Question

This exercise is built around Whole Foods Markets financial statements from the chapter. Average common shareholders equity for 2012 was $3.397 billion, and a 40%

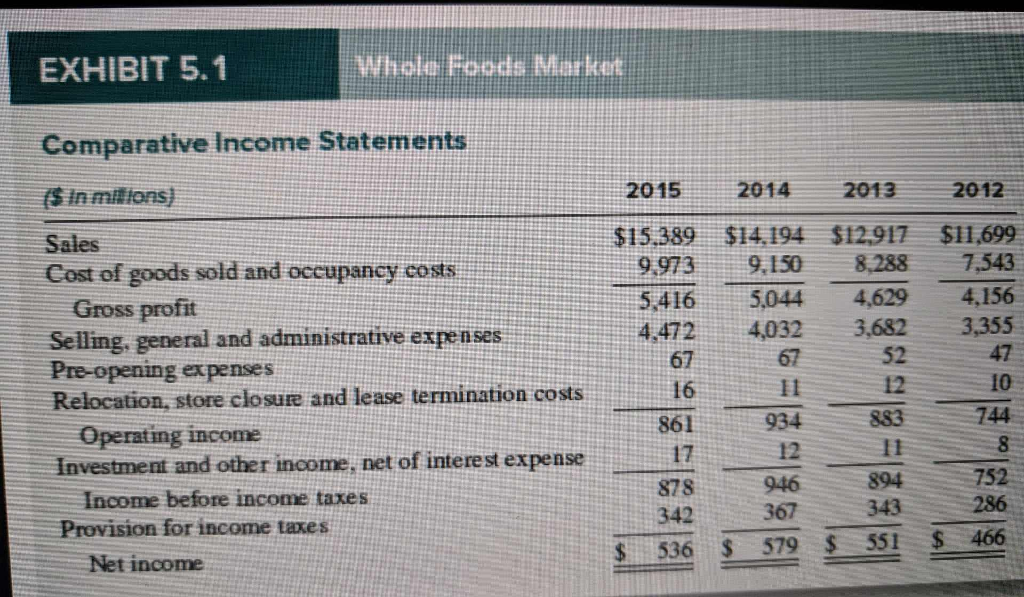

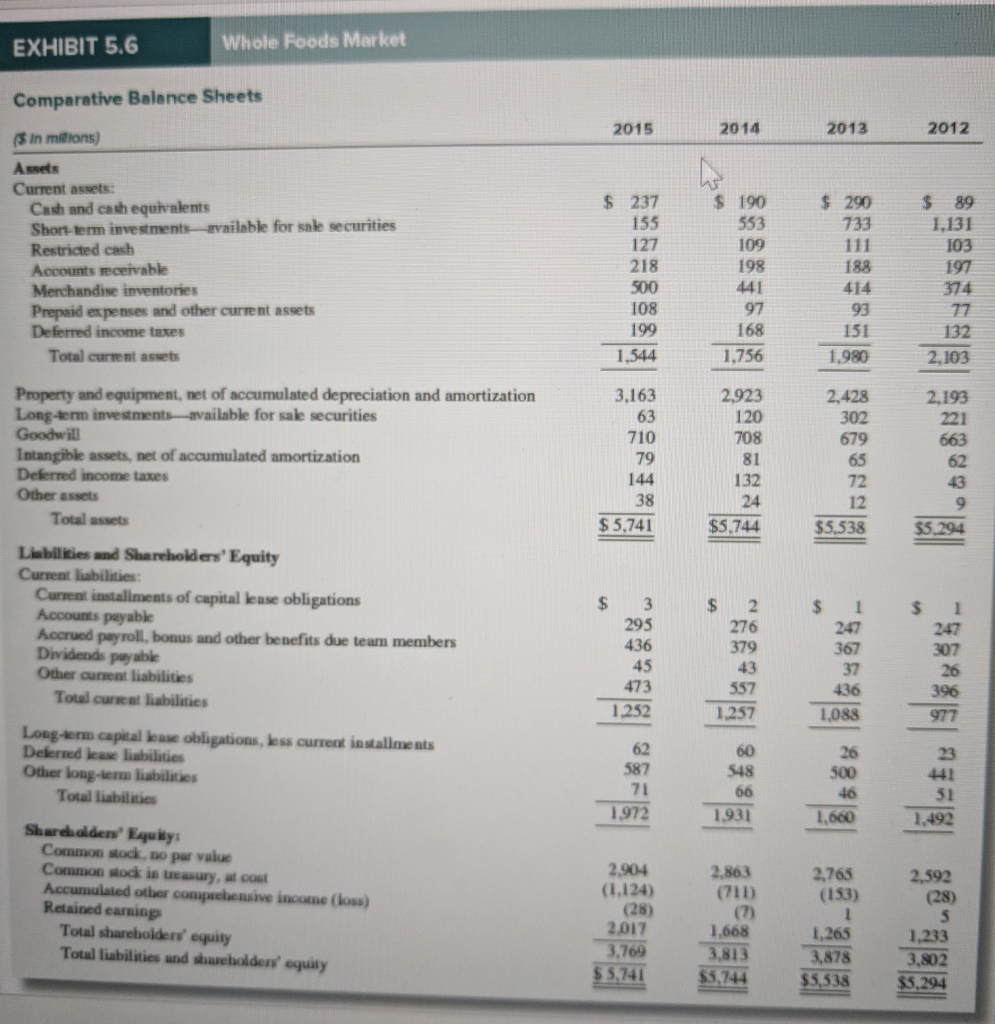

This exercise is built around Whole Foods Markets financial statements from the chapter. Average common shareholders equity for 2012 was $3.397 billion, and a 40% income tax rate should be used as needed. Refer to Exhibits 5.1 and 5.6 from the chapter.

Required:

1. Whole Foods earned an ROA of 9.7% in 2012. What was ROCE that year? (Round your answer to 1 decimal place.)

2. ROA at the company fell to 9.4% in 2015. What was ROCE that year? (Round your answer to 1 decimal place.)

3. Did financial leverage help or hurt Whole Foods Market in 2015?

1.ROCE 2012 %

2.ROCE 2015 %

3.Did financial leverage help or hurt Whole Foods Market in 2015?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started