This following Scenario based on AUSTRALIA's scenario. Therefore for working out for solution need to consider Australian GST, Income Tax etc.

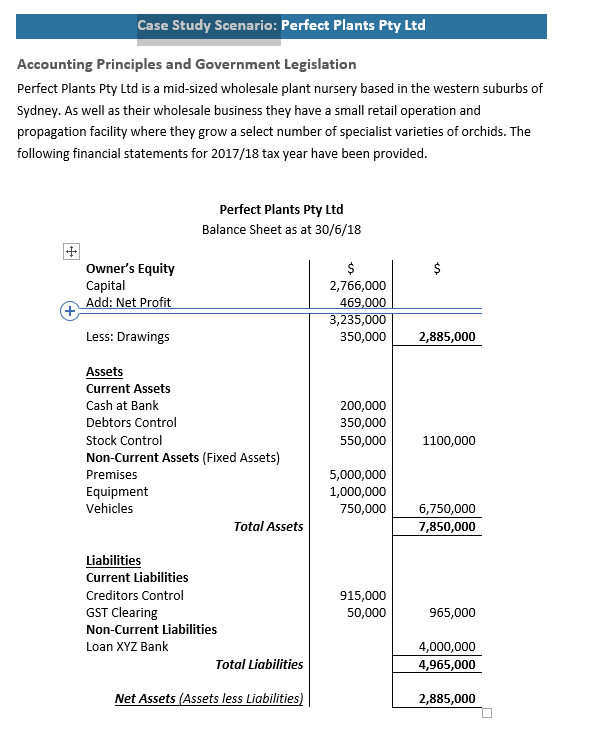

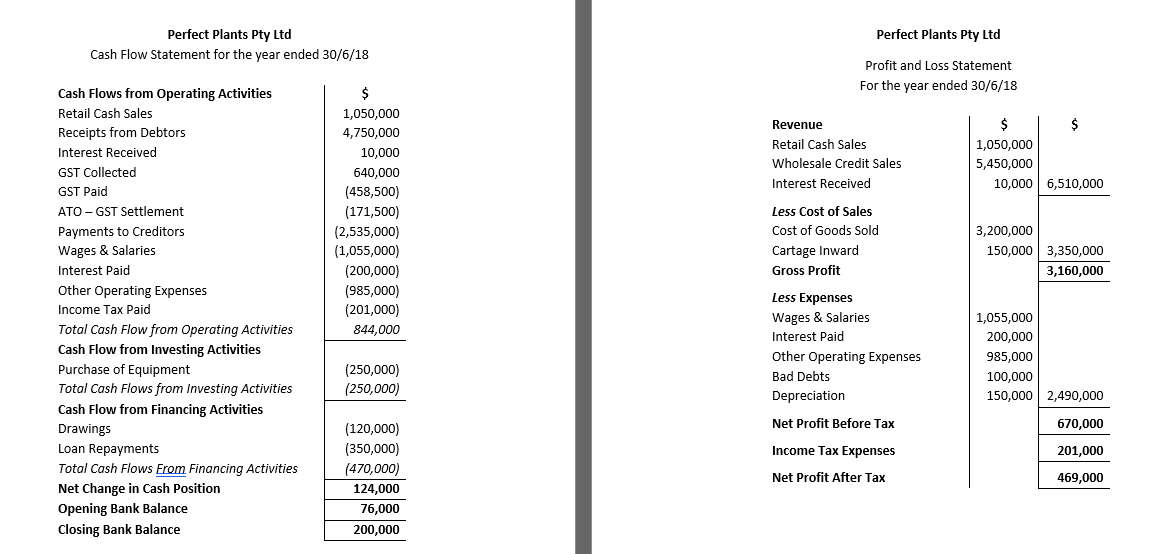

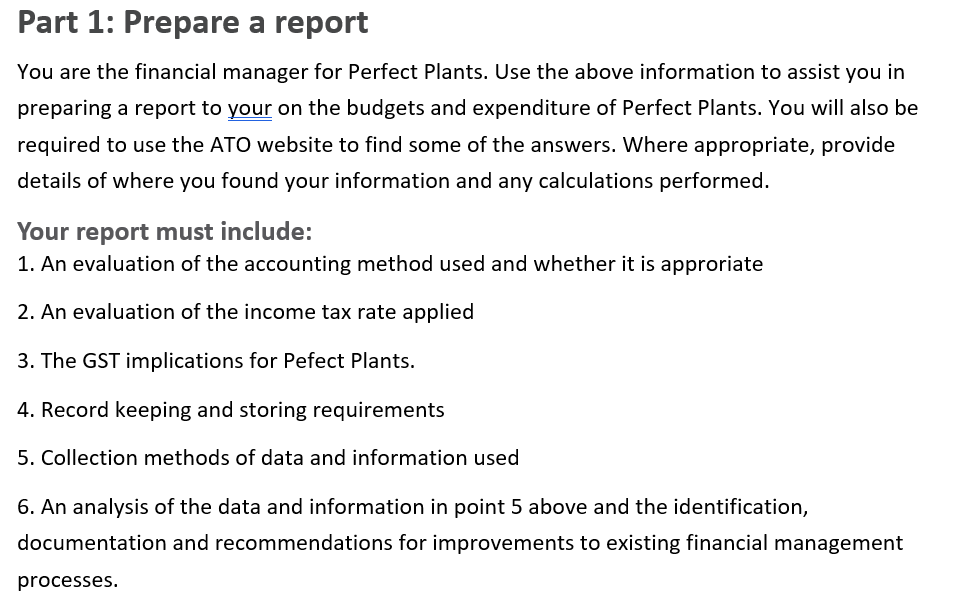

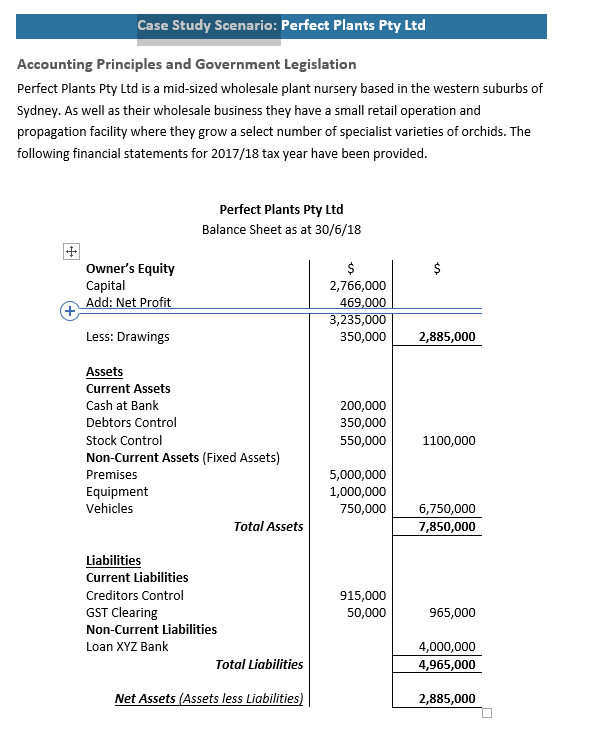

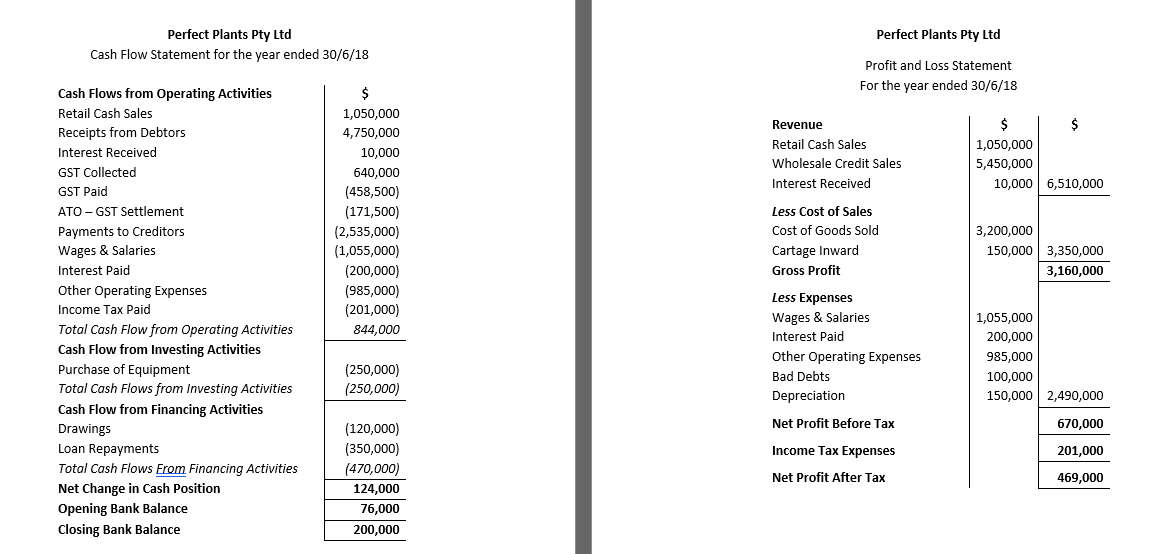

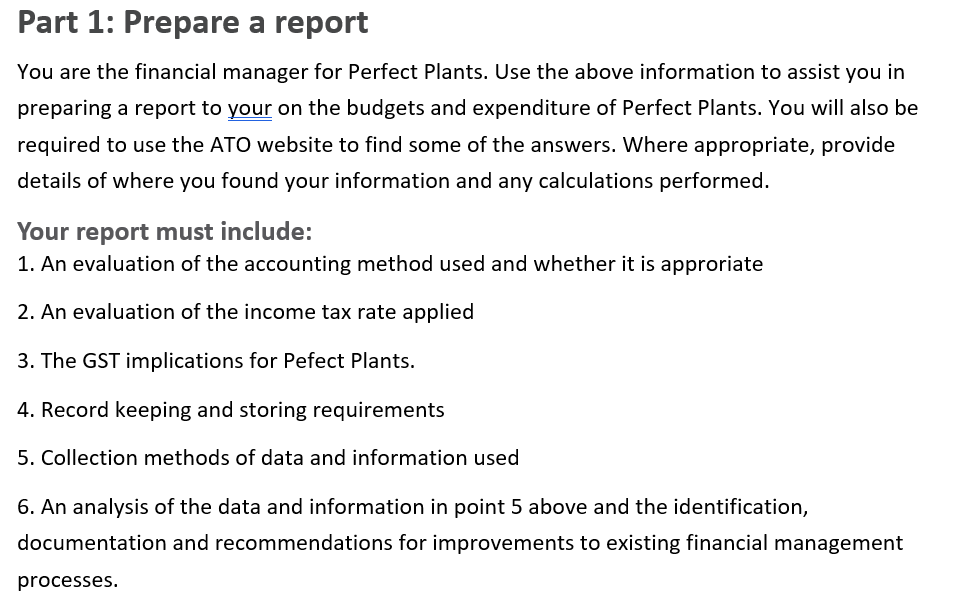

Case Study Scenario: Perfect Plants Pty Ltd Accounting Principles and Government Legislation Perfect Plants Pty Ltd is a mid-sized wholesale plant nursery based in the western suburbs of Sydney. As well as their wholesale business they have a small retail operation and propagation facility where they grow a select number of specialist varieties of orchids. The following financial statements for 2017/18 tax year have been provided. Perfect Plants Pty Ltd Balance Sheet as at 30/6/18 Owner's Equity Capital Add: Net Profit $ 2,766,000 469,000 3,235,000 350,000 Less: Drawings 2,885,000 200,000 350,000 550,000 1100,000 Assets Current Assets Cash at Bank Debtors Control Stock Control Non-Current Assets (Fixed Assets) Premises Equipment Vehicles Total Assets 5,000,000 1,000,000 750,000 6,750,000 7,850,000 Liabilities Current Liabilities Creditors Control GST Clearing Non-Current Liabilities Loan XYZ Bank Total Liabilities 915,000 50,000 965,000 4,000,000 4,965,000 Net Assets (Assets less Liabilities) 2,885,000 Perfect Plants Pty Ltd Perfect Plants Pty Ltd Cash Flow Statement for the year ended 30/6/18 Profit and Loss Statement For the year ended 30/6/18 Revenue Retail Cash Sales Wholesale Credit Sales Interest Received $ $ 1,050,000 5,450,000 10,000 6,510,000 1,050,000 4,750,000 10,000 640,000 (458,500) (171,500) (2,535,000) (1,055,000) (200,000) (985,000) (201,000) 844,000 Less Cost of Sales Cost of Goods Sold Cartage Inward Gross Profit Cash Flows from Operating Activities Retail Cash Sales Receipts from Debtors Interest Received GST Collected GST Paid ATO-GST Settlement Payments to Creditors Wages & Salaries Interest Paid Other Operating Expenses Income Tax Paid Total Cash Flow from Operating Activities Cash Flow from Investing Activities Purchase of Equipment Total Cash Flows from Investing Activities Cash Flow from Financing Activities Drawings Loan Repayments Total Cash Flows From Financing Activities Net Change in Cash Position Opening Bank Balance Closing Bank Balance 3,200,000 150,000 3,350,000 3,160,000 Less Expenses Wages & Salaries Interest Paid Other Operating Expenses Bad Debts Depreciation 1,055,000 200,000 985,000 100,000 150,000 2,490,000 (250,000) (250,000) Net Profit Before Tax 670,000 Income Tax Expenses 201,000 (120,000) (350,000) (470,000) 124,000 76,000 200,000 Net Profit After Tax 469,000 Part 1: Prepare a report You are the financial manager for Perfect Plants. Use the above information to assist you in preparing a report to your on the budgets and expenditure of Perfect Plants. You will also be required to use the ATO website to find some of the answers. Where appropriate, provide details of where you found your information and any calculations performed. Your report must include: 1. An evaluation of the accounting method used and whether it is approriate 2. An evaluation of the income tax rate applied 3. The GST implications for Pefect Plants. 4. Record keeping and storing requirements 5. Collection methods of data and information used 6. An analysis of the data and information in point 5 above and the identification, documentation and recommendations for improvements to existing financial management processes