This "Chapter 22 Problem 1" doesn't match the books "P22-1". This answer has something to do with depreciating equipment. The book's "P22-1" question wants the student to "Prepare comparative statements for the 5 years, assuming that Utrillo changed its method of inventory pricing to average-cost. Indicate the effects on net income and earnings per share for the years involved. Utrillo Instruments started business in 2012. (All amounts except EPS are rounded tip to the nearest dollar.)" Where is the solution for this question (P22-1)? I have my own solution ready and I'd like to check it. Thank you.

I'm not exactly sure what you mean by "both". If you mean the books question and my answer, here they are.

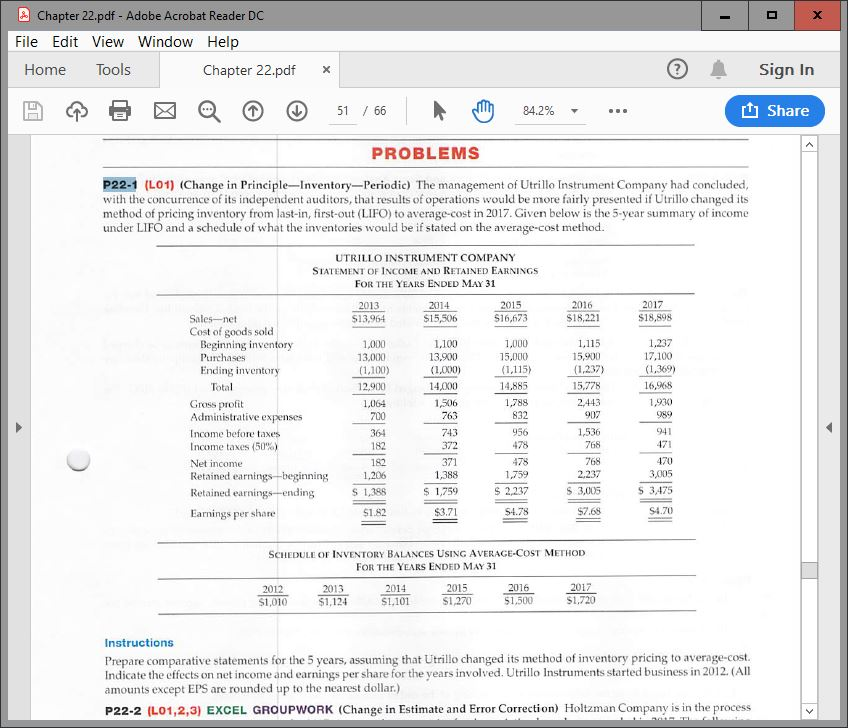

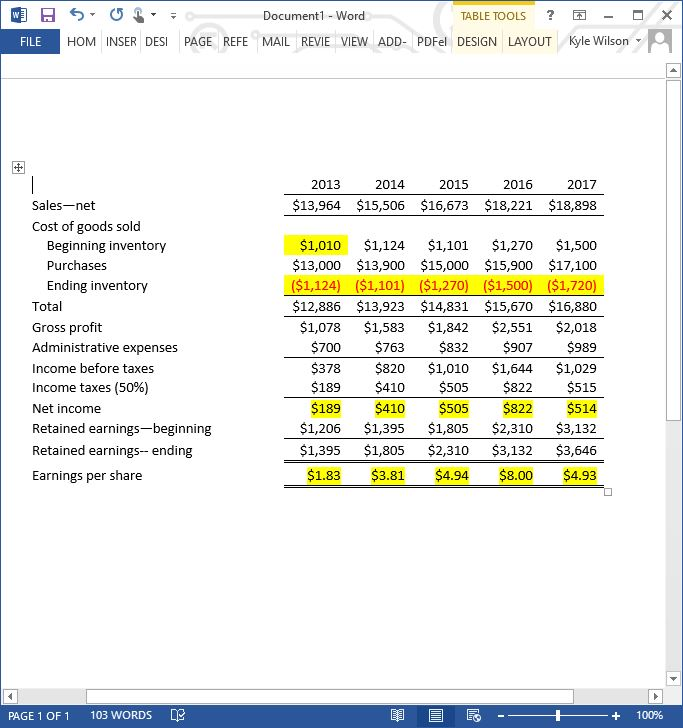

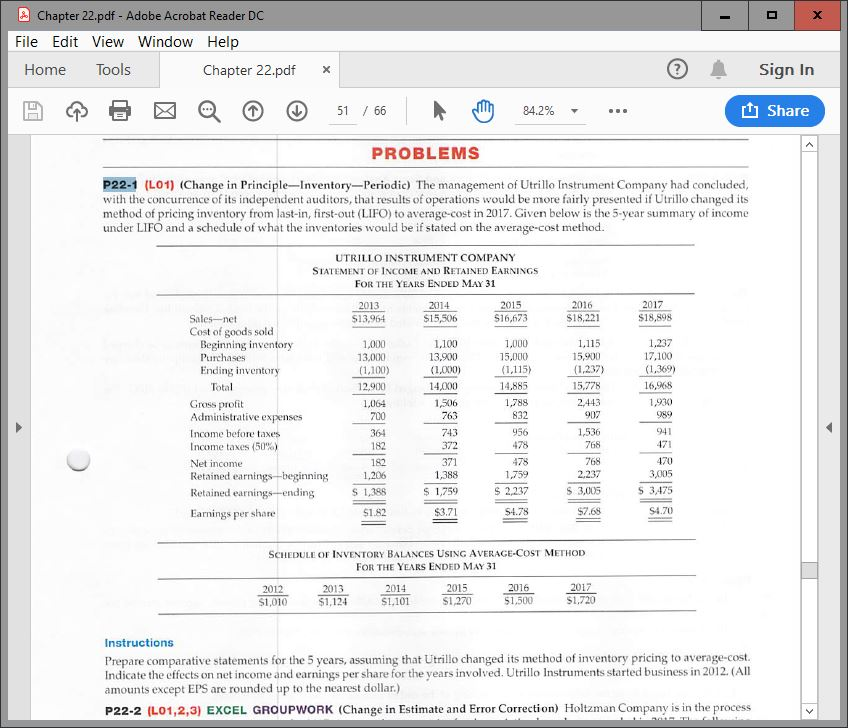

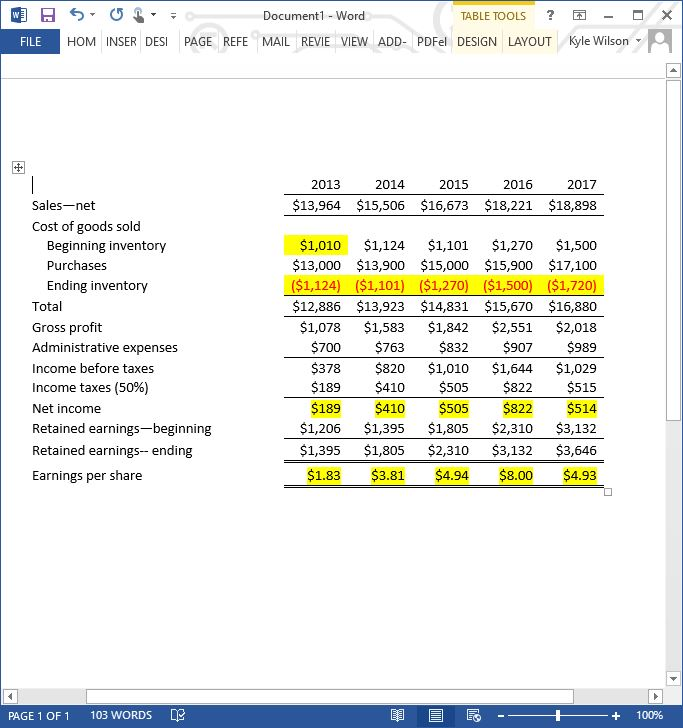

Chapter 22.pdf - Adobe Acrobat Reader DC File Edit View Window Help Home Tools Sign In Chapter 22.pdf x Share 51 66 PROBLEMS P22-1 (L01) (Change in Principle-Inventory-Periodic) The management of Utrillo Instrument Company had concluded, with the concurrence of its independent auditors, that results of operations would be more fairly presented if Utrillo changed its method of pricing inventory from last-in, first-out (LIFO) to average-cost in 2017. Given below is the 5-year summary of income under LIFO and a schedule of what the inventories would be if stated on the average-cost method UTRILLO INSTRUMENT COMPANY STATEMENT OF INCOME AND RETAINED EARNINGS FOR THE YEARS ENDED MAY 31 2014 $15,506 $16,623 $18,221 $18,898 $13,964 Cost of goods sold 1,237 17,100 (1.23) (1.369 16,968 1,930 Beginning inventory 1,000 13,000 (1,100) 1,100 13,900 1,000 15,000 1.115 Purchases Ending inventor 14,000 1,506 2.443 907 Gross profit Administrative expenses Income before taxe Income taxes (50%) Net income Retained earnings -beginning 1,064 700 364 182 956 478 478 1,759 941 1,536 372 371 1,388 470 768 2.237 1,206 Retained earnings-ending1359 23 3,005 3,475 S4.70 $3.71 54.78 Earnings per share SCHEDULE OF INVENTORY BALANCES USING AVERAGE-COST METHOD FOR THE YEARS ENDED MAY 31 2015 S1,270 2013 2014 S1101 1,720 $1,500 Instructions Prepare comparative statements for the 5 years, assuming that Utrillo changed its method of inventory pricing to average-cost. Indicate the effects on net income and earnings per share for the years involved. Utrillo Instruments started business in 2012. (All amounts except EPS are rounded up to the nearest dollar.) P22-2 (L01,2,3) EXCEL GROUPWORK (Change in Estimate and Error Correctio Holtzman Company is in the process TABLE TOOLS ? - Document Word HOM INSER DESI PAGE REFE MAIL REVIE VIEW ADD- PDFel DESIGN LAYOUT Kyle Wilson FILE 2016 2014 2015 2017 2013 $13,964 $15,506 $16,673 $18,221 $18,898 Sales-net Cost of goods sold $1,010 $1,124 $1,101 $1,270 $1,500 $13,000 $13,900 $15,000 $15,900 $17,100 ($1,124) ($1,101) ($1,270) ($1,500) ($1,720) $12,886 $13,923 $14,831 $15,670 $16,880 $1,078 $1,583 $1,842 $2,551 $2,018 $700 $763 $832 907 $989 $378 $820 $1,010 $1,644 $1,029 $189 $410 $505 $822 $515 $189 $410 $505 $822 $514 2 $1,395 $1,805$2,310 $3,132 $3,6406 $1.83 $3.81 4.94$8.00 $4.93 Beginning inventory Purchases Ending inventory Total Gross profit Administrative expenses Income before taxes Income taxes (50%) Net income Retained earnings-beginning Retained earnings- ending Earnings per share $1,206 $1,395 $1,805 $2,310 $3,13 103 WORDS PAGE 1 OF 1 +100%