Answered step by step

Verified Expert Solution

Question

1 Approved Answer

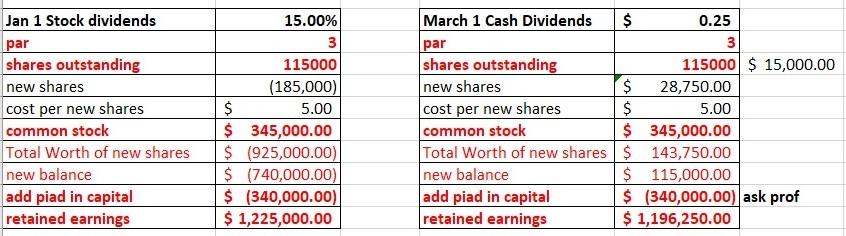

This excel below is what i did. I keep getting this question incorrect and I cannot figure it out :( Please show on excel. Thank

This excel below is what i did.

This excel below is what i did. I keep getting this question incorrect and I cannot figure it out :(

I keep getting this question incorrect and I cannot figure it out :(

Please show on excel. Thank you

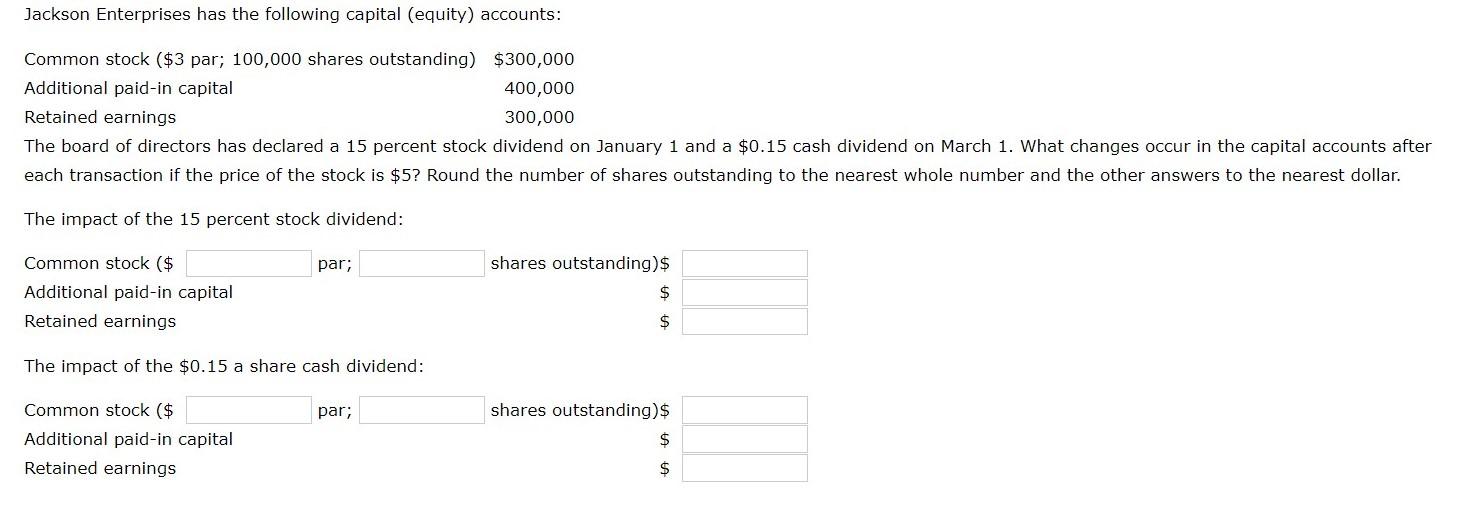

Jackson Enterprises has the following capital (equity) accounts: Common stock ($3 par; 100,000 shares outstanding) $300,000 Additional paid-in capital 400,000 Retained earnings 300,000 The board of directors has declared a 15 percent stock dividend on January 1 and a $0.15 cash dividend on March 1. What changes occur in the capital accounts after each transaction if the price of the stock is $5? Round the number of shares outstanding to the nearest whole number and the other answers to the nearest dollar. The impact of the 15 percent stock dividend: par; Common stock ($ Additional paid-in capital Retained earnings shares outstanding)$ $ $ The impact of the $0.15 a share cash dividend: par; Common stock ($ Additional paid-in capital Retained earnings shares outstanding) $ $ $ Jan 1 Stock dividends $ par shares outstanding new shares cost per new shares common stock Total Worth of new shares new balance add piad in capital retained earnings 15.00% 3 115000 (185,000) $ 5.00 $ 345,000.00 $ (925,000.00) $ (740,000.00) $ (340,000.00) $ 1,225,000.00 March 1 Cash Dividends 0.25 par 3 shares outstanding 115000 $ 15,000.00 new shares $ 28,750.00 cost per new shares $ 5.00 common stock $ 345,000.00 Total Worth of new shares $ 143,750.00 new balance $ 115,000.00 add piad in capital $ (340,000.00) ask prof retained earnings $ 1,196,250.00Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started