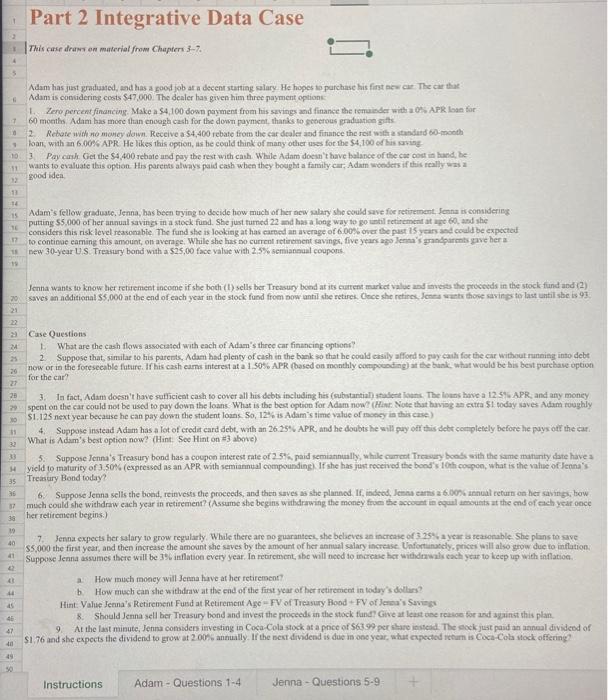

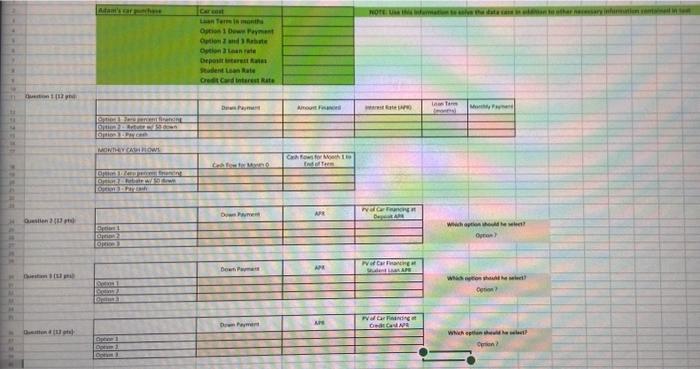

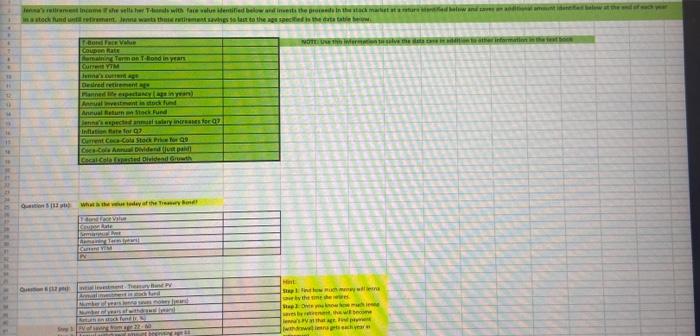

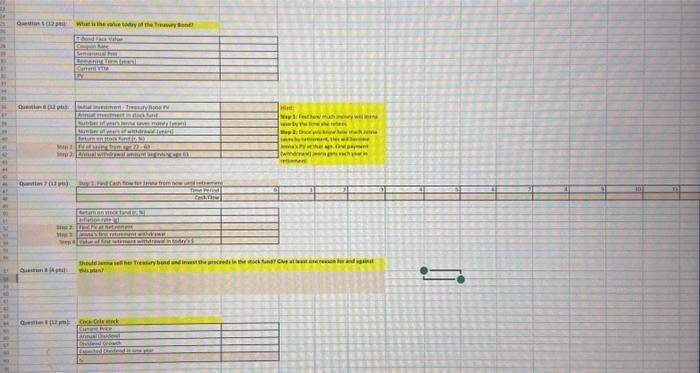

This carse drans en material from Chapteri 37 Adam has just graduased, aod has a good job ar a decent startiag calary. He hopes io purchase his first acw cue The car that Adam is contidering costs $47,000. The dealer has given him three payment options: 1. Zeno percent finameing. Make a 54,100 down pryment from his sevings and finance the temaioder with a os. APR loae far 60 months. Adam las more than enoogh cash for the down payment, thanks to seberous graduatice gits. 2. Rebore widh no money down. Receive a $4,400 rebate from the car dealer and firuitice the reit with a standits eo-month 3 boan, with an 6.00% APR He likes this oprion, as be cogld think of many other uses fot the $4,100 of his whing:- 30. Pay carh Gei the $4,400 rebate and pay the rest with cauh. While Adam doen't thave balance of the cae coot in hand, be: wants to evaluate this option. Hits parents always paid cash when they booght a famity ear, Adam woders if this really was a good idea. Adam's fellow graduace. Jenna, bas been trying to decide how much of her acw salary she eould suve foe retirement, fenna is eonuderieg. putting 55,000 of her anaual xavings in a stock fund. She just furned 22 and has a long way to go until retirement at ape 60 and she considers this risk level reasomeble. The fund she is looking at has eareed an average of 6 . oos orer the pase 15 years asd coald be expected to continoe eaming this amount; on average. Whale she has no current retirement avings, five years ago lenna's gnotparmbs gue ber a bed 30 -year U.S. Treatury bond with a $25,00 face value with 2.5% semiannal coupons. Jenna wants to know her retiement income if sbe both (1) sells ber Treasury bond at its current market value and iavess the prococds in the stock fund and (2) saves an additional 55,000 at the end of each year in the stock fund from pow until she retires. Cace she retires, Jenes waets those savings to last until she is 91. Case Questions 1. What are the cash flows associated with each of Adam's three car financing options? 2. Suppese that similar to his parents, Adam had plenty of cash in the bank so that he coald casily afford so pay caih for the car without runniass into debt now or in the foreseeable future. If his cash eams interest at a 1,505 APR (based on menthly conpouading) at the bunk, what would be bis beit puredase option for the car? spent on the car could not be used to pay down the loans. What is the bed option for Adam now? ( Hiat. Note that bavige as eutra St today saves Autam roughly $1.125 next year because he can pay dopn the student loans. 50,12% is Adam's sime value of rocecy in this case) 4. Suppose instead Adam has a lot of credit card debt, with an 26.25* APR, and he doubts he will guy off this deht centietely before he puys ots the ear. What is Adam's best option now? (Hint. See Hint on =3 above) 5. Suppose Jenna's Treasury bond has a coopon interest rate of 254 . paid semiannually, while cument Treasary bonds with the same mananty date have a. yicld to maturity of 3.50 ( (expressed as an APR with semiannual compounding). If she has just received the bend's 10 oh conpon, what is the valise of Ienas's Treasury Bond todiy? 6. Suppose Jenna selis the boad, reinvests the proeeds, and then saves as she planned, If, indeod, Jenen eams a bioons amabl return on her savings, bow much could she withdraw each year in retirement? (Assume she begins withdrawing the money fium the account in equal amouats at the end of each year once her retircment begins.) 7. Jenna expects ber salary 10 grow regularty. While there are a9 guarantees, she believes an increase of 3.254 a year is reaionable. She plans to save S5, 000 the firs year, abd then iscrease the amount she saves by the amount of her annual salary increase. Vafortaruaty, prices will also grow due to inflation. Suppose Jeana assumes there will be 3S inflation every year. In retirement, abe will necd to increuse her withdrawis each ytar to keep up with inflation. a. How much moncy will Jena have at her retirement? b. How much can she withdraw at the end of the first year of her tetirement in todyy's dodlin?? Hint. Value Jerna's Retirement Fusd at Retirement Age - FV of Treasury Bood + FV of Jeas's Suviegs 8. Sbould Jenna sell ber Treasury bond and invest the proceeds in the stock fund? Give at leas coe reasoe for and against this plan. 9. At the last minute, Jenna considen investing is Coca-Cola sock at a price of 56399 per alare insteid: The eock just paid an aanmal dividerd of $1,76 and she expects the dividend to growat 200 s, annually. If the bect dividend is due is one year, what cxpected return is Coca-Cola nock affering? par manh This carse drans en material from Chapteri 37 Adam has just graduased, aod has a good job ar a decent startiag calary. He hopes io purchase his first acw cue The car that Adam is contidering costs $47,000. The dealer has given him three payment options: 1. Zeno percent finameing. Make a 54,100 down pryment from his sevings and finance the temaioder with a os. APR loae far 60 months. Adam las more than enoogh cash for the down payment, thanks to seberous graduatice gits. 2. Rebore widh no money down. Receive a $4,400 rebate from the car dealer and firuitice the reit with a standits eo-month 3 boan, with an 6.00% APR He likes this oprion, as be cogld think of many other uses fot the $4,100 of his whing:- 30. Pay carh Gei the $4,400 rebate and pay the rest with cauh. While Adam doen't thave balance of the cae coot in hand, be: wants to evaluate this option. Hits parents always paid cash when they booght a famity ear, Adam woders if this really was a good idea. Adam's fellow graduace. Jenna, bas been trying to decide how much of her acw salary she eould suve foe retirement, fenna is eonuderieg. putting 55,000 of her anaual xavings in a stock fund. She just furned 22 and has a long way to go until retirement at ape 60 and she considers this risk level reasomeble. The fund she is looking at has eareed an average of 6 . oos orer the pase 15 years asd coald be expected to continoe eaming this amount; on average. Whale she has no current retirement avings, five years ago lenna's gnotparmbs gue ber a bed 30 -year U.S. Treatury bond with a $25,00 face value with 2.5% semiannal coupons. Jenna wants to know her retiement income if sbe both (1) sells ber Treasury bond at its current market value and iavess the prococds in the stock fund and (2) saves an additional 55,000 at the end of each year in the stock fund from pow until she retires. Cace she retires, Jenes waets those savings to last until she is 91. Case Questions 1. What are the cash flows associated with each of Adam's three car financing options? 2. Suppese that similar to his parents, Adam had plenty of cash in the bank so that he coald casily afford so pay caih for the car without runniass into debt now or in the foreseeable future. If his cash eams interest at a 1,505 APR (based on menthly conpouading) at the bunk, what would be bis beit puredase option for the car? spent on the car could not be used to pay down the loans. What is the bed option for Adam now? ( Hiat. Note that bavige as eutra St today saves Autam roughly $1.125 next year because he can pay dopn the student loans. 50,12% is Adam's sime value of rocecy in this case) 4. Suppose instead Adam has a lot of credit card debt, with an 26.25* APR, and he doubts he will guy off this deht centietely before he puys ots the ear. What is Adam's best option now? (Hint. See Hint on =3 above) 5. Suppose Jenna's Treasury bond has a coopon interest rate of 254 . paid semiannually, while cument Treasary bonds with the same mananty date have a. yicld to maturity of 3.50 ( (expressed as an APR with semiannual compounding). If she has just received the bend's 10 oh conpon, what is the valise of Ienas's Treasury Bond todiy? 6. Suppose Jenna selis the boad, reinvests the proeeds, and then saves as she planned, If, indeod, Jenen eams a bioons amabl return on her savings, bow much could she withdraw each year in retirement? (Assume she begins withdrawing the money fium the account in equal amouats at the end of each year once her retircment begins.) 7. Jenna expects ber salary 10 grow regularty. While there are a9 guarantees, she believes an increase of 3.254 a year is reaionable. She plans to save S5, 000 the firs year, abd then iscrease the amount she saves by the amount of her annual salary increase. Vafortaruaty, prices will also grow due to inflation. Suppose Jeana assumes there will be 3S inflation every year. In retirement, abe will necd to increuse her withdrawis each ytar to keep up with inflation. a. How much moncy will Jena have at her retirement? b. How much can she withdraw at the end of the first year of her tetirement in todyy's dodlin?? Hint. Value Jerna's Retirement Fusd at Retirement Age - FV of Treasury Bood + FV of Jeas's Suviegs 8. Sbould Jenna sell ber Treasury bond and invest the proceeds in the stock fund? Give at leas coe reasoe for and against this plan. 9. At the last minute, Jenna considen investing is Coca-Cola sock at a price of 56399 per alare insteid: The eock just paid an aanmal dividerd of $1,76 and she expects the dividend to growat 200 s, annually. If the bect dividend is due is one year, what cxpected return is Coca-Cola nock affering? par manh