Answered step by step

Verified Expert Solution

Question

1 Approved Answer

this book is intermediate financial management 12th by Brigham and Daves. this problem(P14) is in P245 and ch6. can you have solution? a. Cumberland Industries'

this book is intermediate financial management 12th by Brigham and Daves. this problem(P14) is in P245 and ch6.

can you have solution?

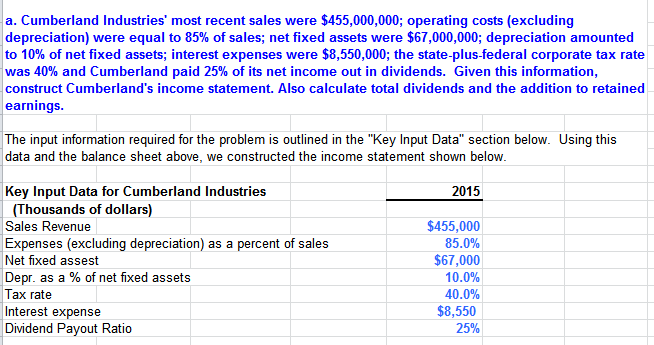

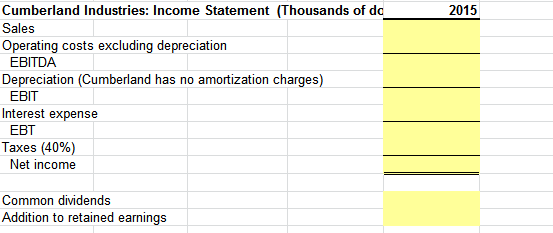

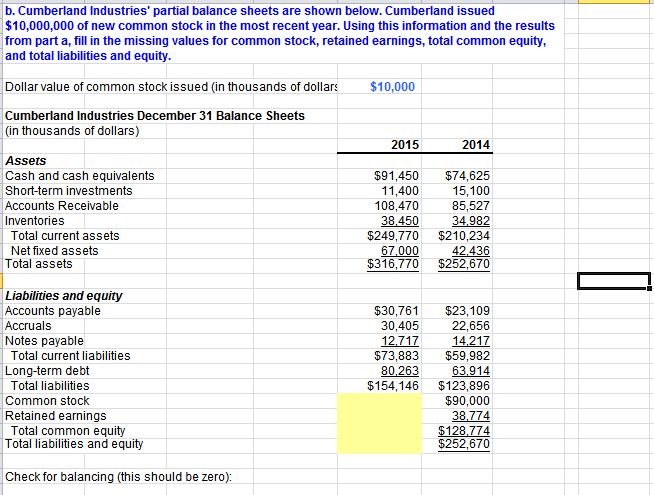

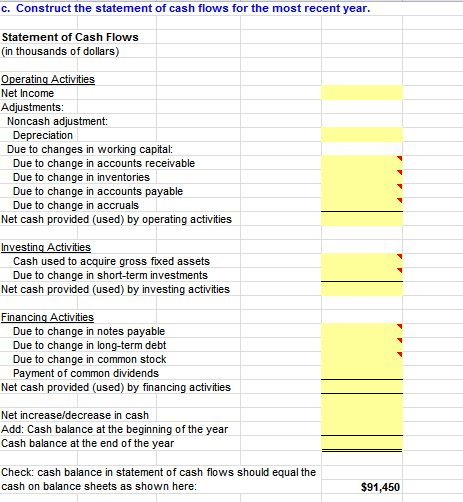

a. Cumberland Industries' most recent sales were $455,000,000; operating costs (excluding depreciation) were equal to 85% of sales; net fixed assets were $67,000,000; depreciation amounted to 10% of net fixed assets, interest expenses were $8,550,000; the state-plus-federal corporate tax rate was 40% and Cumberland paid 25% of its net income out in dividends. Given this information, construct Cumberland's income statement. Also calculate total dividends and the addition to retained earnings The input information required for the problem is outlined in the "Key Input Data" section below. Using this data and the balance sheet above, we constructed the income statement shown below Key Input Data for Cumberland Industries 2015 (Thousands of dollars) Sales Revenue Expenses (excluding depreciation) as a percent of sales Net fixed assest Depr. as a % ot net tixed assets Tax rate Interest expense Dividend Payout Ratio $455,000 85.0% $67,000 10.0% 40.0% $8,550 25%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started