Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This assignment has two independent situations ( Part 1 and Part 2 ) Part 1 of 2 The president of Lynbrook, Inc. recently asked you

This assignment has two independent situations Part and Part

Part of

The president of Lynbrook, Inc. recently asked you to evaluate one of the company's profitable

product lines in response to some new competition that will be entering the market next year. Your

accounting department gave you the following information for your analysis.

Required:

Answer each question independently based on the original data:

What is the product's ratio?

Use the CM ratio to determine the breakeven point in dollar sales.

Assume this year's unit sales and total sales increase by units and $

respectively. If the fixed expenses do not change, how much will net operating income

increase?

a What is the degree of operating leverage based on last year's sales?

b Assume the president expects this year's unit sales to increase by Using the degree

of operation leverage from last year, what percentage increase in net operating income will

the company realize this year?

The sales manager is convinced that a reduction in the selling price, combined with a

$ increase in advertising would increase this year's unit sales by If the sales

manager is right, what would this year's net operating income be if his ideas were

implemented? Do you recommend implementing the sales manager's suggestions? Why?

The president does not want to change the selling price. Instead, she wants to increase the

sales commission by $ per unit. She thinks that this move, combined with some increase

in advertising, would increase this year's unit sales by How much could the president

increase this year's advertising expense and still earn the same $ net operating

income as last year?Part of

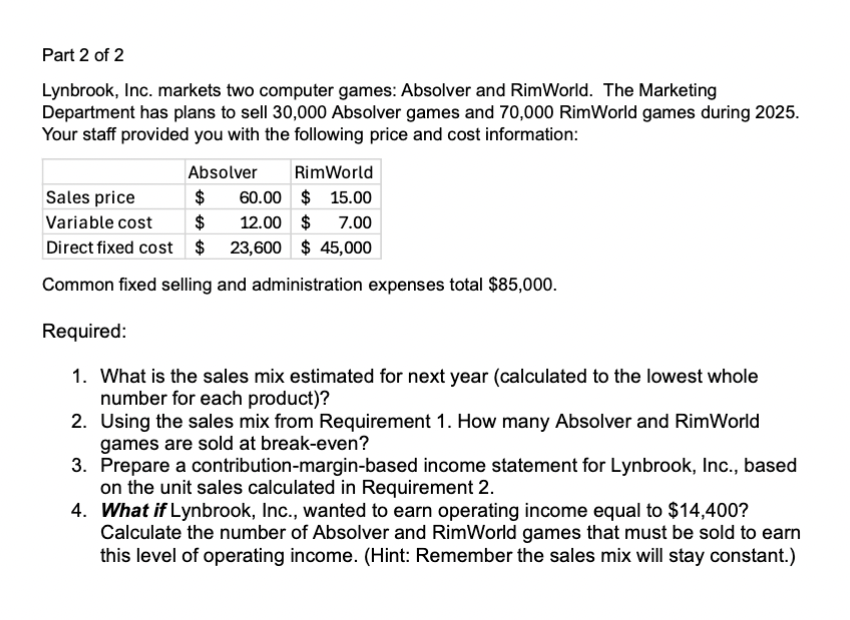

Lynbrook, Inc. markets two computer games: Absolver and RimWorld. The Marketing

Department has plans to sell Absolver games and RimWorld games during

Your staff provided you with the following price and cost information:

Common fixed selling and administration expenses total $

Required:

What is the sales mix estimated for next year calculated to the lowest whole

number for each product

Using the sales mix from Requirement How many Absolver and RimWorld

games are sold at breakeven?

Prepare a contributionmarginbased income statement for Lynbrook, Inc., based

on the unit sales calculated in Requirement

What if Lynbrook, Inc., wanted to earn operating income equal to $

Calculate the number of Absolver and RimWorld games that must be sold to earn

this level of operating income. Hint: Remember the sales mix will stay constant.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started