Question

This exercise requires you to prepare a multi-step income statement. You will provide all the numbers yourself. Each amount must be in thousands ($1,000,

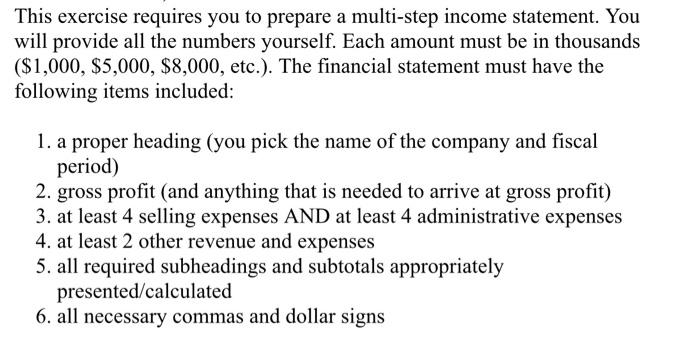

This exercise requires you to prepare a multi-step income statement. You will provide all the numbers yourself. Each amount must be in thousands ($1,000, $5,000, $8,000, etc.). The financial statement must have the following items included: 1. a proper heading (you pick the name of the company and fiscal period) 2. gross profit (and anything that is needed to arrive at gross profit) 3. at least 4 selling expenses AND at least 4 administrative expenses 4. at least 2 other revenue and expenses 5. all required subheadings and subtotals appropriately presented/calculated 6. all necessary commas and dollar signs

Step by Step Solution

3.38 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

ABC Inc Income Statement For the Year Ended December 31 2022 Sales r...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamental financial accounting concepts

Authors: Thomas P. Edmonds, Frances M. Mcnair, Philip R. Olds, Edward

8th edition

978-007802536, 9780077648831, 0078025362, 77648838, 978-0078025365

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App