Answered step by step

Verified Expert Solution

Question

1 Approved Answer

this doesnt make sense if it is not knowledge to you then leave it alone . 12.Zappo Company began operations in 2017. Since then, it

this doesnt make sense if it is not knowledge to you then leave it alone .

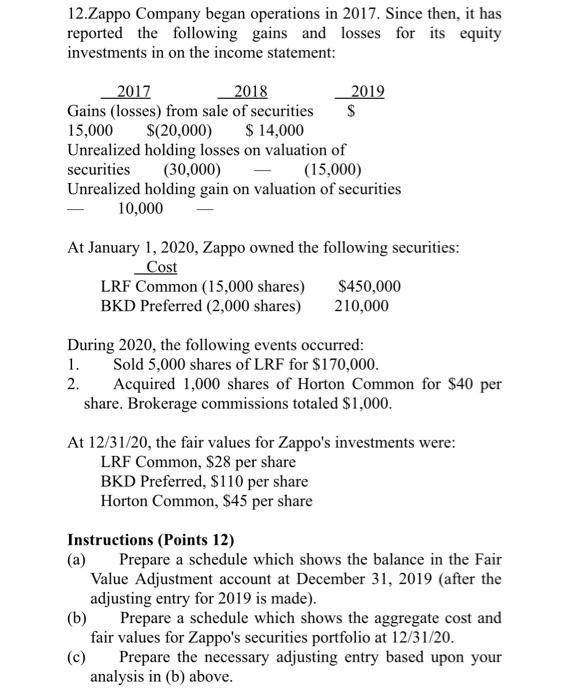

12.Zappo Company began operations in 2017. Since then, it has reported the following gains and losses for its equity investments in on the income statement: 2017 2018 2019 Gains (losses) from sale of securities $ 15,000 $(20,000) $ 14,000 Unrealized holding losses on valuation of securities (30,000) (15,000) Unrealized holding gain on valuation of securities 10,000 At January 1, 2020, Zappo owned the following securities: Cost LRF Common (15,000 shares) $450,000 BKD Preferred (2,000 shares) 210,000 During 2020, the following events occurred: 1. Sold 5,000 shares of LRF for $170,000. 2. Acquired 1,000 shares of Horton Common for $40 per share. Brokerage commissions totaled $1,000. At 12/31/20, the fair values for Zappo's investments were: LRF Common, $28 per share BKD Preferred, $110 per share Horton Common, $45 per share Instructions (Points 12) Prepare a schedule which shows the balance in the Fair Value Adjustment account at December 31, 2019 (after the adjusting entry for 2019 is made). (b) Prepare a schedule which shows the aggregate cost and fair values for Zappo's securities portfolio at 12/31/20. Prepare the necessary adjusting entry based upon your analysis in (b) above Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started