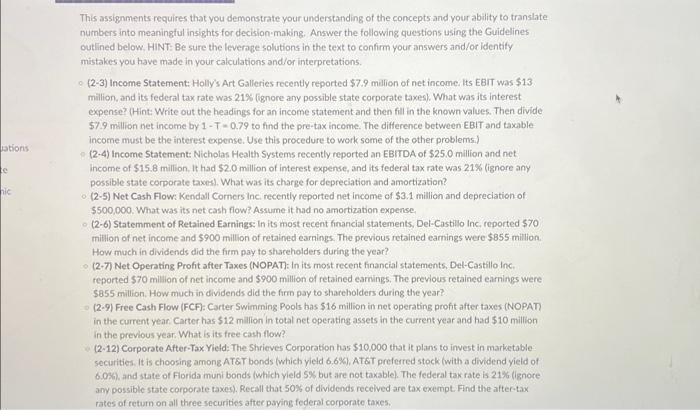

This assignments requires that you demonstrate your understanding of the concepts and your ability to translate numbers into meaningful insights for decision making. Answer the following questions using the Guidelines outlined below. HINT: Be sure the leverage solutions in the text to confirm your answers and/or identify mistakes you have made in your calculations and/or interpretations. (2-3) Income Statement: Holly's Art Galleries recently reported $7.9 milion of net income. Its EBIT was $13 milion, and its federal tax rate was 21% (ignore any possible state corporate taxes). What was its interest expense? (Hint: Write out the headings for an income statement and then fill in the known values. Then divide $7.9 million net income by 1T=0.79 to find the pre-tax income. The difference between EBIT and taxable income must be the interest expense. Use this procedure to work some of the other problems.) (2.4) Income Statement: Nicholas Health Systems recently reported an EBITDA of \$2.5.0 million and net. income of $15.8 million. It had $2.0 million of interest expense, and its federal tax rate was 21% (ignore any possible state corporate taxes). What was its charge for depreciation and amortization? - (2-5) Net Cash Flow: Kendall Corners Inci recently reported net income of \$3.1 million and depreciation of $500,000. What was its net cash flow? Assume it had no amortization expense, - (2-6) Statemment of Retained Earnings: In its most recent financial statements, Dei-Castillo Inc, reported $70 mitlion of net income and $900 million of retained earnings. The previous retained earnings were $855 million. How much in dividends did the firm pay to shareholders during the year? (2-7) Net Operating Profit after Taxes (NOPAT): In its most recent financial statements, Del-Castillo inc. reported $70 million of net income and $900 million of retained eamings. The previous retained earnings were $855 million. How much in dividends did the firm pay to shareholders during the year? (2-9) Free Cash Flow (FCF): Carter Swimming Pools bas $16 million in net operating profit after taxes (NOPAT) in the current year: Carter has $12 million in total net operating assets in the current year and had $10 million in the previous year. What is its free cash flow? (2-12) Corporate After-Tax. Yield: The Shrieves Corporation has $10,000 that it plans to invest in marketable securities. It is choosing among AT\&T bonds (which yield 6.6\%). ATET preferred stock (with a dividend yield of 6.0% ), and state of Fiorida muni bonds (which yield 5% but are not taxable). The federal tak rate is 21% (ignore amy possible state corporate taxes). Reeall that 50% of dividends recelved are tax exempt. Find the after-tax rates of return on all three securities after paying federal corporate taxes