this company uses the perpetual inventory method and incurred the following transactions.

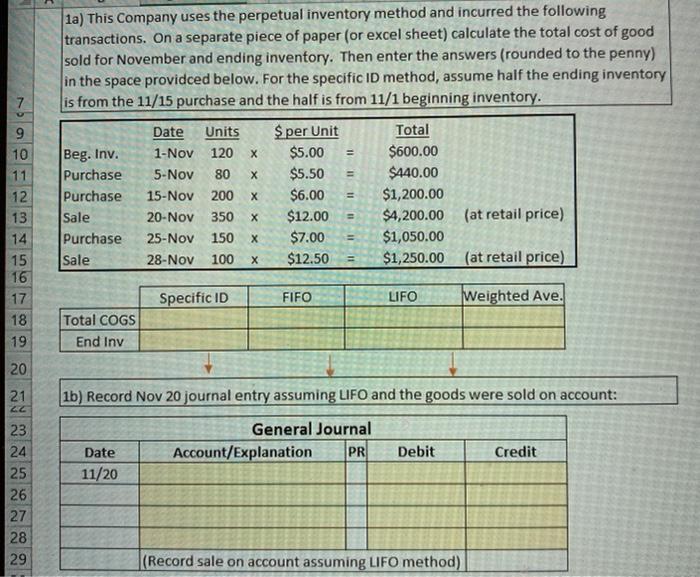

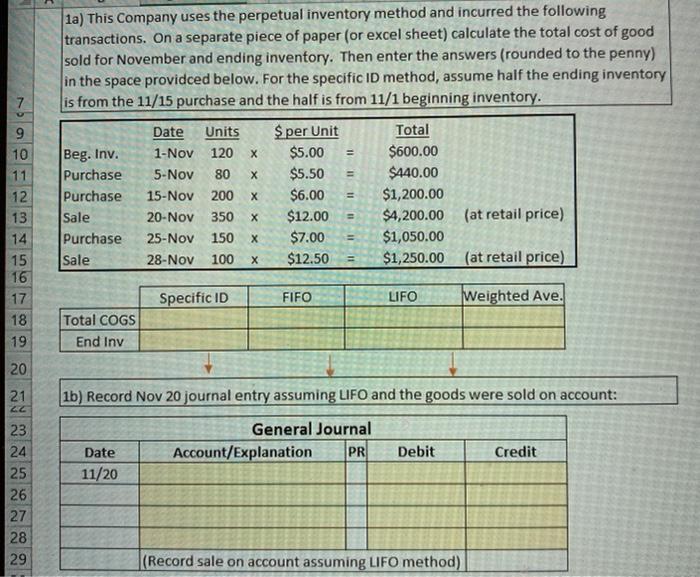

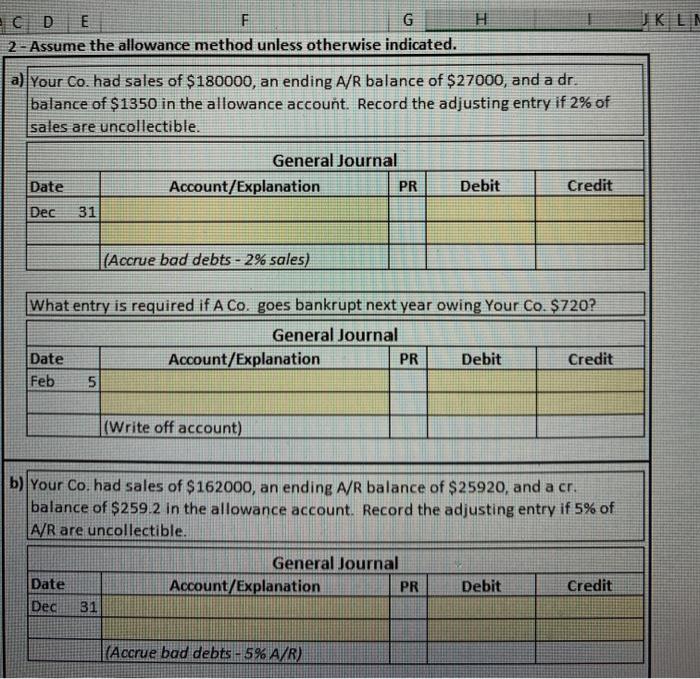

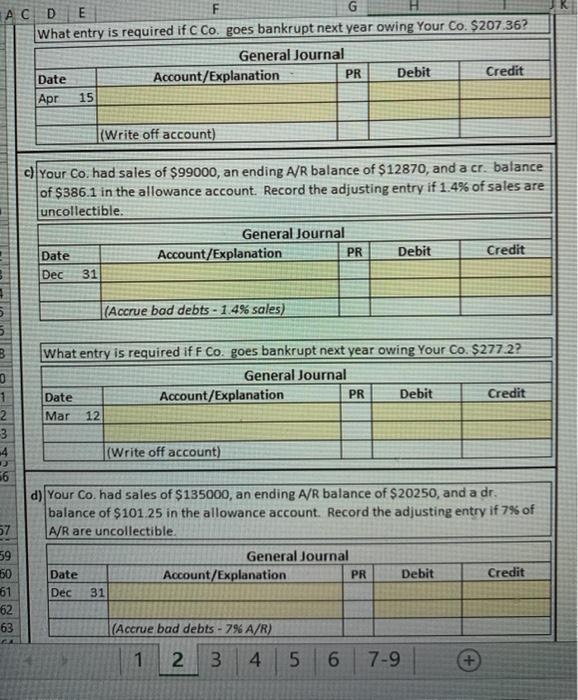

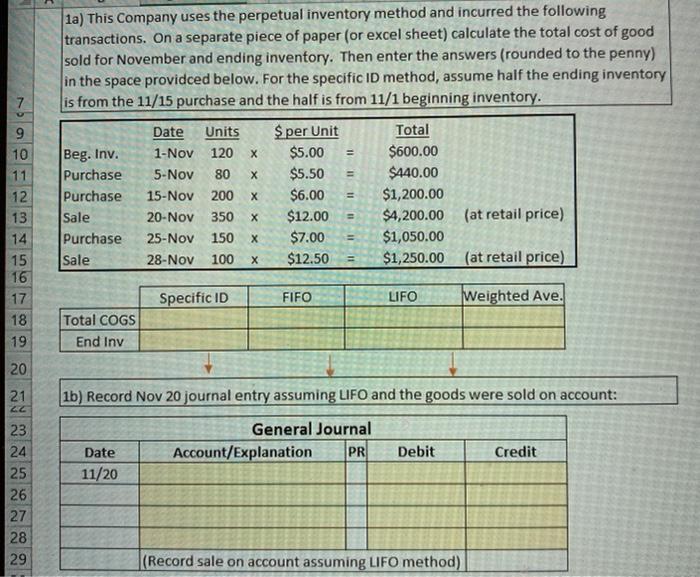

1a) This Company uses the perpetual inventory method and incurred the following transactions. On a separate piece of paper (or excel sheet) calculate the total cost of good sold for November and ending inventory. Then enter the answers (rounded to the penny) in the space providced below. For the specific ID method, assume half the ending inventory is from the 11/15 purchase and the half is from 11/1 beginning inventory. X Date Units 1-Nov 120 5-Nov 80 15-Nov 200 20-Nov 350 25-Nov 150 28-Nov 100 Beg. Inv. Purchase Purchase Sale Purchase Sale Sper Unit $5.00 $5.50 $6.00 $12.00 $7.00 $12.50 10 11 12 13 14 15 16 17 18 19 Total $600.00 $440.00 $1,200.00 $4,200.00 $1,050.00 $1,250.00 (at retail price) (at retail price) Specific ID FIFO LIFO Weighted Ave. Total COGS End Inv 20 21 22 1b) Record Nov 20 journal entry assuming LIFO and the goods were sold on account: General Journal Account/Explanation PR Debit Credit Date 11/20 2 23 24 25 26 27 28 29 2 2 (Record sale on account assuming LIFO method) H J K L M C D E F G 2 - Assume the allowance method unless otherwise indicated. a) Your Co. had sales of $180000, an ending A/R balance of $27000, and a dr. balance of $1350 in the allowance account. Record the adjusting entry if 2% of sales are uncollectible. General Journal Account/Explanation PR Date Debit Credit Dec 31 (Accrue bad debts - 2% sales) What entry is required if A Co. goes bankrupt next year owing Your Co. $720? General Journal Date Account/Explanation PR Debit Credit Feb 5 (Write off account) b) Your Co. had sales of $162000, an ending A/R balance of $25920, and a cr. balance of $259.2 in the allowance account. Record the adjusting entry if 5% of A/R are uncollectible. General Journal Account/Explanation PR Debit Date Dec Credit 31 (Accrue bad debts -15% ALR) AC D E G What entry is required if C Co. goes bankrupt next year owing Your Co. $207.36? General Journal Date Account/Explanation PR Debit Credit Apr 15 (Write off account) c) Your Co. had sales of $99000, an ending A/R balance of $12870, and a cr. balance of $386.1 in the allowance account. Record the adjusting entry if 1.4% of sales are uncollectible. General Journal Date Account/Explanation PR Debit Credit Dec 31 (Accrue bad debts - 1.4% sales) 5 B 0 1 2 3 What entry is required if F Co. goes bankrupt next year owing Your Co. $277.2? General Journal Date Account/Explanation PR Debit Credit Mar 12 (Write off account) 56 57 59 50 61 62 63 d) Your Co. had sales of $135000, an ending A/R balance of $20250, and a dr. balance of $101.25 in the allowance account. Record the adjusting entry if 7% of A/R are uncollectible. General Journal Date Account/Explanation PR Debit Credit Dec 31 (Accrue bad debts -7% A/R) 1 2 3 4 5 5 6 7-9 +