Answered step by step

Verified Expert Solution

Question

1 Approved Answer

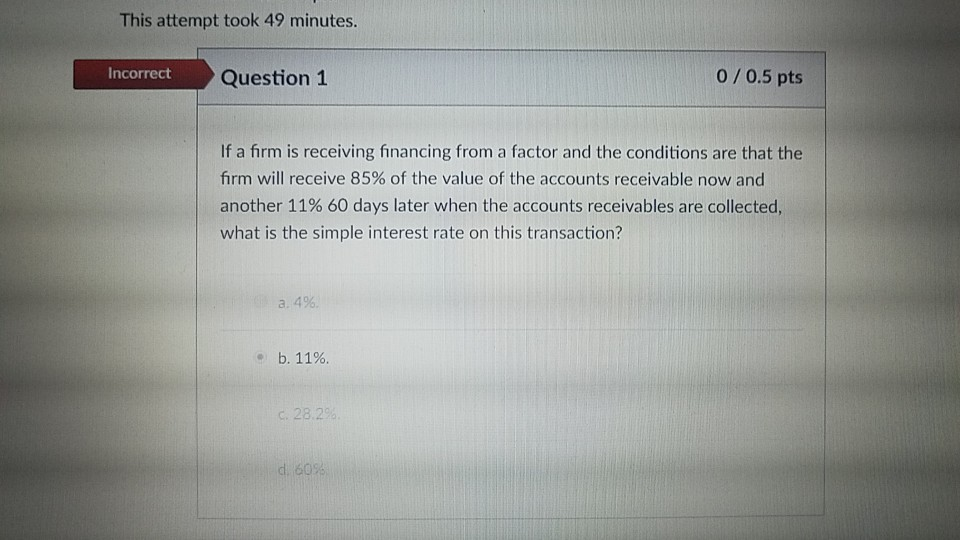

This attempt took 49 minutes. Incorrect Question 1 0/0.5 pts If a firm is receiving financing from a factor and the conditions are that the

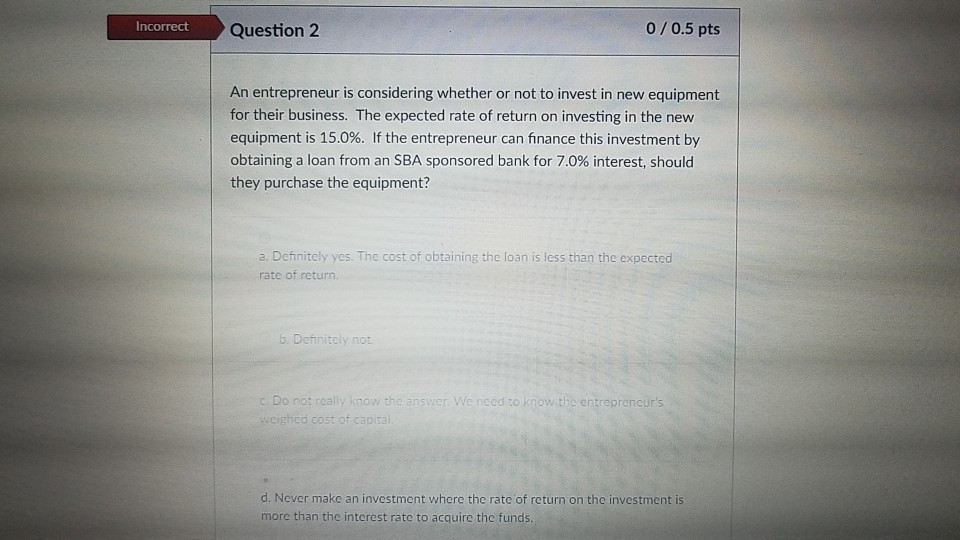

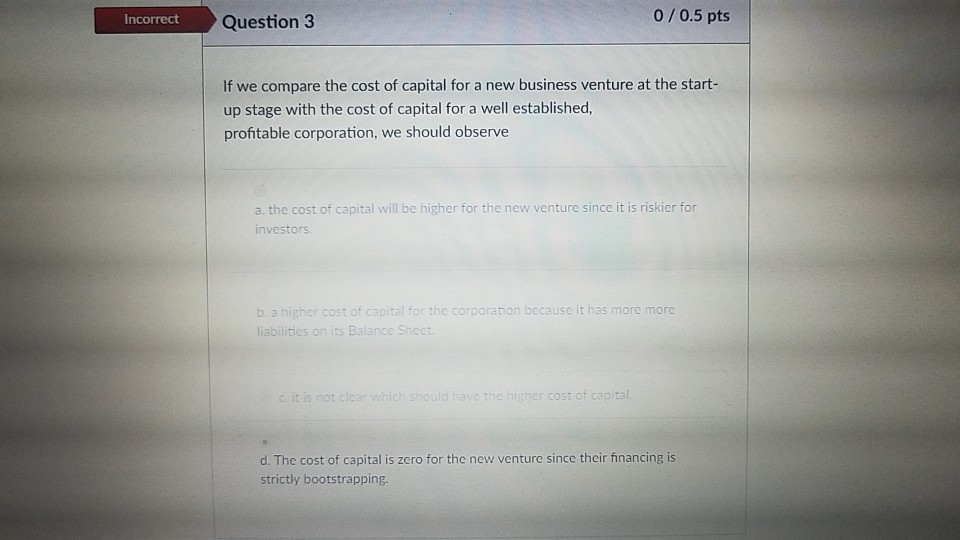

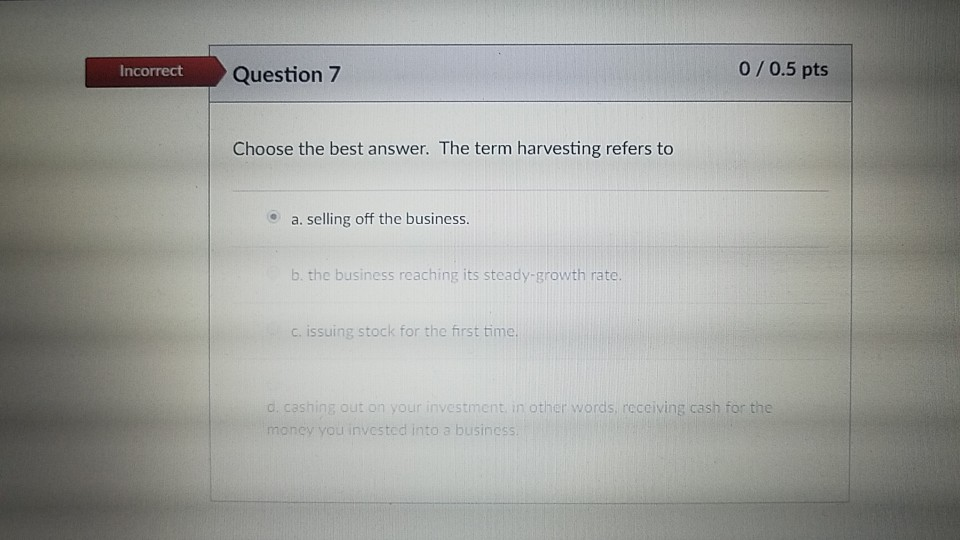

This attempt took 49 minutes. Incorrect Question 1 0/0.5 pts If a firm is receiving financing from a factor and the conditions are that the firm will receive 85% of the value of the accounts receivable now and another 11% 60 days later when the accounts receivables are collected, what is the simple interest rate on this transaction? a.14%. c. 28.2 Incorrect Question 2 0/0.5 pts An entrepreneur is considering whether or not to invest in new equipment for their business. The expected rate of return on investing in the new equipment is 15.0%. If the entrepreneur can finance this investment by obtaining a loan from an SBA sponsored bank for 7.0% interest, should they purchase the equipment? a. Definitely yes. The cost of obtaining the loan is less than the expected rate of return. b. Definitcly not Do not reall now th ed to entrepreneurs eighed cost of capis d. Never make an investment where the rate of return on the investment is more than the interest rate to acquire the funds Incorrect Question 3 0/0.5 pts If we compare the cost of capital for a new business venture at the start- up stage with the cost of capital for a ell established, profitable corporation, we should observe a. the cost of capital will be higher for the new venture since it is riskier for investors b a higher co liabilitics on its B poration because it has more more s not clca ost of capital d. The cost of capital is zero for the new venture since their financing is strictly bootstrapping. Incorrect Question 7 0 0.5 pts Choose the best answer. The term harvesting refers to a. selling off the business. b. the business reaching its steady-growth rate c. issuing stock for the first time out on your investment in other words, receiving cash for the to a business Incorrect Question 8 0/0.5 pts When a business wants to issue and sell stock, the stock is generally initially sold in the primary market by a. an Investment Banking firm. b. Wall Street stock brokers. e c. the Securities and Exchange Commission d. Donald Trump Incorrect Question 10 0/0.5 pts If a business is purchased and merged with other businesses and then stock is issued by the business that purchased the other businesses this is known as a. preferred stock roll-up IPO c. a stock swap d. a private placement. o

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started