Answered step by step

Verified Expert Solution

Question

1 Approved Answer

this counts as one question. please help me. thank you! please help solve for a thumbs up. TY (Annuity payments) You plan to retire in

this counts as one question. please help me. thank you!

please help solve for a thumbs up. TY

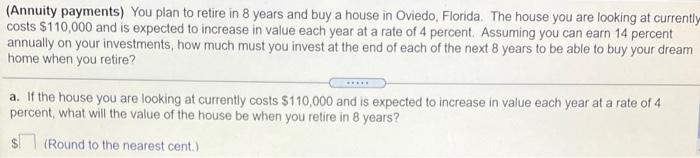

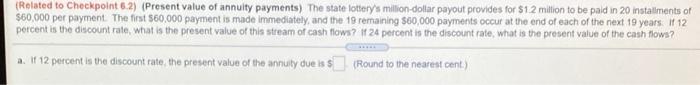

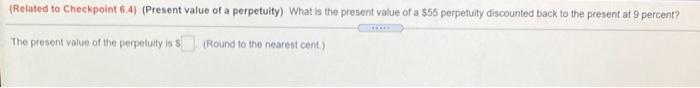

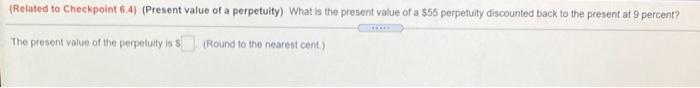

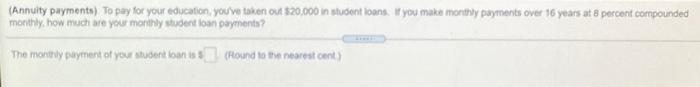

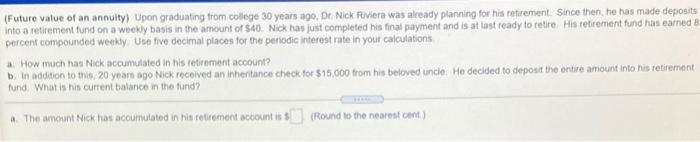

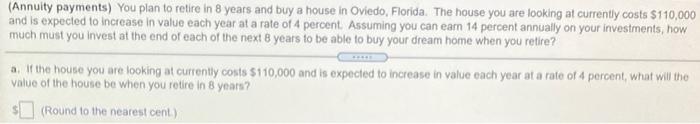

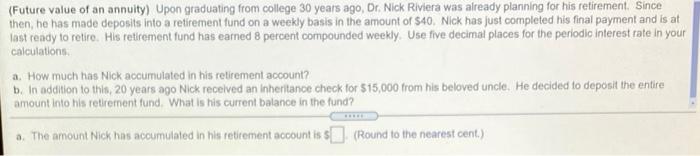

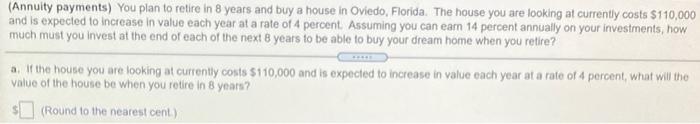

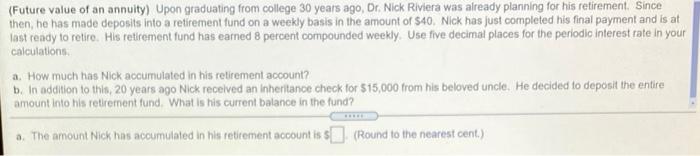

(Annuity payments) You plan to retire in 8 years and buy a house in Oviedo, Florida. The house you are looking at currently costs $110,000 and is expected to increase in value each year at a rate of 4 percent. Assuming you can earn 14 percent annually on your investments, how much must you invest at the end of each of the next 8 years to be able to buy your dream home when you retire? a. If the house you are looking at currently costs $110,000 and is expected to increase in value each year at a rate of 4 percent, what will the value of the house be when you retire in 8 years? (Round to the nearest cent) (Related to Checkpoint 6.2) (Present value of annuity payments) The state lottery's million dollar payout provides for $1.2 million to be paid in 20 installments of $60,000 per payment . The first $60,000 payment is made immediately, and the 19 remaining $60,000 payments occur at the end of each of the next 19 years. If 12 percent is the discount rate what is the present value of this stream of cash flows? If 24 percent is the discount rate what is the present value of the cash flows? a. 112 percent is the discount rate, the present value of the annuty due is $(Round to the nearest cent) (Related to Checkpoint 6.4) (Present value of a perpetulty) What is the present value of a $55 perpetuity discounted back to the present at 9 percent? The present value of the perpetuity is $(Round to the nearest cont.) (Annuity payments) To pay for your education, you've taken out $20,000 in student loans. If you make monthly payments over 16 years at 8 percent compounded monthly, how much are your monthly student loan payments? The monthly payment of your studentoriss (Round to the nearest cent) (Future value of an annuity) Upon graduating from college 30 years ago, Dr Nick Riviera was already planning for his retirement. Since then, he has made deposits into a retirement fund on a weekly basis in the amount of $40. Nick has just completed his final payment and is at last ready to retire His retirement fund has earned 8 percent compounded weekly Use five decimal places for the periodic interest rate in your calculations How much has Nick accumulated in his retirement account? b. In addition to thin 20 years ago Nick received an inheritance check for $15.000 from his beloved unde. He decided to deposit the entire amount into his retirement fund. What is his current balance in the furid? The amount Nick has accumulated in his retirement account is 3)(Round to the nearest cond) (Annuity payments) You plan to retire in 8 years and buy a house in Oviedo, Florida. The house you are looking at currently costs $110,000 and is expected to increase in value each year at a rate of 4 percent. Assuming you can earn 14 percent annually on your investments, how much must you invest at the end of each of the next 8 years to be able to buy your dream home when you retire? a. If the house you are looking at currently costs $110,000 and is expected to increase in value each year at a rate of 4 percent, what will the value of the house be when you retire in 8 years? s(Round to the nearest cent) (Future value of an annuity) Upon graduating from college 30 years ago, Dr. Nick Riviera was already planning for his retirement. Since then he has made deposits into a retirement fund on a weekly basis in the amount of $40, Nick has just completed his final payment and is at last ready to retire. His retirement fund has earned 8 percent compounded weekly. Use five decimal places for the periodic interest rate in your calculations a. How much has Nick accumulated in his retirement account? b. In addition to this, 20 years ago Nick received an inheritance check for $15,000 from his beloved uncle. He decided to deposit the entire amount into his retirement fund. What is his current balance in the fund? a. The amount Nick has accumulated in his retirement account is $. (Round to the nearest cent.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started