Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This assessment is a continuation of Summative assessment 1 from the module on financial markets and Instruments. The assessment has some additional Components to

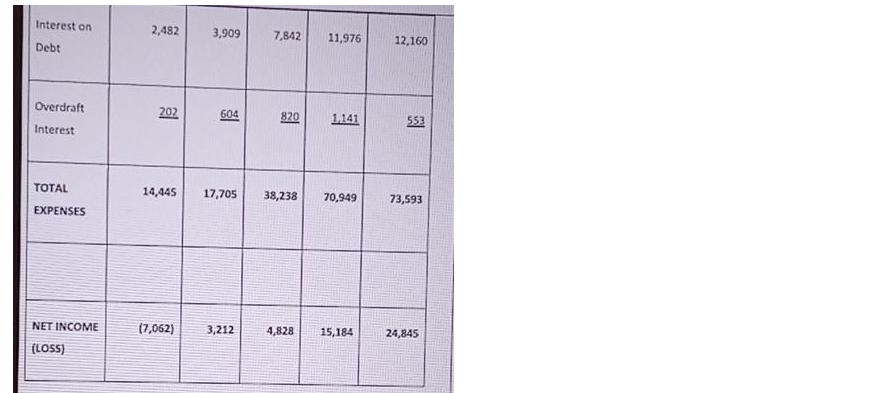

This assessment is a continuation of Summative assessment 1 from the module on financial markets and Instruments. The assessment has some additional Components to it as detailed below, however the assessment is a presentation and must be developed as such. OUR Presentation must be presented in your Portfolio as a hard copy using Powerpoint 2.1. Identify the clients business requirements and explain how you came to this conclusions-what sources of information were used (3) 2.2. SWOT analysis of the Client and business entity and Historical Analysis of business (fundamental analysis) (6) 2.3. Conduct a Risk Analysis on the business with a focus on financial risks and business risks (6) 2.4. What financial solutions are you providing and why? (5) 2.5. How have you benchmarked your solutions? (Investment strategy)? (4) 2.6. What markets are you suggesting to this client and why? (5) Interest on Debt Overdraft Interest TOTAL EXPENSES NET INCOME (LOSS) 2,482 202 3,909 (7,062) 604 7,842 3,212 820 14,445 17,705 38,238 70,949 11,976 4,828 1,141 15,184 12,160 553 73,593 24,845

Step by Step Solution

★★★★★

3.38 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Presentation Financial Solutions for Client X 21 Identifying Client Business Requirements Client X operates in the manufacturing industry with a focus on producing consumer electronics and home applia...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started