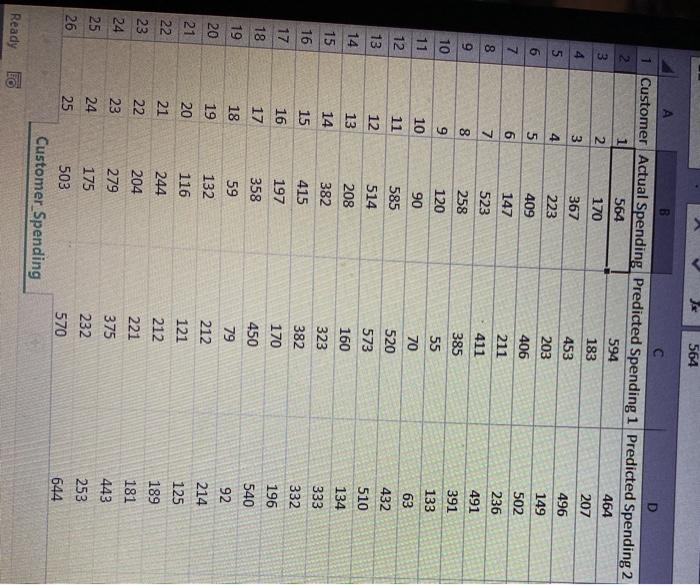

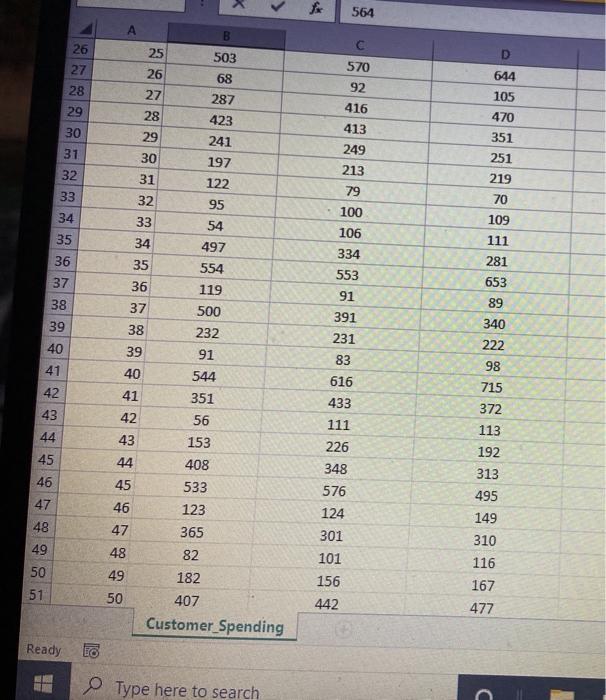

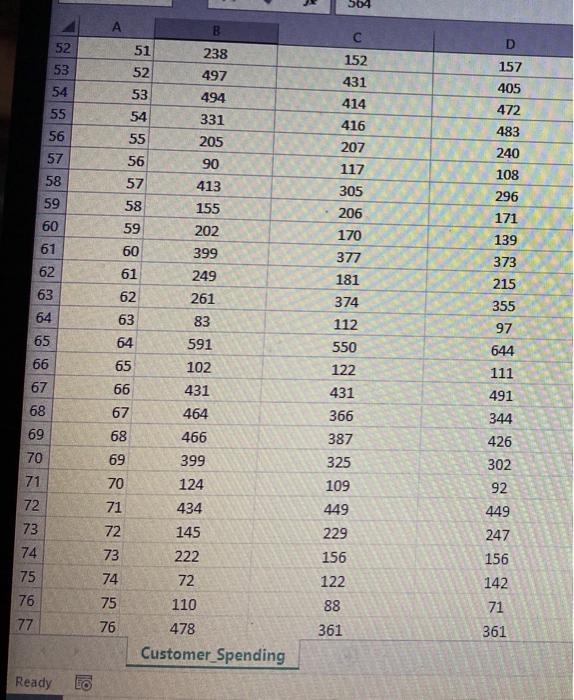

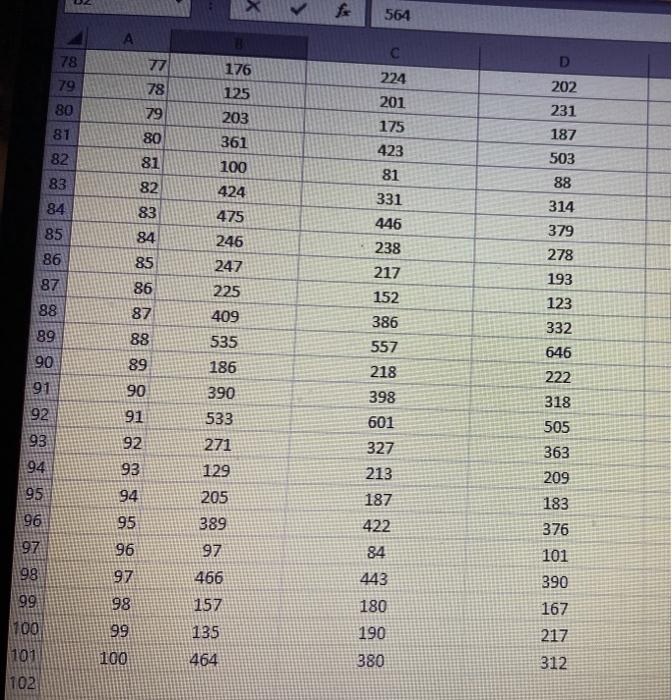

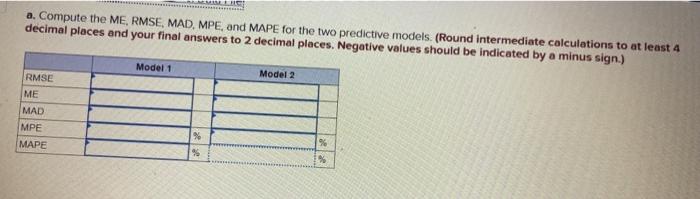

Question: this for business anayltics 564 4 5 8 c D 1 Customer Actual Spending Predicted Spending 1 Predicted Spending 2 2. 1 564 594 464

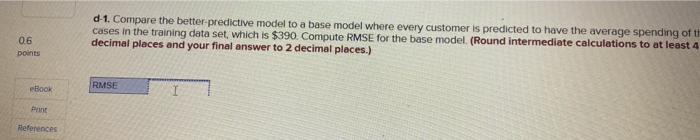

564 4 5 8 c D 1 Customer Actual Spending Predicted Spending 1 Predicted Spending 2 2. 1 564 594 464 3 2 170 183 207 3 367 453 496 5 4 223 203 149 6 5 409 406 502 7 6 147 211 236 7 523 411 491 9 8 258 385 391 10 9 120 55 133 11 10 90 70 63 12 11 585 520 432 13 12 514 573 510 14 13 208 160 134 15 14 382 323 333 16 15 415 382 332 17 16 197 170 196 18 358 450 540 19 18 59 79 92 20 19 132 212 214 21 20 116 121 125 22 21 244 212 189 23 22 204 221 181 24 23 279 375 443 25 24 175 232 253 26 25 503 570 644 Customer Spending Ready 17 fx 564 A B 25 503 D 26 27 28 570 26 68 644 27 287 105 29 28 423 30 92 416 413 249 213 470 351 251 31 32 33 79 219 70 34 100 106 109 111 334 553 281 653 89 340 222 98 35 36 37 38 39 40 41 42 43 44 45 46 47 48 29 241 30 197 31 122 32 95 33 54 34 497 35 554 36 119 37 500 38 232 39 91 40 544 41 351 42 56 43 153 44 408 45 533 46 123 47 365 48 82 49 182 50 407 Customer_Spending 715 91 391 231 83 616 433 111 226 348 576 124 301 101 156 442 372 113 192 313 495 149 310 116 167 477 49 50 51 Ready Type here to search O 564 B 52 157 53 54 55 56 57 405 472 54 483 58 59 60 152 431 414 416 207 117 305 206 170 377 181 374 112 550 122 51 238 52 497 53 494 331 55 205 56 90 57 413 58 155 59 202 60 399 61 249 62 261 63 83 64 591 65 102 66 431 67 464 68 466 69 399 70 124 71 434 72 145 73 222 74 72 75 110 76 478 Customer Spending 61 62 63 64 65 66 240 108 296 171 139 373 215 355 97 644 111 491 344 426 302 92 449 247 67 68 69 431 366 387 325 109 70 71 72 449 229 156 73 74 75 76 77 122 156 142 71 361 88 361 Ready 19 564 C 224 28 79 176 125 78 9 203 202 231 187 503 81 0 82 81 83 82 8 314 83 4 85 361 100 424 475 246 247 225 09 379 84 86 5 201 175 423 81 331 446 238 217 152 386 557 218 398 601 87 86 88 87 99 90 88 89 0 535 186 278 193 123 332 646 222 318 505 363 2009 183 9 92 390 533 91 95 271 92 93 94 95 99 327 213 187 422 84 96 95 376 9 99 96 97 129 205 389 97 466 157 135 064 101 390 43 99 167 98 99 100 01 180 19 380 217 160 312 02 a. Compute the ME, RMSE, MAD, MPE, and MAPE for the two predictive models. (Round intermediate calculations to at least 4 decimal places and your final answers to 2 decimal places. Negative values should be indicated by a minus sign.) Model 1 Model 2 RMSE ME MAD MPE MAPE % % % % d-1. Compare the better-predictive model to a base model where every customer is predicted to have the average spending of cases in the training data set, which is $390. Compute RMSE for the base model (Round intermediate calculations to at least 4 decimal places and your final answer to 2 decimal places.) 0.6 points Book RMSE I References 564 4 5 8 c D 1 Customer Actual Spending Predicted Spending 1 Predicted Spending 2 2. 1 564 594 464 3 2 170 183 207 3 367 453 496 5 4 223 203 149 6 5 409 406 502 7 6 147 211 236 7 523 411 491 9 8 258 385 391 10 9 120 55 133 11 10 90 70 63 12 11 585 520 432 13 12 514 573 510 14 13 208 160 134 15 14 382 323 333 16 15 415 382 332 17 16 197 170 196 18 358 450 540 19 18 59 79 92 20 19 132 212 214 21 20 116 121 125 22 21 244 212 189 23 22 204 221 181 24 23 279 375 443 25 24 175 232 253 26 25 503 570 644 Customer Spending Ready 17 fx 564 A B 25 503 D 26 27 28 570 26 68 644 27 287 105 29 28 423 30 92 416 413 249 213 470 351 251 31 32 33 79 219 70 34 100 106 109 111 334 553 281 653 89 340 222 98 35 36 37 38 39 40 41 42 43 44 45 46 47 48 29 241 30 197 31 122 32 95 33 54 34 497 35 554 36 119 37 500 38 232 39 91 40 544 41 351 42 56 43 153 44 408 45 533 46 123 47 365 48 82 49 182 50 407 Customer_Spending 715 91 391 231 83 616 433 111 226 348 576 124 301 101 156 442 372 113 192 313 495 149 310 116 167 477 49 50 51 Ready Type here to search O 564 B 52 157 53 54 55 56 57 405 472 54 483 58 59 60 152 431 414 416 207 117 305 206 170 377 181 374 112 550 122 51 238 52 497 53 494 331 55 205 56 90 57 413 58 155 59 202 60 399 61 249 62 261 63 83 64 591 65 102 66 431 67 464 68 466 69 399 70 124 71 434 72 145 73 222 74 72 75 110 76 478 Customer Spending 61 62 63 64 65 66 240 108 296 171 139 373 215 355 97 644 111 491 344 426 302 92 449 247 67 68 69 431 366 387 325 109 70 71 72 449 229 156 73 74 75 76 77 122 156 142 71 361 88 361 Ready 19 564 C 224 28 79 176 125 78 9 203 202 231 187 503 81 0 82 81 83 82 8 314 83 4 85 361 100 424 475 246 247 225 09 379 84 86 5 201 175 423 81 331 446 238 217 152 386 557 218 398 601 87 86 88 87 99 90 88 89 0 535 186 278 193 123 332 646 222 318 505 363 2009 183 9 92 390 533 91 95 271 92 93 94 95 99 327 213 187 422 84 96 95 376 9 99 96 97 129 205 389 97 466 157 135 064 101 390 43 99 167 98 99 100 01 180 19 380 217 160 312 02 a. Compute the ME, RMSE, MAD, MPE, and MAPE for the two predictive models. (Round intermediate calculations to at least 4 decimal places and your final answers to 2 decimal places. Negative values should be indicated by a minus sign.) Model 1 Model 2 RMSE ME MAD MPE MAPE % % % % d-1. Compare the better-predictive model to a base model where every customer is predicted to have the average spending of cases in the training data set, which is $390. Compute RMSE for the base model (Round intermediate calculations to at least 4 decimal places and your final answer to 2 decimal places.) 0.6 points Book RMSE I References

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts