Answered step by step

Verified Expert Solution

Question

1 Approved Answer

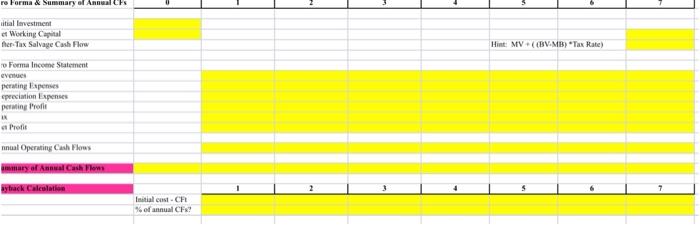

This company has the following project alternatives, and company data Company Data Company WACC (discount rate) 9% Company Tax Rate 21% Example Project Data Alternative

| This company has the following project alternatives, and company data | |||||||||||||||

| Company Data | |||||||||||||||

| Company WACC (discount rate) | |||||||||||||||

| Company Tax Rate | Example | ||||||||||||||

| Project Data | Alternative 1 | Alternative 2 | Alternative 3 | Alternative 4 | After-Tax Salvage Cash Flow | ||||||||||

| Project Type | Independent | Ending Book Value | MV - BV if positive would be a capital gain. | ||||||||||||

| Equipment for project at t=0 | Ending Market Val. | Capital Gain would mean tax is owed. | |||||||||||||

| Installation costs at t=0 | BV - MB | Company would have cash inflow of the MV and outflow of taxes | |||||||||||||

| Net Working Cap. Initial Investment* | *At the end of the project all NWC borrowed from the firm will be returned to the firm (recouped) | The net would be the A.T. Salvage CF | |||||||||||||

| Initial Sales | A.T. Salvage CF | Hint: MV + ( (BV-MB) *Tax Rate) | |||||||||||||

| Annual Sales Growth Rates | |||||||||||||||

| Annual Variable costs as a % of Sales | |||||||||||||||

| Annual Fixed Costs | |||||||||||||||

| Project life | |||||||||||||||

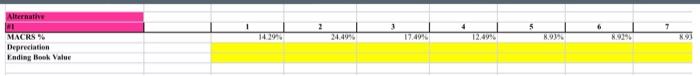

| Method of Depreciation | MACRS | ||||||||||||||

| Expected Life of Equipment | |||||||||||||||

| Market Value at t=T | |||||||||||||||

| Salvage Value at t=T | n.a. | ||||||||||||||

*yellow

*please show excel formulas

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started