Question

This contains data on the annual percentage return on stocks, gold, and Treasury bills over the period from 1987 to 2007. A certain investor would

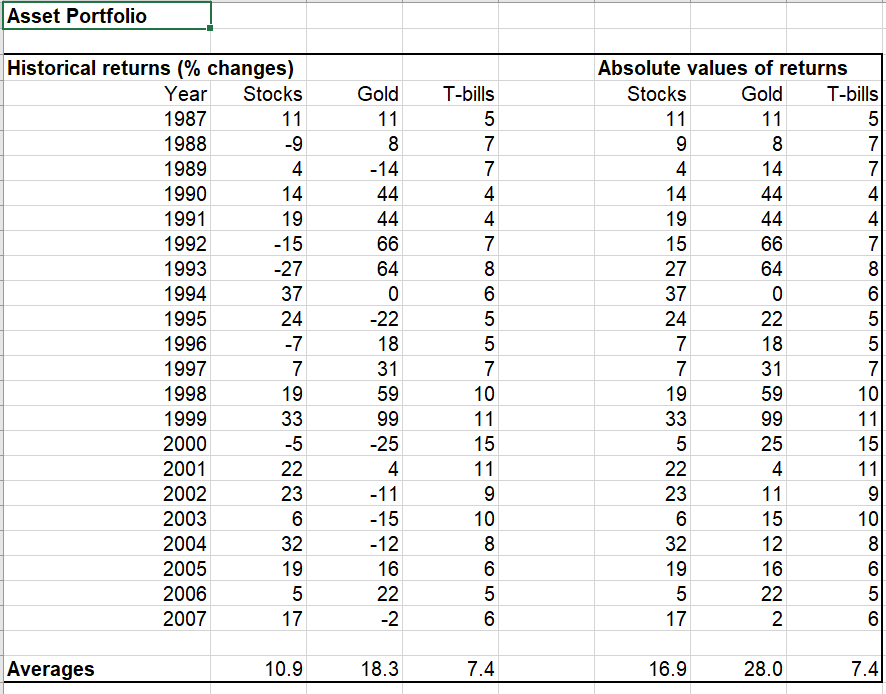

This contains data on the annual percentage return on stocks, gold, and Treasury bills over the period from 1987 to 2007. A certain investor would like to determine the percentages of her portfolio to invest in these three asset categories. Her objective is to maximize the expected return on the portfolio while not investing less than 20% or more than 50% in each asset class. You may estimate the expected return on each asset with its average return over the period 1987-2007. The risk index of an asset is measured by the average absolute percentage change over time. You may estimate the risk indices for stocks, gold, and Treasury bills over 1987- 2007. The risk index for a portfolio is the weighted average of the risk indices of its component assets, where the weights are the percentages invested in each asset. For example, in the data we see that the risk index for stocks is 16.9. Our investor would like the risk index of her portfolio to equal 15. (a) What are the optimal percentages to invest in each asset class? (b) Describe how her average return and the percentages invested in each asset change as she increases her acceptable risk index from 15 to 18

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started