Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Why Couldn't This Be Easy, Inc. has two issues of securities outstanding: common stock and $3,400,000 face value, 5-year, 2%, convertible bonds. The bonds

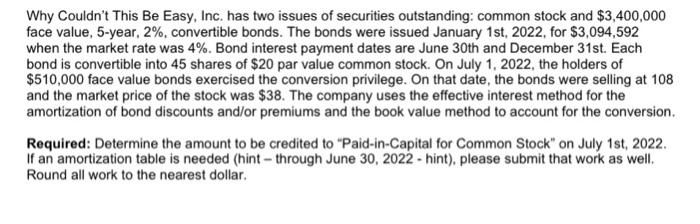

Why Couldn't This Be Easy, Inc. has two issues of securities outstanding: common stock and $3,400,000 face value, 5-year, 2%, convertible bonds. The bonds were issued January 1st, 2022, for $3,094,592 when the market rate was 4%. Bond interest payment dates are June 30th and December 31st. Each bond is convertible into 45 shares of $20 par value common stock. On July 1, 2022, the holders of $510,000 face value bonds exercised the conversion privilege. On that date, the bonds were selling at 108 and the market price of the stock was $38. The company uses the effective interest method for the amortization of bond discounts and/or premiums and the book value method to account for the conversion. Required: Determine the amount to be credited to "Paid-in-Capital for Common Stock" on July 1st, 2022. If an amortization table is needed (hint- through June 30, 2022 - hint), please submit that work as well. Round all work to the nearest dollar.

Step by Step Solution

★★★★★

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

my answer is clearly defined below first we should compute issue price of bonds ie the present ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started