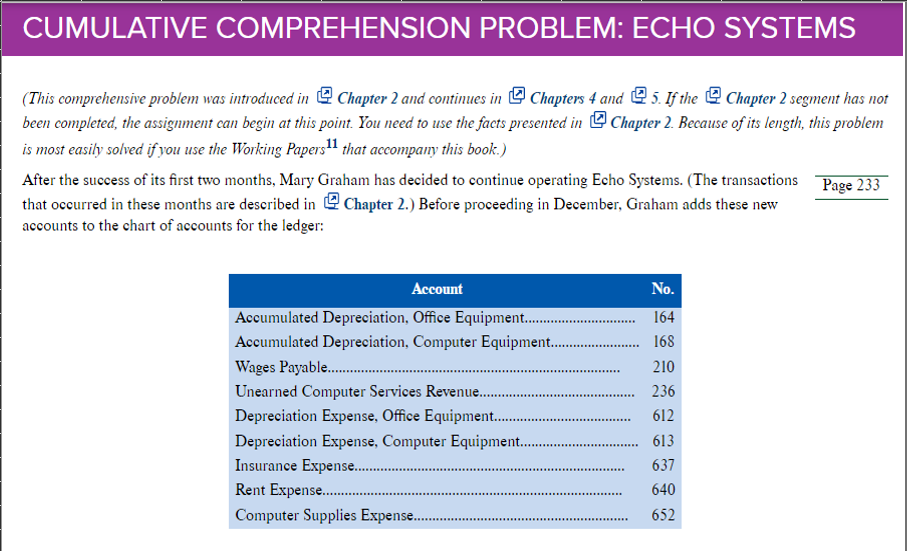

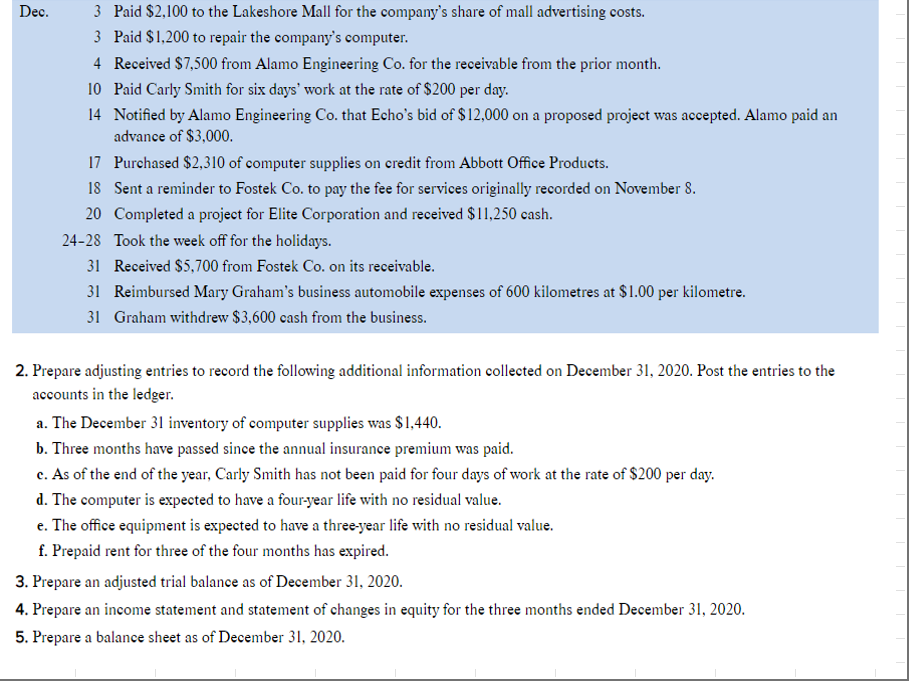

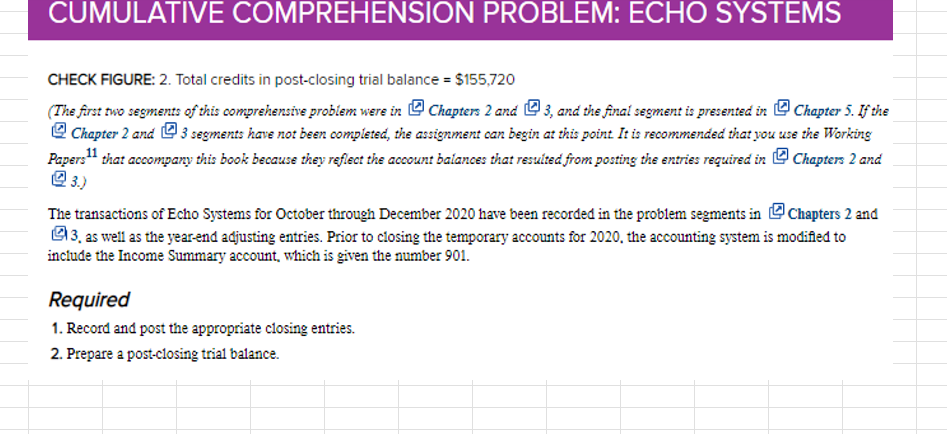

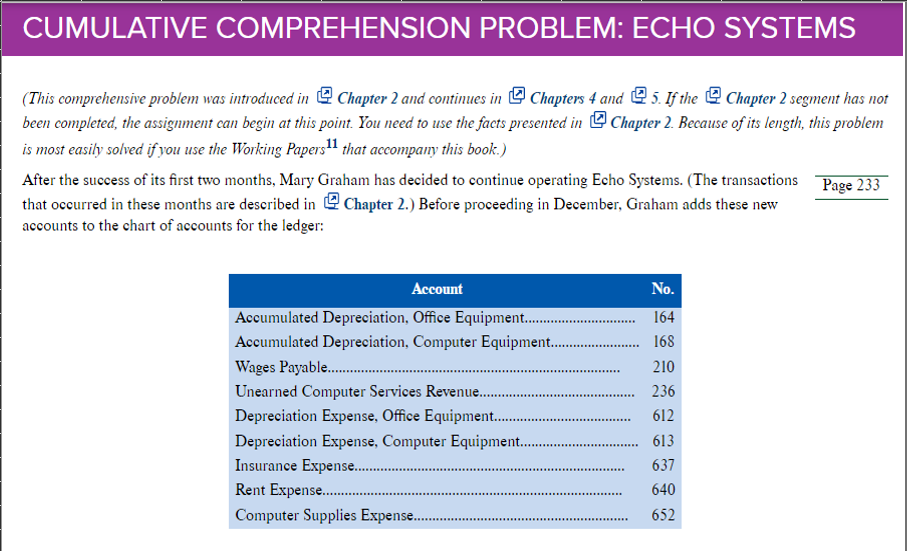

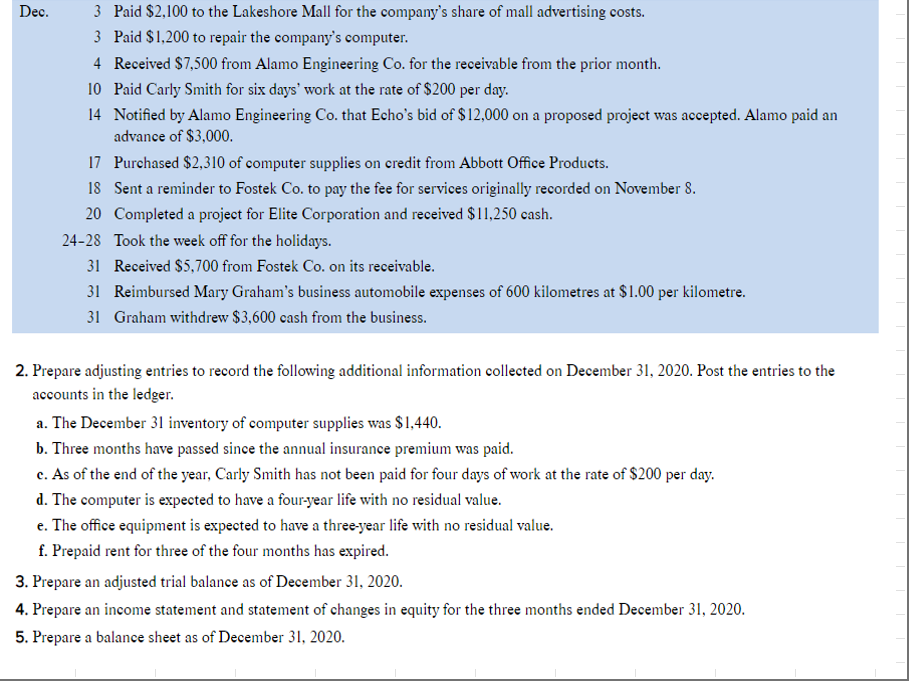

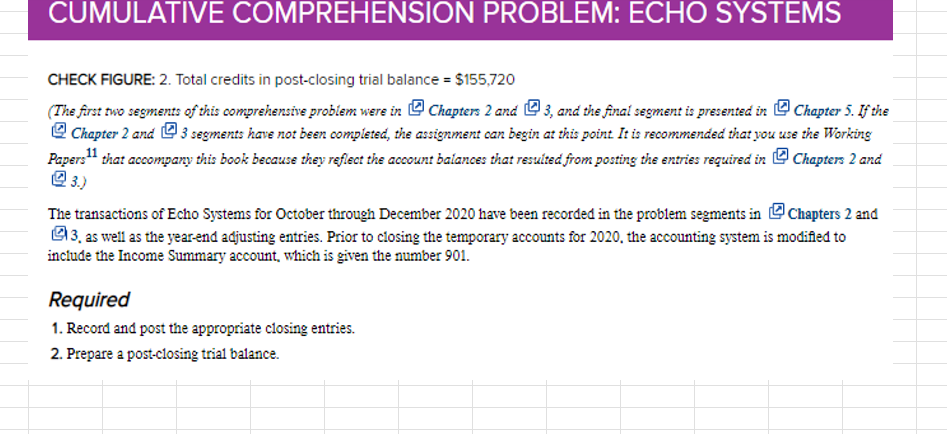

(This comprehensive problem was introduced in Chapter 2 and continues in Chapters 4 and 5. If the Chapter 2 segment has not been completed, the assigmment can begin at this point. You need to use the facts presented in Chapter 2. Because of its length, this problem is most easily solved if you use the Working Papers 11 that accompany this book.) After the success of its first two months, Mary Graham has decided to continue operating Echo Systems. (The transactions Page 233 that occurred in these months are described in Chapter 2.) Before proceeding in December, Graham adds these new accounts to the chart of accounts for the ledger: Dec. 3 Paid $2,100 to the Lakeshore Mall for the company's share of mall advertising costs. 3 Paid $1,200 to repair the company's computer. 4 Received $7,500 from Alamo Engineering Co. for the receivable from the prior month. 10 Paid Carly Smith for six days' work at the rate of $200 per day. 14 Notified by Alamo Engineering Co. that Echo's bid of $12,000 on a proposed project was accepted. Alamo paid an advance of $3,000. 17 Purchased $2,310 of computer supplies on credit from Abbott Office Products. 18 Sent a reminder to Fostek Co. to pay the fee for services originally recorded on November 8 . 20 Completed a project for Elite Corporation and received $11,250 cash. 24-28 Took the week off for the holidays. 31 Received $5,700 from Fostek Co. on its receivable. 31 Reimbursed Mary Graham's business automobile expenses of 600 kilometres at $1.00 per kilometre. 31 Graham withdrew $3,600 cash from the business. 2. Prepare adjusting entries to record the following additional information collected on December 31,2020 . Post the entries to the accounts in the ledger. a. The December 31 inventory of computer supplies was $1,440. b. Three months have passed since the annual insurance premium was paid. c. As of the end of the year, Carly Smith has not been paid for four days of work at the rate of $200 per day. d. The computer is expected to have a four-year life with no residual value. e. The office equipment is expected to have a three-year life with no residual value. f. Prepaid rent for three of the four months has expired. 3. Prepare an adjusted trial balance as of December 31, 2020. CHECK FIGURE: 2. Total credits in post-closing trial balance =$155,720 [ Chapter 2 and [ 3 segments have not been completed, the assignment can begin at this point. It is recommended that you use the Working Papers 11 that accompany this book because they refleot the acoount balances that resuited from posting the entries required in Chapters 2 and 3.) The transactions of Echo Systems for October through December 2020 have been recorded in the problem segments in [ Chapters 2 and 3. as well as the year-end adjusting entries. Prior to closing the temporary accounts for 2020 , the accounting system is modifled to include the Income Summary account, which is given the number 901 . Required 1. Record and post the appropriate closing entries. 2. Prepare a post-closing trial balance. (This comprehensive problem was introduced in Chapter 2 and continues in Chapters 4 and 5. If the Chapter 2 segment has not been completed, the assigmment can begin at this point. You need to use the facts presented in Chapter 2. Because of its length, this problem is most easily solved if you use the Working Papers 11 that accompany this book.) After the success of its first two months, Mary Graham has decided to continue operating Echo Systems. (The transactions Page 233 that occurred in these months are described in Chapter 2.) Before proceeding in December, Graham adds these new accounts to the chart of accounts for the ledger: Dec. 3 Paid $2,100 to the Lakeshore Mall for the company's share of mall advertising costs. 3 Paid $1,200 to repair the company's computer. 4 Received $7,500 from Alamo Engineering Co. for the receivable from the prior month. 10 Paid Carly Smith for six days' work at the rate of $200 per day. 14 Notified by Alamo Engineering Co. that Echo's bid of $12,000 on a proposed project was accepted. Alamo paid an advance of $3,000. 17 Purchased $2,310 of computer supplies on credit from Abbott Office Products. 18 Sent a reminder to Fostek Co. to pay the fee for services originally recorded on November 8 . 20 Completed a project for Elite Corporation and received $11,250 cash. 24-28 Took the week off for the holidays. 31 Received $5,700 from Fostek Co. on its receivable. 31 Reimbursed Mary Graham's business automobile expenses of 600 kilometres at $1.00 per kilometre. 31 Graham withdrew $3,600 cash from the business. 2. Prepare adjusting entries to record the following additional information collected on December 31,2020 . Post the entries to the accounts in the ledger. a. The December 31 inventory of computer supplies was $1,440. b. Three months have passed since the annual insurance premium was paid. c. As of the end of the year, Carly Smith has not been paid for four days of work at the rate of $200 per day. d. The computer is expected to have a four-year life with no residual value. e. The office equipment is expected to have a three-year life with no residual value. f. Prepaid rent for three of the four months has expired. 3. Prepare an adjusted trial balance as of December 31, 2020. CHECK FIGURE: 2. Total credits in post-closing trial balance =$155,720 [ Chapter 2 and [ 3 segments have not been completed, the assignment can begin at this point. It is recommended that you use the Working Papers 11 that accompany this book because they refleot the acoount balances that resuited from posting the entries required in Chapters 2 and 3.) The transactions of Echo Systems for October through December 2020 have been recorded in the problem segments in [ Chapters 2 and 3. as well as the year-end adjusting entries. Prior to closing the temporary accounts for 2020 , the accounting system is modifled to include the Income Summary account, which is given the number 901 . Required 1. Record and post the appropriate closing entries. 2. Prepare a post-closing trial balance