys Cooking School financial account Uni... Nutcracker N 66 67 h 31st dec rent expense 3000 58 prepaid rent 3000 69 70 71 72 Page 3 73 74 75 7 76 77 Search Accent2 Accent Acconto Comma [0] Accenti Conditional Format as Accents Formatting Table Custom $ - % Comma Accents 9 $8.92 Styles Number K F G H 1 1 Cash Ref Debit 31st 34,000 M N accounts receivable Ref Debit Credit 31st ded 7,500 Credit Balance 34,000 34,000 34,000 34,000 Balance 7,500 7,500 7,500 7,500 --- Teaching Supplies Ref Debit Credit 31st 8,000 5,200 Credit Ppd Insurance Ref Debit 31st de 12,000 Balance 8,000 2,800 2,400 Balance 12,000 9,600 9,600 9,600 Page 4 Debit Credit Balance Hef Ppd Rent Ref Debit 31st 3,000 Credit Balance 3,000 3,000 Equipment Ref Debit 31st 80,000 Credit Balance 80,000 Accum Depr Equipment Ref Debit Credit 31st dec 15,000 13,200 Balance 15,000 28,200 28,200 80,000 e Search Custom Accenti Accent2 Accent Arcen $ -% -28 Conditional Format as Accents Formatting Table Accent Comma Comma [0] Number Styles K o G H Prof. Library Ref Debit 31st 35,000 Credit Balance 35,000 35,000 L M N Accum Depr Library Ref Debit Credit 31st dec 10,000 7,200 Balance 10,000 17,200 Accounts Payable Salaries payable Ref Debit Credit Balance Ref Debit Credit Balance 31st dec 400 31st dec 26,000 400 400 26,000 26,000 26,000 26,000 400 Unearned Income Capital/equity Ref Debit Credit Balance Ref Debit Credit Balance 31st dec 12,500 12,500 31st dec 90,000 90,000 5,000 Page 5 90,000 90,000 90,000 Search om Accent Accent Acente %8-8 Accenti Conditional Format as Accents Formatting Table Accents Comma Comma [0] Number 5 Styles G K L M N 0 Draw Tuition and Fees earned Ref Debit Credit Balance Ref Debit Credit Balance 31st dec 123,900 7,500 123,900 131,400 131,400 31st 50,000 50,000 50,000 50,000 50,000 Training fees earned Ref Debit Credit Balance 31st dec 40,000 40,000 5,000 45,000 Utility Expense Ref Debit Credit Balance 31st de 6,400 6,400 6,400 45,000 6,400 6,400 Depreciation exp-Equipmt Salary Expense Ref Debit Credit Balance Ref Debit Balance Credit 13,200 31st de 31st 13,200 50,000 50,000 400 50,400 13,200 13,200 50,400 13,200 50,400 rent Expense Balance Ref Debit Credit Teach Supply Expense Ref Debit Credit 31st de 5,200 Balance 5,200 31st 33,000 33,000 5,200 3,000 36,000 Saved. Search Custom Accenti Accent2 Accents Accent $ - % 8-98 Accent Conditional Format as Accents Formatting Table Comma Comma [0] Number Styles F K M N Insurance expense Depr Expense Prof Library Ref Debit Credit Balance Ref Debit Credit Balance 31st 2,400 2,400 31st de 7,200 7,200 7,200 2,400 2,400 7,200 2,400 7,200 Advertising Expense Ref Debit Credit Balance 31st de 1 6,000 6,000 6,000 ! - Review View Help = Custom Accenti Accent2 Accent3 29 Wrap Text E Merge & Center $ -% -8 Conditional Format as Accents Formatting Table Accento Comma Alignment Number Styles T U TB CR 28,200 Q R Adjusted Trail Balance TRIAL BALANCE Adjusted Accounts DR Cash 34,000 Account receivable 7,500 Teaching supplies 2,800 Ppd insurance 9,600 Ppd rent Equipment 80,000 Accum depr. Equipment prof library 35,000 Accum depr library Salaries payable Account payabale unearned income Capital/ equity Draw 50,000 Tuition fees earned Training fee earned Utilty expenses 6,400 Depreciation exp equipment 13,200 Salaries Expenses 50,400 Rent expenses 36,000 Teaching supplies expenses 5,200 Insurance expenses 2,400 Depr expenses prof library 7,200 Advertising expenses 6,000 age 7 17,200 400 26,000 7,500 90,000 131,400 45,000 ccount Unit 3 Adjusting Entries.xlsx - Saved Search Review View Help Custom E Accent1 Accent2 2 Wrap Text Merge & Center - Accent $ -% -8 -93 Conditional Format as Accents Formatting Table- Accents Comma Alignment F Number Styles P Q R s T U Katys Cooking School Income statement December 31 2018 Revenue Expenses 176,400 126,800 Page 8 126800 Total Expenses Net Income 49,600 Katys Cooking School Statement of Owners Equity December 31 2017 account Unit 3 Adjusting Entries.xlsx - Saved - Search Review View Help Custom Accenti Accent2 Accent3 AC 2 Wrap Text Merge & Center $ - %) 8-98 Conditional Format as Accents Formatting Table Accent Comma Co Alignment Number Styles P Q R T U w Katys Cooking School Statement of Owners Equity December 31 2018 Statement of owner equity Beginning Equity + Ending equity account Unit 3 Adjusting Entries.xlsx - Saved Search Review View Help = Custom AC 2. Wrap Text E Merge & Center - $ - % 8-98 Accenti Conditional Format as Accents Formatting Table Acd Alignment Number Q R T Katys Cooking School Balance Sheet December 31 201X Assets Page 9 Net equipment Total Assets Liabilities Total Liabilities EQUITY Liabilities Total Liabilities EQUITY Equity Total Liabilities and Equity