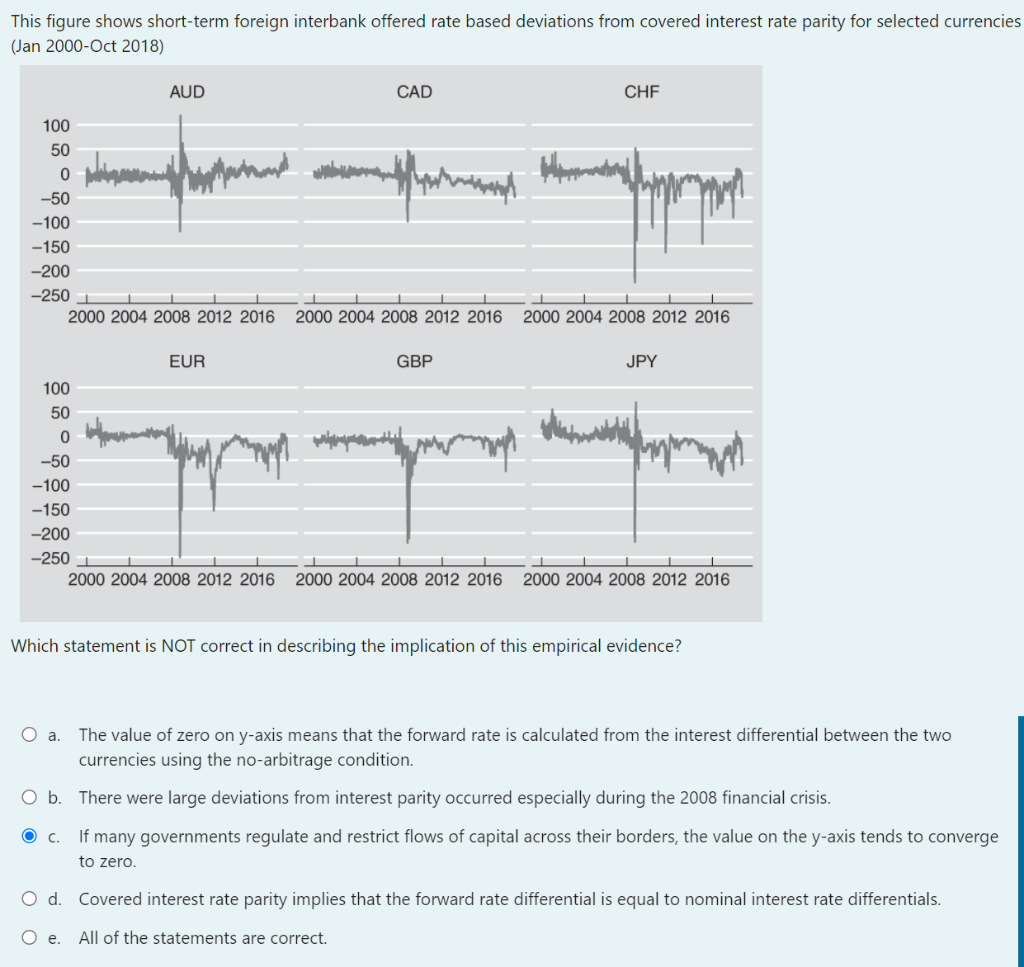

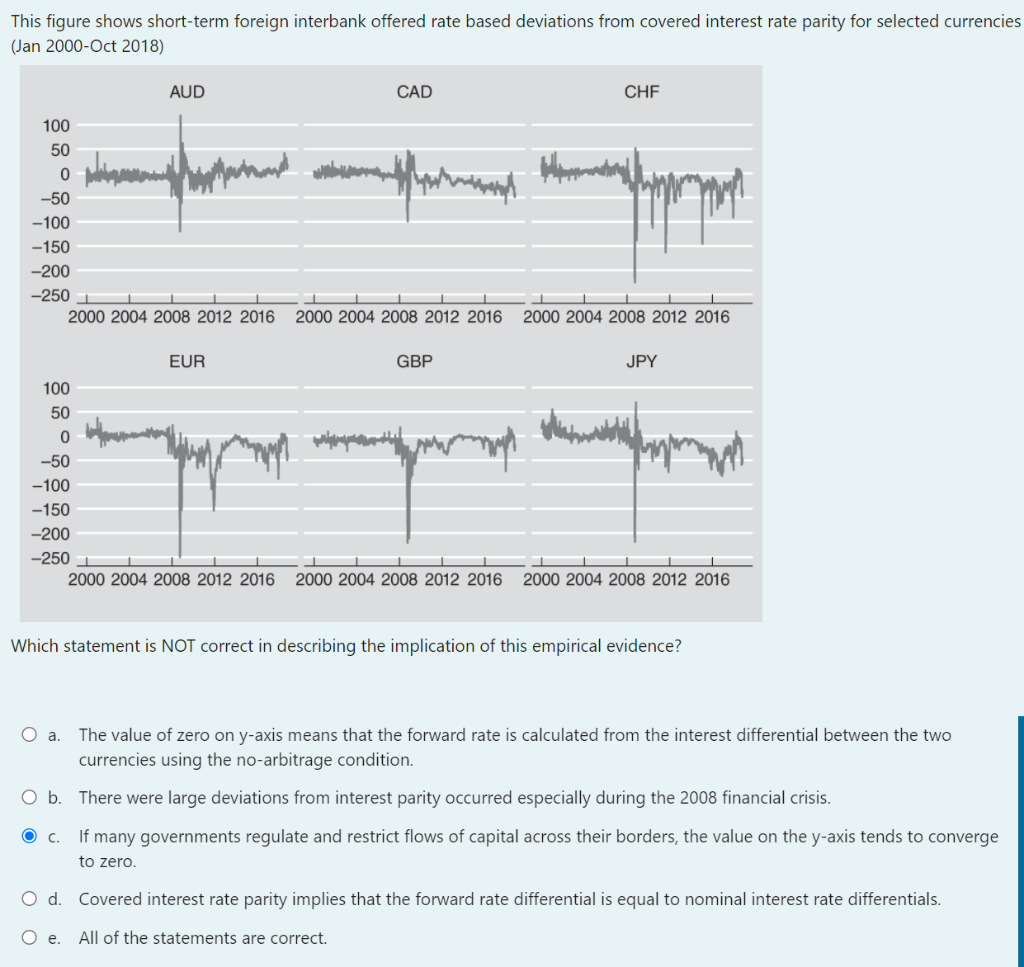

This figure shows short-term foreign interbank offered rate based deviations from covered interest rate parity for selected currencies (Jan 2000-Oct 2018) AUD CAD CHF polomaeneo hay than 100 50 0 -50 -100 -150 -200 Maranh sayang -250 1 LII 2000 2004 2008 2012 2016 I LL IT 2000 2004 2008 2012 2016 2000 2004 2008 2012 2016 EUR GBP JPY 100 50 Wowww 0 -50 -100 -150 -200 - 250 1 2000 2004 2008 2012 2016 2000 2004 2008 2012 2016 2000 2004 2008 2012 2016 Which statement is NOT correct in describing the implication of this empirical evidence? O a. O b. The value of zero on y-axis means that the forward rate is calculated from the interest differential between the two currencies using the no-arbitrage condition. There were large deviations from interest parity occurred especially during the 2008 financial crisis. If many governments regulate and restrict flows of capital across their borders, the value on the y-axis tends to converge to zero. O c. O d. Covered interest rate parity implies that the forward rate differential is equal to nominal interest rate differentials. O e. All of the statements are correct. This figure shows short-term foreign interbank offered rate based deviations from covered interest rate parity for selected currencies (Jan 2000-Oct 2018) AUD CAD CHF polomaeneo hay than 100 50 0 -50 -100 -150 -200 Maranh sayang -250 1 LII 2000 2004 2008 2012 2016 I LL IT 2000 2004 2008 2012 2016 2000 2004 2008 2012 2016 EUR GBP JPY 100 50 Wowww 0 -50 -100 -150 -200 - 250 1 2000 2004 2008 2012 2016 2000 2004 2008 2012 2016 2000 2004 2008 2012 2016 Which statement is NOT correct in describing the implication of this empirical evidence? O a. O b. The value of zero on y-axis means that the forward rate is calculated from the interest differential between the two currencies using the no-arbitrage condition. There were large deviations from interest parity occurred especially during the 2008 financial crisis. If many governments regulate and restrict flows of capital across their borders, the value on the y-axis tends to converge to zero. O c. O d. Covered interest rate parity implies that the forward rate differential is equal to nominal interest rate differentials. O e. All of the statements are correct