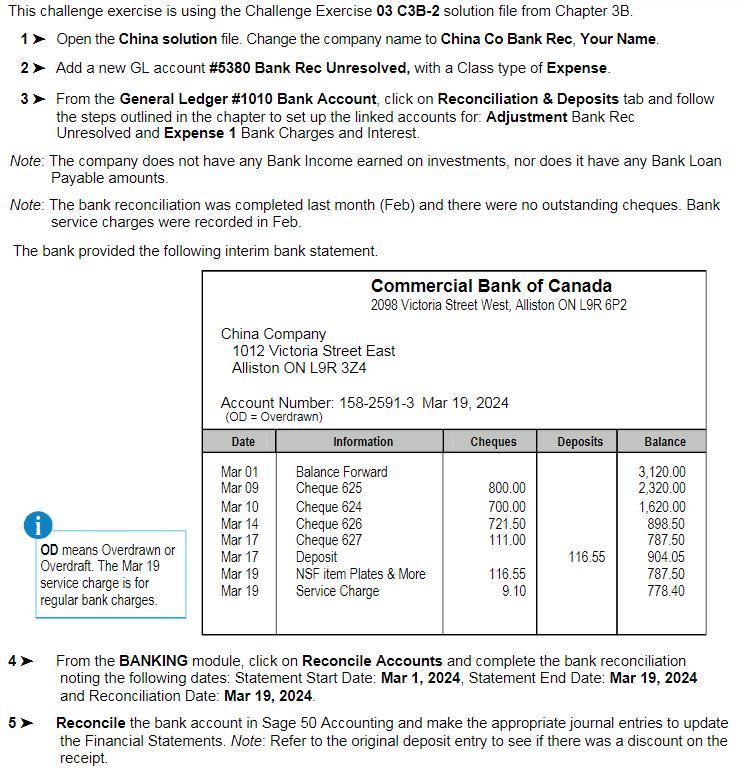

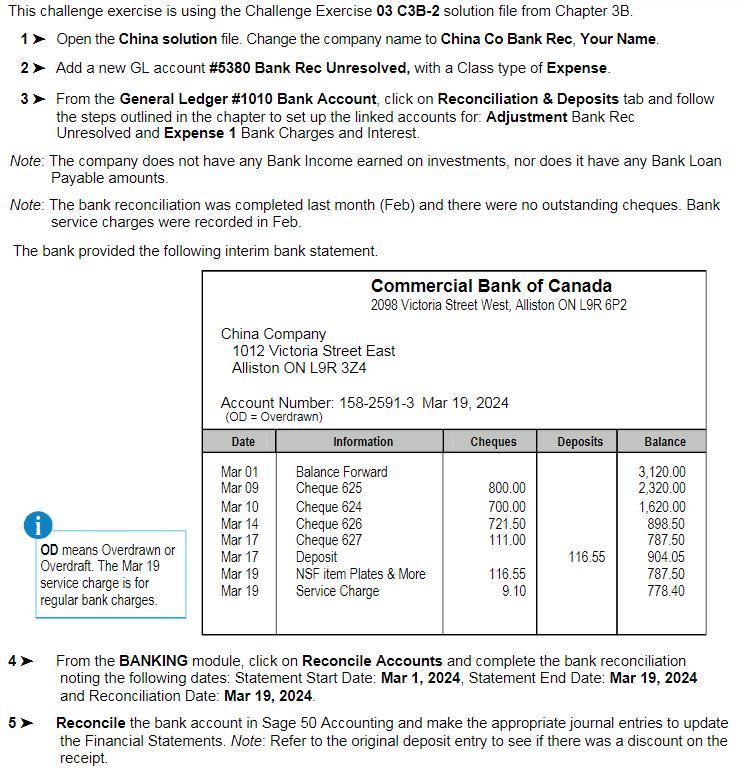

This challenge exercise is using the Challenge Exercise 03C3B2 solution file from Chapter 3B. 1) Open the China solution file. Change the company name to China Co Bank Rec, Your Name. 2 Add a new GL account \#5380 Bank Rec Unresolved, with a Class type of Expense. 3. From the General Ledger \#1010 Bank Account, click on Reconciliation \& Deposits tab and follow the steps outlined in the chapter to set up the linked accounts for: Adjustment Bank Rec Unresolved and Expense 1 Bank Charges and Interest. Note: The company does not have any Bank Income earned on investments, nor does it have any Bank Loan Payable amounts. Note: The bank reconciliation was completed last month (Feb) and there were no outstanding cheques. Bank service charges were recorded in Feb. The bank provided the following interim bank statement. 4 From the BANKING module, click on Reconcile Accounts and complete the bank reconciliation noting the following dates: Statement Start Date: Mar 1, 2024, Statement End Date: Mar 19, 2024 and Reconciliation Date: Mar 19, 2024. Reconcile the bank account in Sage 50 Accounting and make the appropriate journal entries to update the Financial Statements. Note: Refer to the original deposit entry to see if there was a discount on the receipt. This challenge exercise is using the Challenge Exercise 03C3B2 solution file from Chapter 3B. 1) Open the China solution file. Change the company name to China Co Bank Rec, Your Name. 2 Add a new GL account \#5380 Bank Rec Unresolved, with a Class type of Expense. 3. From the General Ledger \#1010 Bank Account, click on Reconciliation \& Deposits tab and follow the steps outlined in the chapter to set up the linked accounts for: Adjustment Bank Rec Unresolved and Expense 1 Bank Charges and Interest. Note: The company does not have any Bank Income earned on investments, nor does it have any Bank Loan Payable amounts. Note: The bank reconciliation was completed last month (Feb) and there were no outstanding cheques. Bank service charges were recorded in Feb. The bank provided the following interim bank statement. 4 From the BANKING module, click on Reconcile Accounts and complete the bank reconciliation noting the following dates: Statement Start Date: Mar 1, 2024, Statement End Date: Mar 19, 2024 and Reconciliation Date: Mar 19, 2024. Reconcile the bank account in Sage 50 Accounting and make the appropriate journal entries to update the Financial Statements. Note: Refer to the original deposit entry to see if there was a discount on the receipt