Question

This case involves making calculations and journal entries for three different firms, Popes Princess Partners (PPP), Franks Finance (FF), and Carlson Construction (CC). PPP is

This case involves making calculations and journal entries for three different firms, Popes Princess Partners (PPP), Franks Finance (FF), and Carlson Construction (CC).

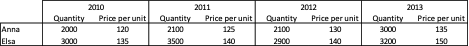

PPP is a manufacturer and seller of high end princess dolls. PPP sells two main products, an Elsa princess doll and an Anna princess doll. These two dolls sell for slightly different prices and have different costs. PPP began using the dollar value LIFO method to account for their inventory in 2010. At the beginning 2010 they had $500,000 of inventory. Over the next several years their ending inventory quantities and per unit inventory costs were as follows:

PPP computes internal cost indexes to perform the dollar value LIFO calculations by comparing the total cost of ending inventory at current year cost to the total cost of ending inventory at base year cost. Per unit costs for the Anna and Elsa dolls at the beginning of 2010 when PPP started using the dollar value LIFO method were 110 and 130 respectively.

Part I

Required: Calculate ending inventory for PPP using the Dollar Value LIFO method for the years 2010, 2011, 2012 and 2013. Show individual LIFO layers that are remaining at the end of each of the years in the calculations.

\begin{tabular}{|c|c|c|c|c|c|c|c|c|} \hline & \multicolumn{2}{|c|}{2010} & \multicolumn{2}{|c|}{2011} & \multicolumn{2}{|c|}{2012} & \multicolumn{2}{|c|}{2013} \\ \hline & Quantity & Price per unit & Quantity & Price per unit & Quantity & Price per unit & Quantity & Price per unit \\ \hline na & 2000 & 120 & 2100 & 125 & 2100 & 130 & 3000 & 135 \\ \hline Elsa & 3000 & 135 & 3500 & 140 & 2900 & 140 & 3200 & 150 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started