This case will enable you to practice conducting planning and substantive analytical procedures for accounts in the revenue cycle. When analyzing the financial data, you may assume that the 2015 information is unaudited, while prior year data is audited.

Consider the following features of and trends in the pharmaceutical industry and for PharmaCorp specifically:

After a long period of industry dominance by companies in the United States, the United Kingdom, and Europe, these companies are facing increasing competition from companies domiciled in emerging economies, such as Brazil, India, and China.

There exists significant uncertainty in the market because of recent regulation covering health-care and government payouts for certain procedures and related pharmaceuticals.

Health-care policy makers and the government are increasingly mandating what physicians can prescribe to patients.

Health-care policy makers and the government are increasingly focusing on prevention regimes rather than treatment regimes, thereby leading to shifts in the demand for various pharmaceuticals.

The global pharmaceutical market is anticipated to grow by 5% to 7% in 2016 compared with a 4% to 5% growth rate in 2015, according to a leading industry analyst publication.

Beginning in 2014, PharmaCorp initiated and executed a significant company-wide cost reduction initiative aimed at improving manufacturing efficiency, cutting back on research and development expenses, and eliminating unnecessary corporate overhead.

PharmaCorp's policies for extending credit to customers has remained stable over the last three years. PharmaCorp's credit-granting policies are considered stringent within the industry, and analysts have sometimes criticized the company for this, contending that such policies have hindered the company's revenue growth relative to industry peers.

PharmaCorp's policies for extending credit to customers have remained stable over the last three years. PharmaCorp's credit granting policies are considered stringent within the industry, and analysts have sometimes criticized the company for this, contending that such policies have hindered the company's revenue growth relative to industry peers.

Two of PharmaCorp's popular pharmaceuticals, Selebrax and Vyvox, came off patent during the fourth quarter of FYE 2015. These pharmaceuticals now face competition in the generic drug portion of the overall industry market.

Identify Suitable Analytical Procedures. Your audit senior has suggested that you should use the following ratios (on an overall financial statement level) for planning analytical procedures in the revenue cycle at PharmaCorp:

Gross margin: (revenues-cost of sales)/revenues

Turnover of receivables: (revenues/average accounts receivable); for ease of computation simply use ending accounts receivable

Receivables as a percentage of current assets and as a percentage of total assets: (accounts receivable/total current assets) and (accounts receivable/total assets)

Allowance for uncollectible accounts as a percentage of accounts receivable: (allowance/accounts receivable)

As part of Step 1, identify any other relevant relationships or trend analyses that would be useful to consider as part of planning analytics. Explain your reasoning.

Evaluate Reliability of Data Used to Develop Expectations. The audit team has determined that the data you will be using to develop expectations in the revenue cycle are reliable. Indicate the factors that the audit team likely considered in making that determination.

Develop Expectations. Complete Step 3 of planning analytical procedures by developing expectations for relevant accounts in the revenue cycle and for the ratios from Part (a). Develop expectations by considering both historical trends of PharmaCorp, and also by considering features of and historical trends in the industry. Given that this is a planning analytical procedure, the expectations are not expected to have a high level of precision. You might indicate that you expect a ratio to increase, decrease, or stay the same, and possibly indicate the size of any expected increases or decreases, or the range of the expected ratio. PharmaCorp's financial information is on first tab of the Excel file, while the financial information for Novartell and AstraZoro is provided on the last two tabs of the Excel file.

Define and Identify Significant Unexpected Differences. Refer to the guidance in Chapter 7 on overall materiality, performance materiality, and posting materiality. Apply those materiality guidelines to Step 4 of planning analytical procedures in the revenue cycle for PharmaCorp, to define what is meant by a significant difference. Explain your reasoning. Also, comment on qualitative materiality considerations in this context. Now that you have determined what amount of difference would be considered significant, calculate the ratios identified in Step 1 (and any additional ratios or trend analyses that you suggested), based on PharmaCorp's recorded financial statement amounts. Identify those ratios where there is a significant unexpected difference.

Investigate Significant Unexpected Differences and Ensure Proper Documentation. Complete Step 6 of planning analytical procedures by describing accounts or relationships that you would investigate further through substantive audit procedures. Explain your reasoning. To complete Step 7, describe what information should be included in the auditor's workpapers.

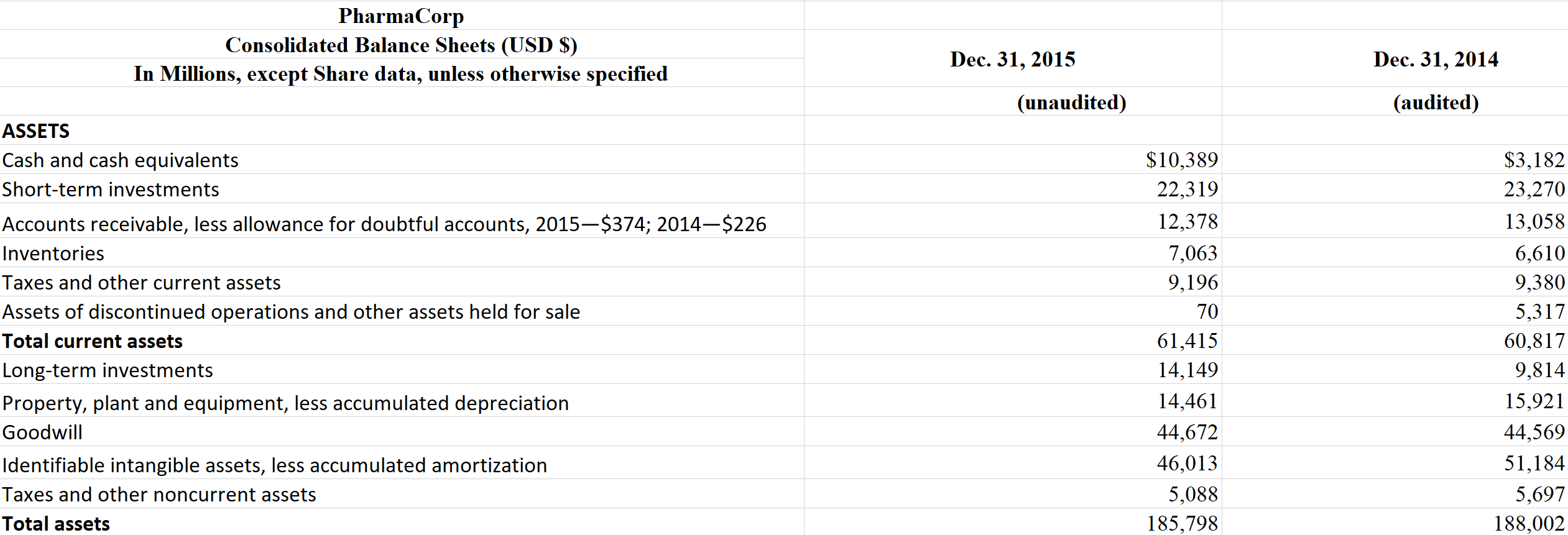

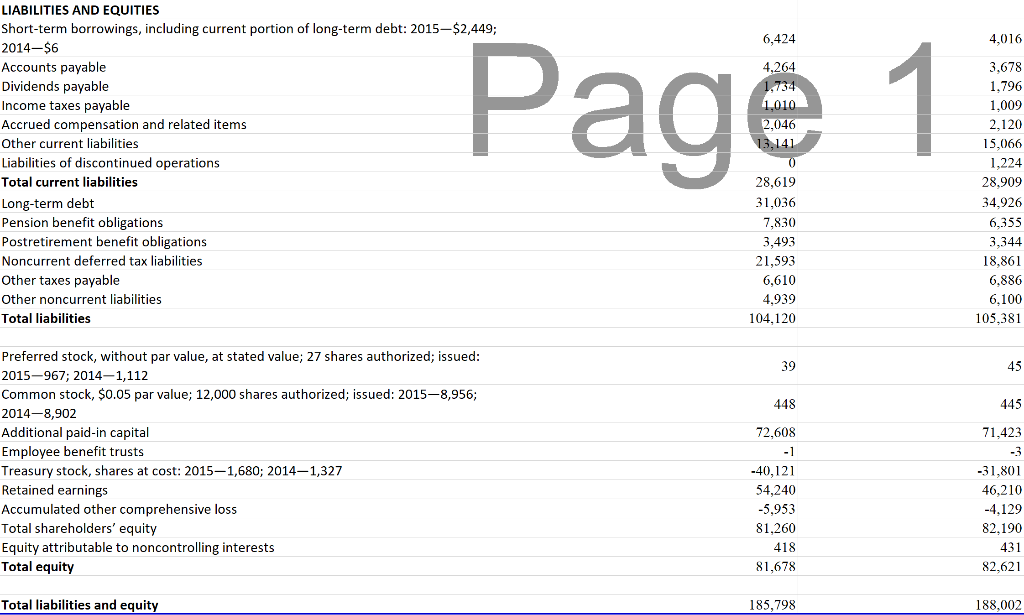

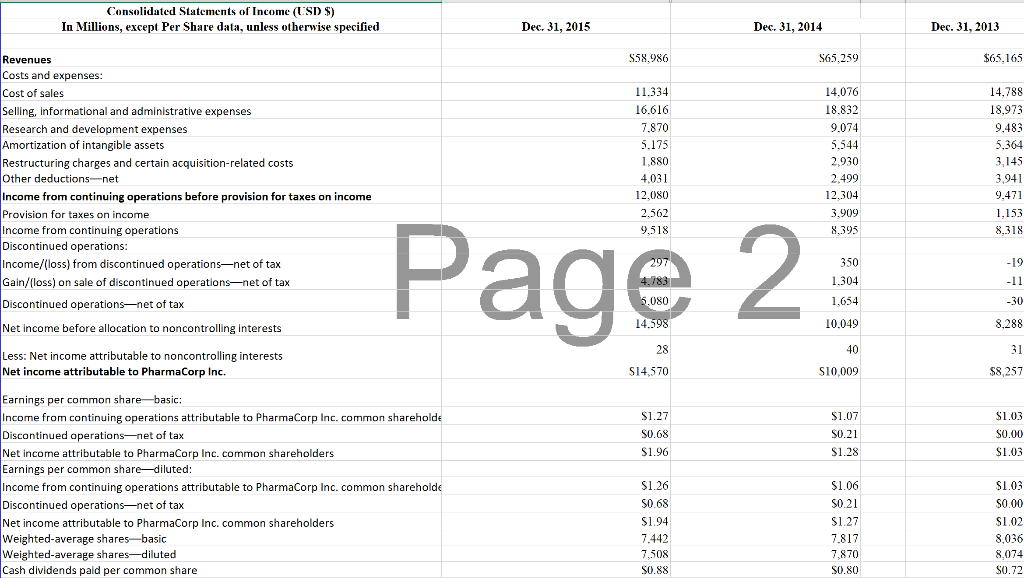

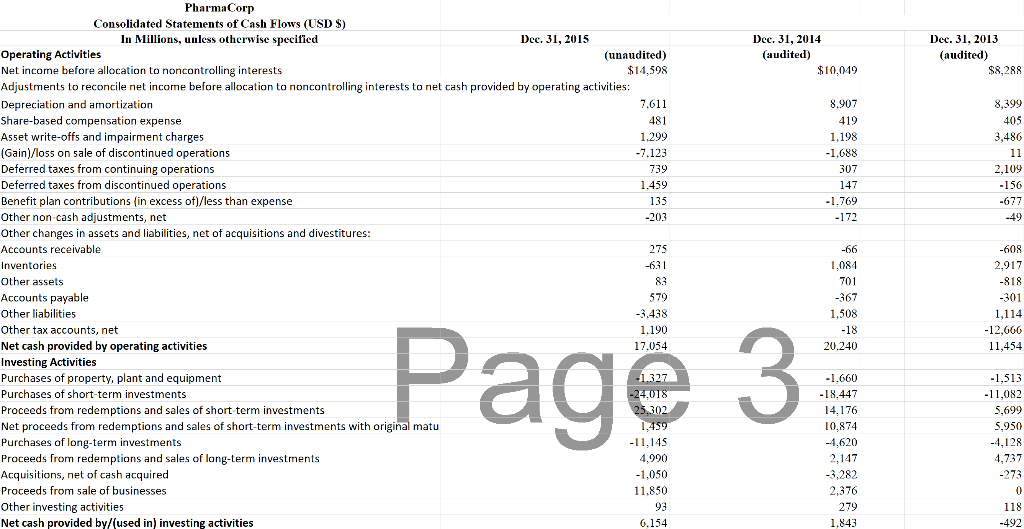

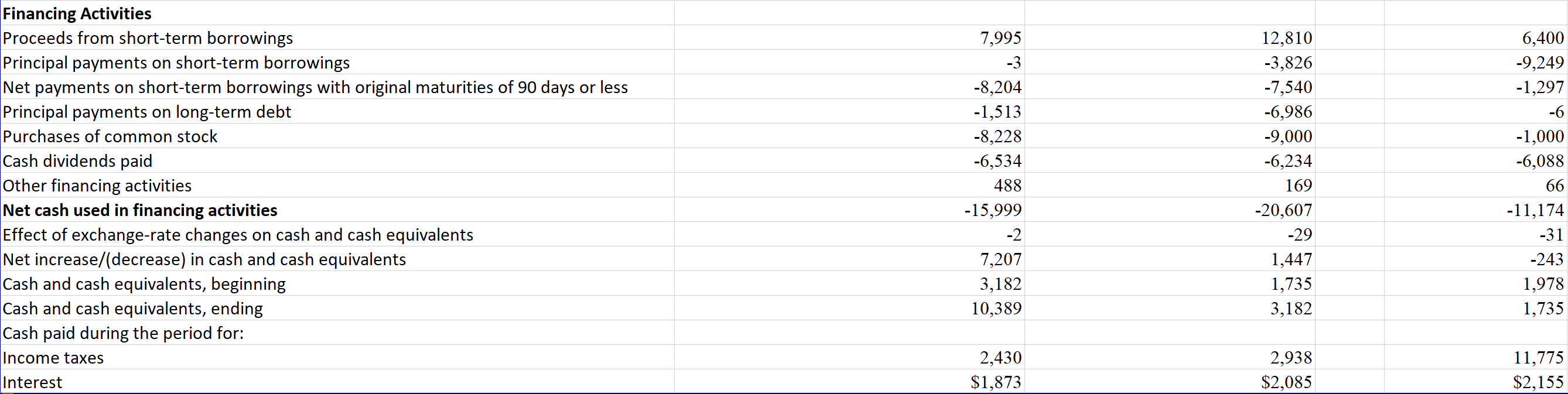

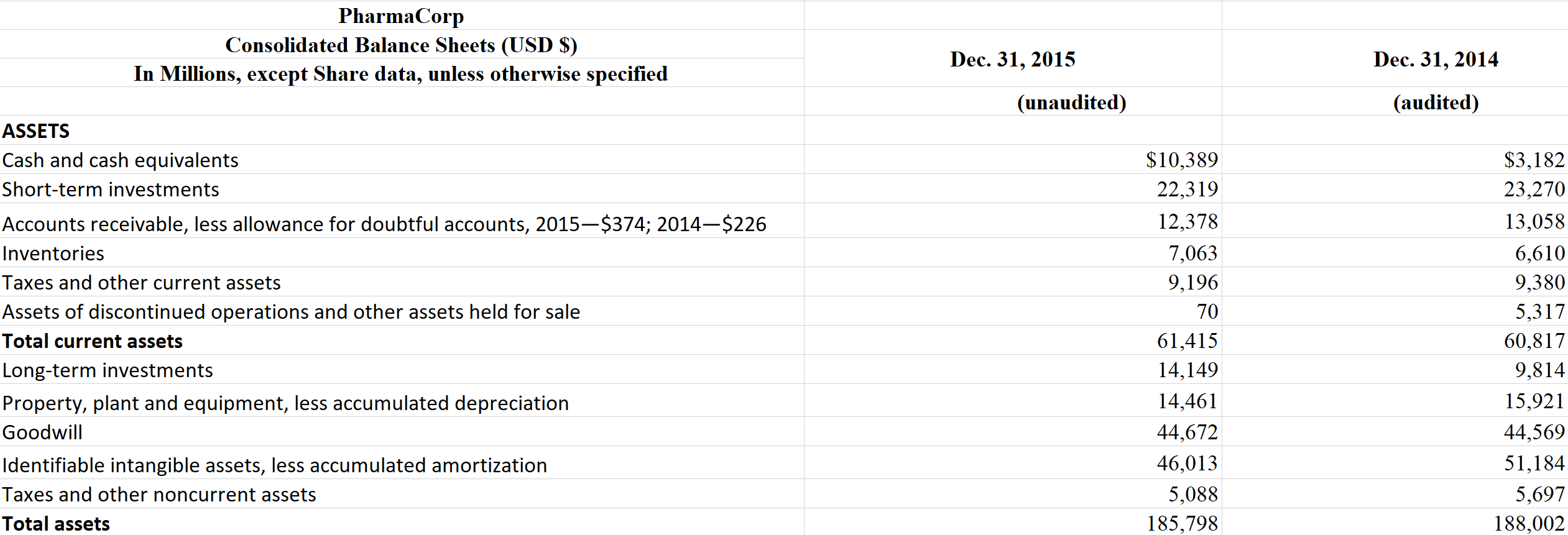

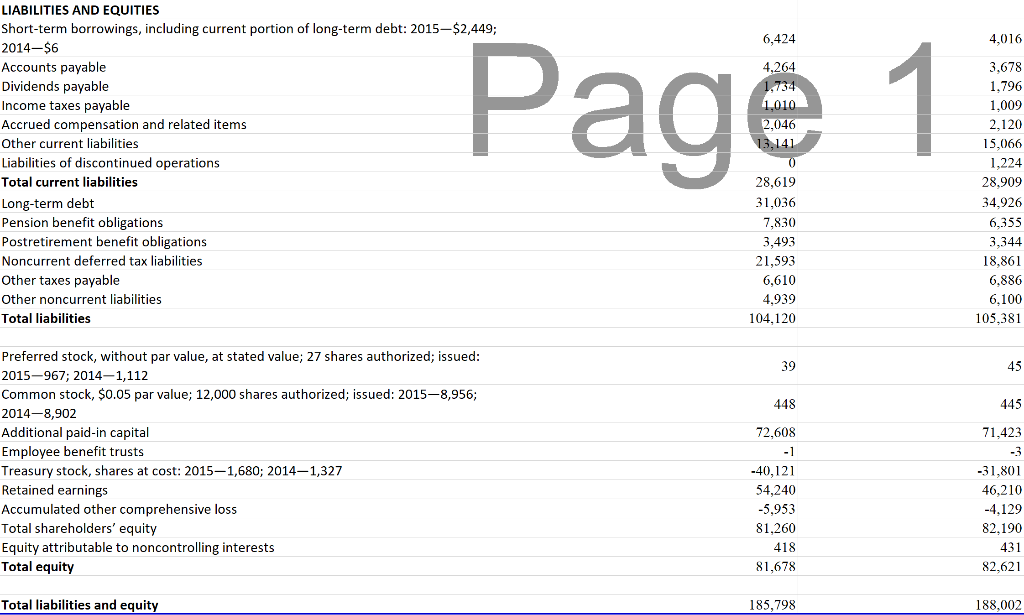

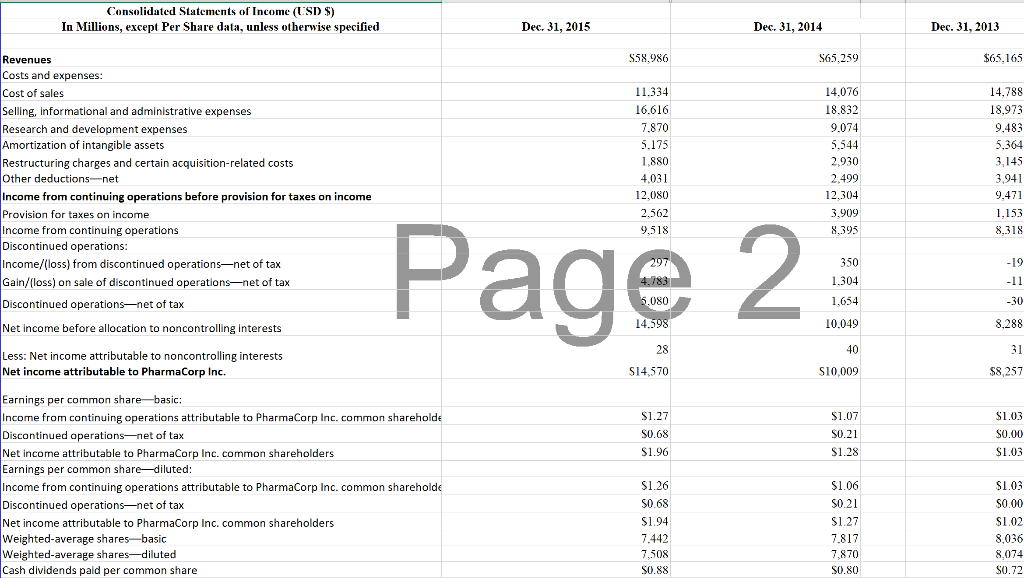

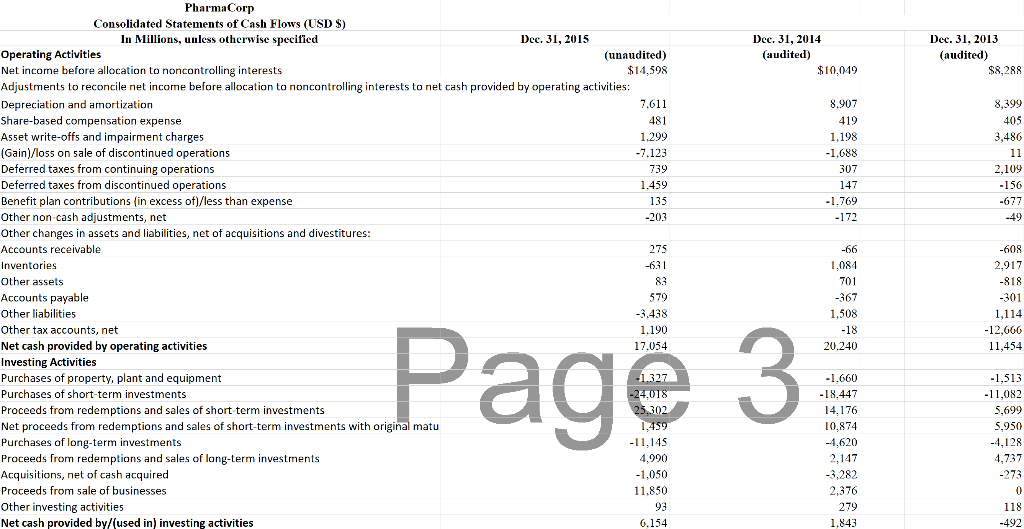

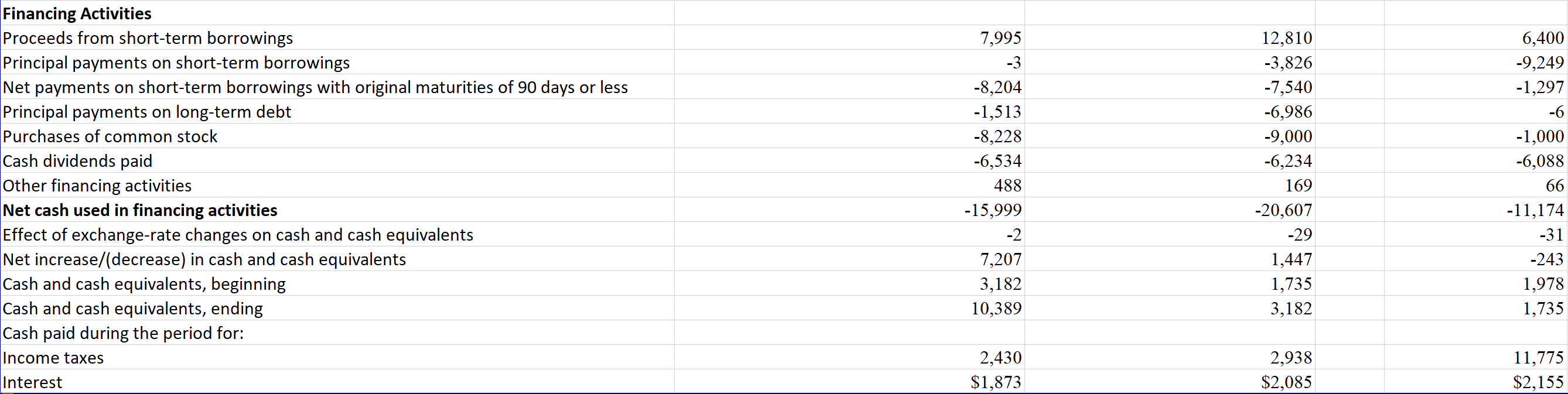

PharmaCorp Consolidated Balance Sheets (USD $) In Millions, except Share data, unless otherwise specified Dec. 31, 2015 Dec. 31, 2014 (unaudited) (audited) $10,389 22,319 12,378 7,063 9,196 70 ASSETS Cash and cash equivalents Short-term investments Accounts receivable, less allowance for doubtful accounts, 2015-$374; 2014-$226 Inventories Taxes and other current assets Assets of discontinued operations and other assets held for sale Total current assets Long-term investments Property, plant and equipment, less accumulated depreciation Goodwill Identifiable intangible assets, less accumulated amortization Taxes and other noncurrent assets Total assets 61,415 14,149 14,461 44,672 46,013 5,088 185,798 $3,182 23,270 13,058 6,610 9,380 5,317 60,817 9,814 15,921 44,569 51,184 5,697 188,002 6,424 LIABILITIES AND EQUITIES Short-term borrowings, including current portion of long-term debt: 2015-$2,449; 2014-$6 Accounts payable Dividends payable Income taxes payable Accrued compensation and related items Other current liabilities Liabilities of discontinued operations Total current liabilities Long-term debt Pension benefit obligations Postretirement benefit obligations Noncurrent deferred tax liabilities Other taxes payable Other noncurrent liabilities Total liabilities 4,264 1,734 1,010 2,046 13,141 Page 1 28,619 31,036 7,830 3,493 21,593 6,610 4,939 104,120 4,016 3,678 1.796 1,009 2,120 15,066 1,224 28,909 34.926 6,355 3,344 18,861 6,886 6.100 105,381 39 45 448 445 71,423 72,608 Preferred stock, without par value, at stated value; 27 shares authorized; issued: 2015-967; 2014-1,112 Common stock, $0.05 par value; 12,000 shares authorized; issued: 20158,956; 20148,902 Additional paid-in capital Employee benefit trusts Treasury stock, shares at cost: 20151,680; 20141,327 Retained earnings Accumulated other comprehensive loss Total shareholders' equity Equity attributable to noncontrolling interests Total equity -40,121 54,240 -5,953 81,260 418 81,678 -31,801 46,210 -4.129 82.190 431 82,621 Total liabilities and equity 185,798 188,002 Consolidated Statements of Income (USDS) In Millions, except Per Share data, unless otherwise specified Dec. 31, 2015 Dec. 31, 2014 Dec. 31, 2013 S58,986 565,259 $65.165 Revenues Costs and expenses: Cost of sales Selling, informational and administrative expenses Research and development expenses Amortization of intangible assets Restructuring charges and certain acquisition-related costs Other deductions -net Income from continuing operations before provision for taxes on income Provision for taxes on income Income from continuing operations Discontinued operations: Income/(loss) from discontinued operations-net of tax Gain/(loss) on sale of discontinued operations-net of tax Discontinued operations-net of tax 11,334 16.616 7.870 5.175 1,880 4,031 12,080 2,562 9.518 14.076 18.832 9.074 5.544 2.930 2.499 12.304 3,909 8,395 14,788 18,973 9,483 5,364 3,145 3.941 9,471 1,153 8,318 Page 23 4.789 5.080 14.598 350 1.304 1,654 10.049 -19 -11 -30 8,288 Net Income before allocation to noncontrolling interests Less: Net income attributable to noncontrolling interests Net income attributable to PharmaCorp Inc. S14,570 S10,009 $8,257 $1.27 $0.68 $1.96 $1.07 $0.21 $1.28 $1.03 $0.00 $1.03 Earnings per common sharebasic: Income from continuing operations attributable to PharmaCorp Inc. common shareholde Discontinued operations-net of tax Net income attributable to PharmaCorp Inc. common shareholders Earnings per common share-diluted: Income from continuing operations attributable to PharmaCorp Inc. common shareholde Discontinued operations net of tax Net income attributable to PharmaCorp Inc. common shareholders Weighted average shares-basic Weighted average shares-diluted Cash dividends paid per common share $1.26 $0.68 $1.94 7.442 7,508 $0.88 $1.06 S0.21 $1.27 7.817 7,870 $0.80 $1.03 50.00 SL.02 8,036 8,074 $0.72 Dec. 31, 2014 (audited) $10,049 Dec. 31, 2013 (audited) $8,288 8.907 419 1,198 -1.688 307 147 -1.769 - 172 8,399 405 3,486 11 2,109 -156 -677 -66 -608 PharmaCorp Consolidated Statements of Cash Flows (USD $) In Millions, unless otherwise specified Dec. 31, 2015 Operating Activities (unaudited) Net income before allocation to noncontrolling interests $14,598 Adjustments to reconcile net income before allocation to noncontrolling interests to net cash provided by operating activities: Depreciation and amortization 7.611 Share-based compensation expense 481 Asset write-offs and impairment charges 1.299 (Gain)/loss on sale of discontinued operations -7.123 Deferred taxes from continuing operations 739 Deferred taxes from discontinued operations 1.459 Benefit plan contributions (in excess of)/less than expense 135 Other non-cash adjustments, net -203 Other changes in assets and liabilities, net of acquisitions and divestitures: Accounts receivable 275 Inventories -631 Other assets Accounts payable 579 Other liabilities -3,438 Other tax accounts, net 1.190 Net cash provided by operating activities 17.054 Investing Activities Purchases of property, plant and equipment 1.327 Purchases of short-term investments -24.018 Proceeds from redemptions and sales of short term investments 25.302 Net proceeds from redemptions and sales of short-term investments with original matu 1,459 Purchases of long-term investments -11.145 Proceeds from redemptions and sales of long-term investments 4.990 Acquisitions, net of cash acquired -1,050 Proceeds from sale of businesses 11,850 Other investing activities Net cash provided by/(used in) investing activities 6.154 1,084 2,917 701 -367 1,508 -18 20.240 -818 -301 1,114 -12,666 11,454 Page 3 -1.660 -18.447 14.176 10,874 -4.620 2,147 -3,282 2,376 279 1.843 -1,513 -11,082 5,699 5,950 -4.128 4,737 -273 118 -492 7,995 -3 6,400 -9,249 -1,297 -6 Financing Activities Proceeds from short-term borrowings Principal payments on short-term borrowings Net payments on short-term borrowings with original maturities of 90 days or less Principal payments on long-term debt Purchases of common stock Cash dividends paid Other financing activities Net cash used in financing activities Effect of exchange-rate changes on cash and cash equivalents Net increase/(decrease) in cash and cash equivalents Cash and cash equivalents, beginning Cash and cash equivalents, ending Cash paid during the period for: Income taxes Interest -8,204 -1,513 -8,228 -6,534 488 -15,999 12,810 -3,826 -7,540 -6,986 -9,000 -6,234 169 -20,607 -29 1,447 1,735 3,182 -1,000 -6,088 66 -11,174 -31 -243 1,978 1,735 7,207 3,182 10,389 2,430 $1,873 2,938 $2,085 11,775 $2,155 PharmaCorp Consolidated Balance Sheets (USD $) In Millions, except Share data, unless otherwise specified Dec. 31, 2015 Dec. 31, 2014 (unaudited) (audited) $10,389 22,319 12,378 7,063 9,196 70 ASSETS Cash and cash equivalents Short-term investments Accounts receivable, less allowance for doubtful accounts, 2015-$374; 2014-$226 Inventories Taxes and other current assets Assets of discontinued operations and other assets held for sale Total current assets Long-term investments Property, plant and equipment, less accumulated depreciation Goodwill Identifiable intangible assets, less accumulated amortization Taxes and other noncurrent assets Total assets 61,415 14,149 14,461 44,672 46,013 5,088 185,798 $3,182 23,270 13,058 6,610 9,380 5,317 60,817 9,814 15,921 44,569 51,184 5,697 188,002 6,424 LIABILITIES AND EQUITIES Short-term borrowings, including current portion of long-term debt: 2015-$2,449; 2014-$6 Accounts payable Dividends payable Income taxes payable Accrued compensation and related items Other current liabilities Liabilities of discontinued operations Total current liabilities Long-term debt Pension benefit obligations Postretirement benefit obligations Noncurrent deferred tax liabilities Other taxes payable Other noncurrent liabilities Total liabilities 4,264 1,734 1,010 2,046 13,141 Page 1 28,619 31,036 7,830 3,493 21,593 6,610 4,939 104,120 4,016 3,678 1.796 1,009 2,120 15,066 1,224 28,909 34.926 6,355 3,344 18,861 6,886 6.100 105,381 39 45 448 445 71,423 72,608 Preferred stock, without par value, at stated value; 27 shares authorized; issued: 2015-967; 2014-1,112 Common stock, $0.05 par value; 12,000 shares authorized; issued: 20158,956; 20148,902 Additional paid-in capital Employee benefit trusts Treasury stock, shares at cost: 20151,680; 20141,327 Retained earnings Accumulated other comprehensive loss Total shareholders' equity Equity attributable to noncontrolling interests Total equity -40,121 54,240 -5,953 81,260 418 81,678 -31,801 46,210 -4.129 82.190 431 82,621 Total liabilities and equity 185,798 188,002 Consolidated Statements of Income (USDS) In Millions, except Per Share data, unless otherwise specified Dec. 31, 2015 Dec. 31, 2014 Dec. 31, 2013 S58,986 565,259 $65.165 Revenues Costs and expenses: Cost of sales Selling, informational and administrative expenses Research and development expenses Amortization of intangible assets Restructuring charges and certain acquisition-related costs Other deductions -net Income from continuing operations before provision for taxes on income Provision for taxes on income Income from continuing operations Discontinued operations: Income/(loss) from discontinued operations-net of tax Gain/(loss) on sale of discontinued operations-net of tax Discontinued operations-net of tax 11,334 16.616 7.870 5.175 1,880 4,031 12,080 2,562 9.518 14.076 18.832 9.074 5.544 2.930 2.499 12.304 3,909 8,395 14,788 18,973 9,483 5,364 3,145 3.941 9,471 1,153 8,318 Page 23 4.789 5.080 14.598 350 1.304 1,654 10.049 -19 -11 -30 8,288 Net Income before allocation to noncontrolling interests Less: Net income attributable to noncontrolling interests Net income attributable to PharmaCorp Inc. S14,570 S10,009 $8,257 $1.27 $0.68 $1.96 $1.07 $0.21 $1.28 $1.03 $0.00 $1.03 Earnings per common sharebasic: Income from continuing operations attributable to PharmaCorp Inc. common shareholde Discontinued operations-net of tax Net income attributable to PharmaCorp Inc. common shareholders Earnings per common share-diluted: Income from continuing operations attributable to PharmaCorp Inc. common shareholde Discontinued operations net of tax Net income attributable to PharmaCorp Inc. common shareholders Weighted average shares-basic Weighted average shares-diluted Cash dividends paid per common share $1.26 $0.68 $1.94 7.442 7,508 $0.88 $1.06 S0.21 $1.27 7.817 7,870 $0.80 $1.03 50.00 SL.02 8,036 8,074 $0.72 Dec. 31, 2014 (audited) $10,049 Dec. 31, 2013 (audited) $8,288 8.907 419 1,198 -1.688 307 147 -1.769 - 172 8,399 405 3,486 11 2,109 -156 -677 -66 -608 PharmaCorp Consolidated Statements of Cash Flows (USD $) In Millions, unless otherwise specified Dec. 31, 2015 Operating Activities (unaudited) Net income before allocation to noncontrolling interests $14,598 Adjustments to reconcile net income before allocation to noncontrolling interests to net cash provided by operating activities: Depreciation and amortization 7.611 Share-based compensation expense 481 Asset write-offs and impairment charges 1.299 (Gain)/loss on sale of discontinued operations -7.123 Deferred taxes from continuing operations 739 Deferred taxes from discontinued operations 1.459 Benefit plan contributions (in excess of)/less than expense 135 Other non-cash adjustments, net -203 Other changes in assets and liabilities, net of acquisitions and divestitures: Accounts receivable 275 Inventories -631 Other assets Accounts payable 579 Other liabilities -3,438 Other tax accounts, net 1.190 Net cash provided by operating activities 17.054 Investing Activities Purchases of property, plant and equipment 1.327 Purchases of short-term investments -24.018 Proceeds from redemptions and sales of short term investments 25.302 Net proceeds from redemptions and sales of short-term investments with original matu 1,459 Purchases of long-term investments -11.145 Proceeds from redemptions and sales of long-term investments 4.990 Acquisitions, net of cash acquired -1,050 Proceeds from sale of businesses 11,850 Other investing activities Net cash provided by/(used in) investing activities 6.154 1,084 2,917 701 -367 1,508 -18 20.240 -818 -301 1,114 -12,666 11,454 Page 3 -1.660 -18.447 14.176 10,874 -4.620 2,147 -3,282 2,376 279 1.843 -1,513 -11,082 5,699 5,950 -4.128 4,737 -273 118 -492 7,995 -3 6,400 -9,249 -1,297 -6 Financing Activities Proceeds from short-term borrowings Principal payments on short-term borrowings Net payments on short-term borrowings with original maturities of 90 days or less Principal payments on long-term debt Purchases of common stock Cash dividends paid Other financing activities Net cash used in financing activities Effect of exchange-rate changes on cash and cash equivalents Net increase/(decrease) in cash and cash equivalents Cash and cash equivalents, beginning Cash and cash equivalents, ending Cash paid during the period for: Income taxes Interest -8,204 -1,513 -8,228 -6,534 488 -15,999 12,810 -3,826 -7,540 -6,986 -9,000 -6,234 169 -20,607 -29 1,447 1,735 3,182 -1,000 -6,088 66 -11,174 -31 -243 1,978 1,735 7,207 3,182 10,389 2,430 $1,873 2,938 $2,085 11,775 $2,155