Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This contains all the information to solve the questions. 4. Suppose the yield to maturity on a one-year zero-coupon bond is 8%. The yield to

This contains all the information to solve the questions.

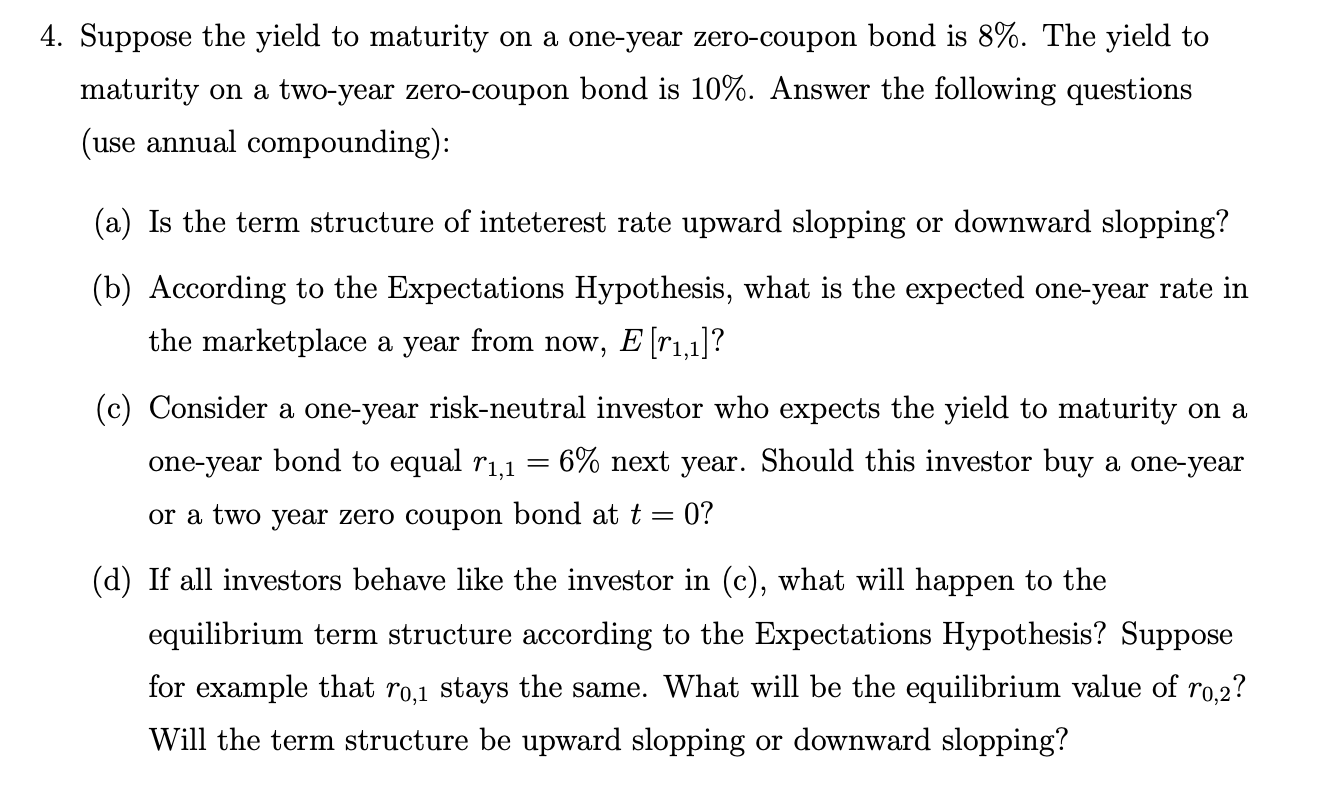

4. Suppose the yield to maturity on a one-year zero-coupon bond is 8%. The yield to maturity on a two-year zero-coupon bond is 10%. Answer the following questions (use annual compounding): (a) Is the term structure of inteterest rate upward slopping or downward slopping? (b) According to the Expectations Hypothesis, what is the expected one-year rate in the marketplace a year from now, E [11,1]? (c) Consider a one-year risk-neutral investor who expects the yield to maturity on a one-year bond to equal r1,1 = 6% next year. Should this investor buy a one-year or a two year zero coupon bond at t = 0? (d) If all investors behave like the investor in (c), what will happen to the equilibrium term structure according to the Expectations Hypothesis? Suppose for example that r0,1 stays the same. What will be the equilibrium value of r0,2? Will the term structure be upward slopping or downward slopping? 4. Suppose the yield to maturity on a one-year zero-coupon bond is 8%. The yield to maturity on a two-year zero-coupon bond is 10%. Answer the following questions (use annual compounding): (a) Is the term structure of inteterest rate upward slopping or downward slopping? (b) According to the Expectations Hypothesis, what is the expected one-year rate in the marketplace a year from now, E [11,1]? (c) Consider a one-year risk-neutral investor who expects the yield to maturity on a one-year bond to equal r1,1 = 6% next year. Should this investor buy a one-year or a two year zero coupon bond at t = 0? (d) If all investors behave like the investor in (c), what will happen to the equilibrium term structure according to the Expectations Hypothesis? Suppose for example that r0,1 stays the same. What will be the equilibrium value of r0,2? Will the term structure be upward slopping or downward sloppingStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started