Answered step by step

Verified Expert Solution

Question

1 Approved Answer

this book is intermediate financial management by Brigham and Daves by 12th. this problem is ch8 and problme 23 in page 343. Do you have

this book is intermediate financial management by Brigham and Daves by 12th. this problem is ch8 and problme 23 in page 343.

Do you have a solution?

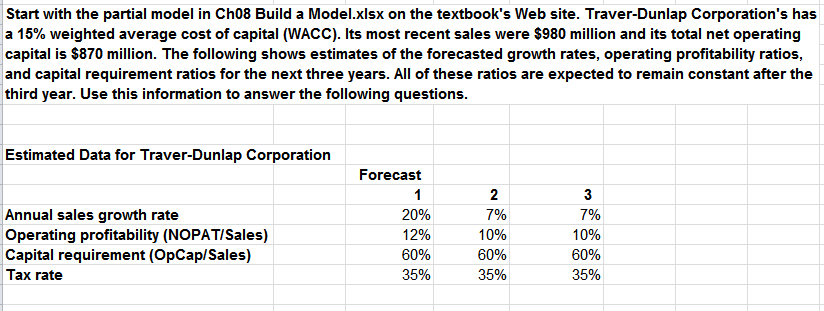

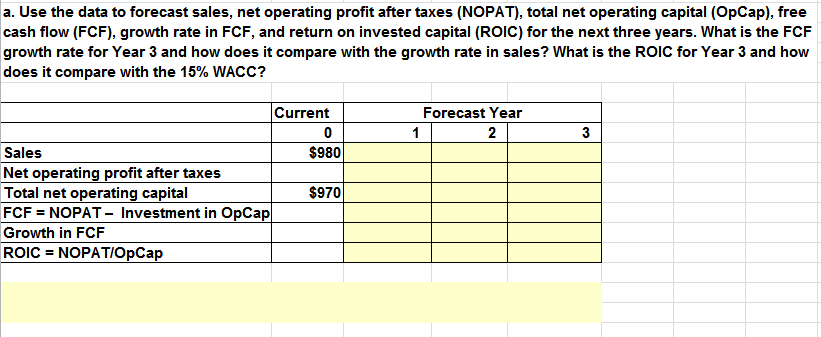

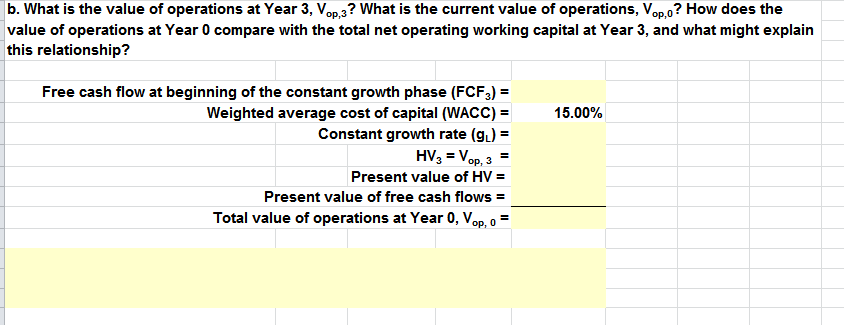

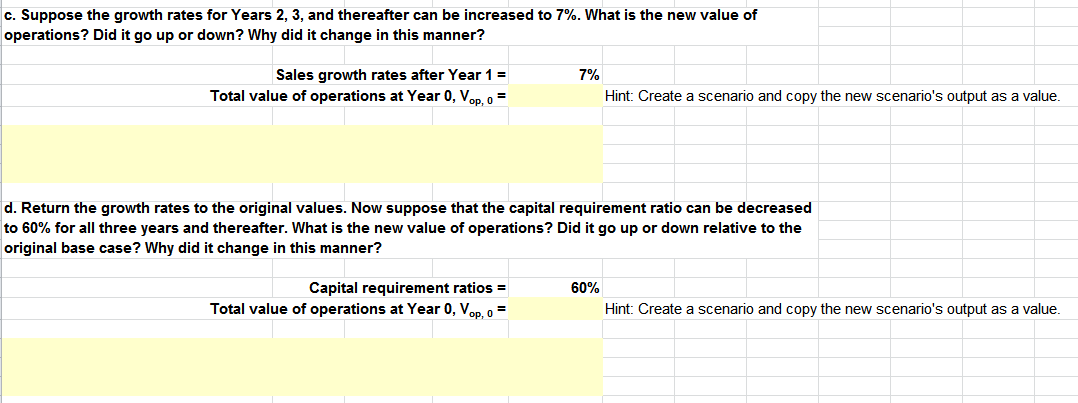

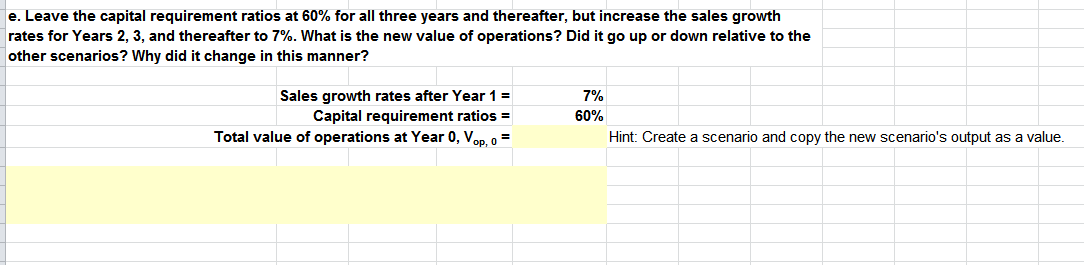

rtial model in Ch08 Build a Model a 15% weighted average cost of capital (WACC). Its most recent sales were $980 million and its total net operating capital is $870 million. The following shows estimates of the forecasted growth rates, operating profitability ratios, and capital requirement ratios for the next three years. All of these ratios are expected to remain constant after the third year. Use this information to answer the following questions. Estimated Data for Traver-Dunlap Corporation Forecast Annual sales growth rate Operating profitability (NOPAT/Sales) Capital requirement (OpCap/Sales) Tax rate 20% 12% 60% 35% 7% 10% 60% 35% 3 7% 10% 60% 35%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started