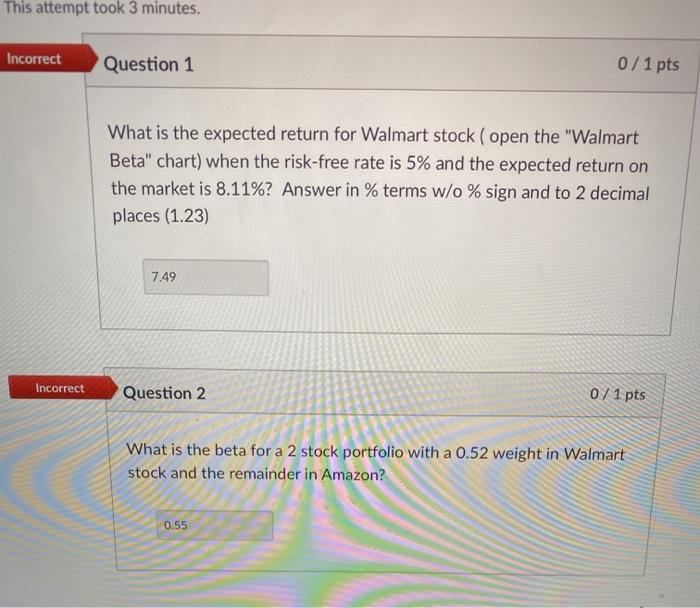

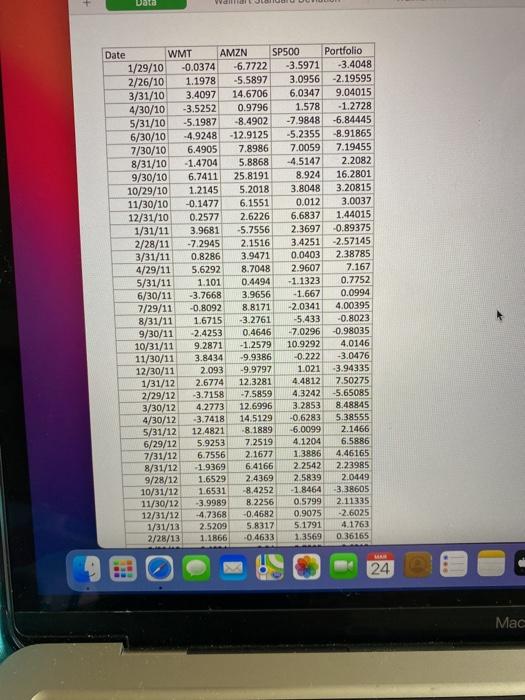

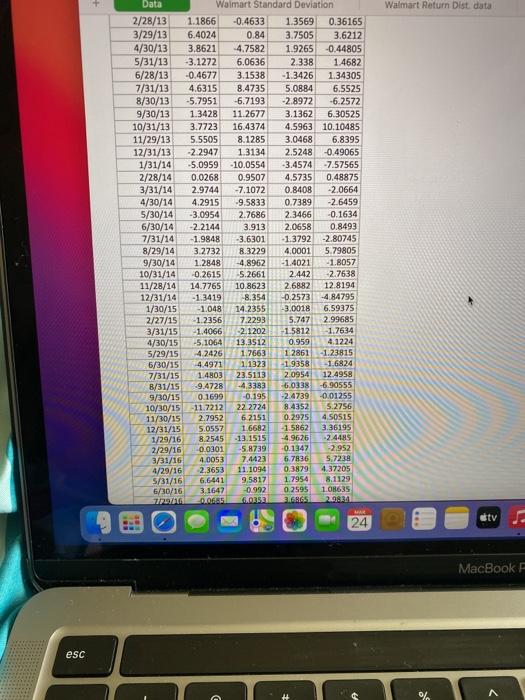

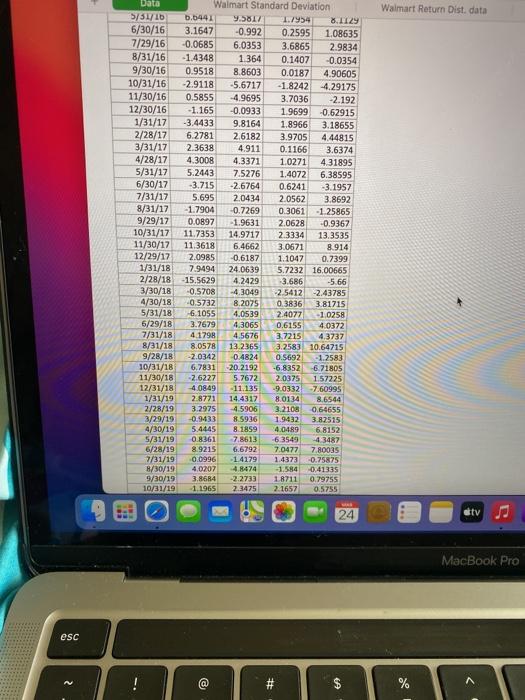

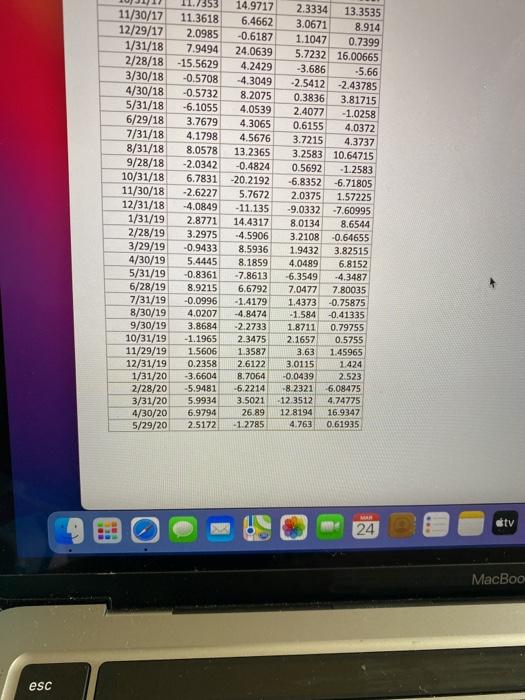

This attempt took 3 minutes. Incorrect Question 1 0/1 pts What is the expected return for Walmart stock ( open the "Walmart Beta" chart) when the risk-free rate is 5% and the expected return on the market is 8.11%? Answer in % terms w/o % sign and to 2 decimal places (1.23) 7.49 Incorrect Question 2 0/1 pts What is the beta for a 2 stock portfolio with a 0.52 weight in Walmart stock and the remainder in Amazon? 0.55 Data YOU Date WMT AMZN SP500 Portfolio 1/29/10 -0.0374 -6.7722 -3.5971 -3.4048 2/26/10 1.1978 -5.5897 3.0956 -2.19595 3/31/10 3.4097 14.6706 6.0347 9.04015 4/30/10 -3.5252 0.9796 1.578 - 1.2728 5/31/10 -5.1987 -8.4902 -7.9848 -6.84445 6/30/10 -4.9248 -12.9125 -5.2355 -8.91865 7/30/10 6.4905 7.8986 7.0059 7.19455 8/31/10 -1.4704 5.8868 -4.5147 2.2082 9/30/10 6.7411 25.8191 8.924 16.2801 10/29/10 1.2145 5.2018 3.8048 3.20815 11/30/10 -0.1477 6.1551 0.012 3.0037 12/31/10 0.2577 2.6226 6.6837 1.44015 1/31/11 3.9681 -5.7556 2.3697 -0.89375 2/28/11 -7.2945 2.1516 3.4251 -2.57145 3/31/11 0.8286 3.9471 0.0403 2.38785 4/29/11 5.6292 8.7048 2.9607 7.167 5/31/11 1.101 0.4494 -1.1323 0.7752 6/30/11 -3.7668 3.9656 -1.667 0.0994 7/29/11 -0.8092 8.8171 -2.0341 4.00395 8/31/11 1.6715 -3.2761 -5.433 -0.8023 9/30/11 -2.4253 0.4646 -7.0296 -0.98035 10/31/11 9.2871 -1.2579 10.9292 4.0146 11/30/11 3.8434 -9.9386 -0.222 -3.0476 12/30/11 2.093 -9.9797 1.021 -3.94335 1/31/12 2.6774 12.3281 4.4812 7.50275 2/29/12 -3.7158 -7.5859 4.3242 -5.65085 3/30/12 4.2773 12.6996 3.2853 8.48845 4/30/12 -3.7418 14.5129 -0.6283 5.38555 5/31/12 12.4821 -8.1889 -6.0099 2.1466 6/29/12 5.9253 7.2519 4.1204 6.5886 7/31/12 6.7556 2.1677 1.3886 4.46165 8/31/12 -1.9369 6.4166 2.2542 2.23985 9/28/12 1.6529 2.4369 2.5839 2.0449 10/31/12 1.6531 8,4252 -1.8464 -3.38605 11/30/12 -3.9989 8.2256 0.5799 2.11335 12/31/12 -4.7368 -0.4682 0.9075 -2.6025 1/31/13 2.5209 5.8317 5.1791 4.1763 2/28/13 1.1866 -0.4633 1.3569 0.36165 24 Mac + Walmart Return Dist. data Data Walmart Standard Deviation 2/28/13 1.1866 -0.4633 1.3569 0.36165 3/29/13 6.4024 0.84 3.7505 3.6212 4/30/13 3,8621 -4.7582 1.9265 -0.44805 5/31/13 -3.1272 6.0636 2.338 1.4682 6/28/13 -0.4677 3.1538 -1.3426 1.34305 7/31/13 4.6315 8.4735 5.0884 6.5525 8/30/13 -5.7951 -6.7193 -2.8972 -6.2572 9/30/13 1.3428 11.2677 3.1362 6.30525 10/31/13 3.7723 16.4374 4.5963 10.10485 11/29/13 5.5505 8.1285 3.0468 6.8395 12/31/13 -2.2947 1.3134 2.5248 -0.49065 1/31/14 -5.0959 -10.0554 -3.4574 -7.57565 2/28/14 0.0268 0.9507 4.5735 0.48875 3/31/14 2.9744 -7.1072 0.8408 -2.0664 4/30/14 4.2915 -9.5833 0.7389 -2.6459 5/30/14 -3.0954 2.7686 2.3466 -0.1634 6/30/14 -2.2144 3.913 2.0658 0.8493 7/31/14 -1.9848 -3.6301 -1.3792 -2.80745 8/29/14 3.2732 8.3229 4.0001 5.79805 9/30/14 1.2848 -4.8962 -1.4021 -1.8057 10/31/14 0.2615 5.2661 2.442 -2.7638 11/28/14 14.7765 10.8623 2.6882 12.8194 12/31/14 -1.3419 -8.354 -0.2573 -4.84795 1/30/15 -1.048 14.2355 -3.0018 6.59375 2/27/15 -1.2356 7.2293 5.747 2.99685 3/31/15 -1.4066 -2.1202 -1.5812 -1.7634 4/30/15 -5,1064 13.3512 4.1224 5/29/15 4.2426 1.7663 1.2861 -1.23815 6/30/15 4.4971 1.1323 -1.9358 -1.6824 7/31/15 1.4803 23.5113 2.0954 12.4958 8/31/15 -9.4728 -4.3383 -6.0338 -6.90555 9/30/15 0.1699 -0.195 -2.4739 -0.01255 10/30/15 -11.7212 22 2724 84352 5.2756 11/30/15 2.7952 6.2151 0.2975 4.50515 12/31/15 5.0557 1 6682 - 1.5862 3.36195 1/29/16 8.2545 -13.1515 -4.9626 -2.4485 2/29/16 0.0301 -5.8739 -0.1347 -2.952 3/31/16 4.0053 7.4423 6.7836 5.7238 4/29/16 2.3653 11.1094 0.3879 4.37205 5/31/16 6.6441 9.5817 1.7954 8.1129 6/30/16 3.1647 -0.992 0.2595 1.08635 77/79/06 0.0685 316865 2.9834 0.959 24 ity MacBook F esc % Walmart Return Dist. data Data 5751/16 6/30/16 7/29/16 8/31/16 9/30/16 10/31/16 11/30/16 12/30/16 1/31/17 2/28/17 3/31/17 4/28/17 5/31/17 6/30/17 7/31/17 8/31/17 9/29/17 10/31/17 11/30/17 12/29/17 1/31/18 2/28/18 3/30/18 4/30/18 5/31/18 6/29/18 7/31/18 8/31/18 9/28/18 10/31/18 11/30/18 12/31/18 1/31/19 2/28/19 3/29/19 4/30/19 5/31/19 6/28/19 7/31/19 B/30/19 9/30/19 10/31/19 Walmart Standard Deviation 6.6441 9.5817 1.7954 8.1129 3.1647 -0.992 0.2595 1.08635 -0.0685 6.0353 3.6865 2.9834 -1.4348 1.364 0.1407 -0.0354 0.9518 8.8603 0.0187 4.90605 -2.9118 -5.6717 -1.8242 -4.29175 0.5855 -4.9695 3.7036 -2.192 -1.165 -0.0933 1.9699 -0.62915 -3.4433 9.8164 1.8966 3.18655 6.2781 2.6182 3.9705 4.44815 2.3638 4.911 0.1166 3.6374 4.3008 4.3371 1.0271 4.31895 5.2443 7.5276 1.4072 6.38595 -3.715 -2.6764 0.6241 -3.1957 5.695 2.0434 2.0562 3.8692 -1.7904 -0.7269 0.3061 -1.25865 0.0897 -1.9631 2.0628 -0.9367 11.7353 14.9717 2.3334 13.3535 11.3618 6.4662 3.0671 8.914 2.0985 -0.6187 1.1047 0.7399 7.9494 24.0639 5.7232 16.00665 -15.5629 4.2429 -3.686 -5.66 -0.5708 -4.3049 -2.5412 -2.43785 -0.5732 8.2075 0.3836 3.81715 6.1055 4.0539 2.4077 -1.0258 3.7679 4.3065 0.6155 4.0372 41798 4.5676 3.7215 4,3737 8.0578 13.2365 3.2583 10.64715 -2.0342 0.4824 0.5692 -1.2583 6.7831 -20.2192 -6.8352 -6.71805 -2.6227 5.7672 2,0375 1.57225 4.0849 11.135 9.0332 7.60995 2.8771 14.4317 8.0134 8.6544 3.2975 4.5906 3.2108 0.64655 -0.9433 8.5936 1.9432 3.82515 5.4445 8.1859 14.0489 6.8152 0.8361 7.8613 -63549 43487 8.9215 6.6792 7.0477 7.80035 0.0996 -1.4179 1.4373 -0.75875 4.0207 4.8474 -1.580 -0.41335 3.8684 -2.2733 18711 0.79755 1.1965 2.3475 2.1657 0.5755 24 otv MacBook Pro esc @ # $ % 353 11/30/17 11.3618 12/29/17 2.0985 1/31/18 7.9494 2/28/18 -15.5629 3/30/18 -0.5708 4/30/18 -0.5732 5/31/18 -6.1055 6/29/18 3.7679 7/31/18 4.1798 8/31/18 8.0578 9/28/18 -2.0342 10/31/18 6.7831 11/30/18 -2.6227 12/31/18 -4.0849 1/31/19 2.8771 2/28/19 3.2975 3/29/19 -0.9433 4/30/19 5.4445 5/31/19 -0.8361 6/28/19 8.9215 7/31/19 -0.0996 8/30/19 4.0207 9/30/19 3.8684 10/31/19 -1.1965 11/29/19 1.5606 12/31/19 0.2358 1/31/20 -3.6604 2/28/20 -5.9481 3/31/20 5.9934 4/30/20 6.9794 5/29/20 2.5172 14.9717 6.4662 -0.6187 24.0639 4.2429 -4.3049 8.2075 4.0539 4.3065 4.5676 13.2365 -0.4824 -20.2192 5.7672 -11.135 14.4317 -4.5906 8.5936 8.1859 -7.8613 6.6792 -1.4179 -4.8474 -2.2733 2.3475 1.3587 2.6122 8.7064 -6.2214 3.5021 26.89 -1.2785 2.3334 13.3535 3.0671 8.914 1.1047 0.7399 5.7232 16.00665 -3.686 -5.66 -2.5412 -2.43785 0.3836 3.81715 2.4077 -1.0258 0.6155 4.0372 3.7215 4.3737 3.2583 10.64715 0.5692 -1.2583 -6.8352 -6.71805 2.0375 1.57225 -9.0332 -7.60995 8.0134 8.6544 3.2108 -0.64655 1.9432 3.82515 4.0489 6.8152 -6.3549 -4.3487 7.0477 7.80035 1.4373 -0.75875 -1.584 -0.41335 1.8711 0.79755 2.1657 0.5755 3.63 1.45965 3.0115 1.424 -0.0439 2.523 -8.2321 6.08475 -12.3512 4.74775 12.8194 16.9347 4.763 0.61935 otv 24 MacBoo esc