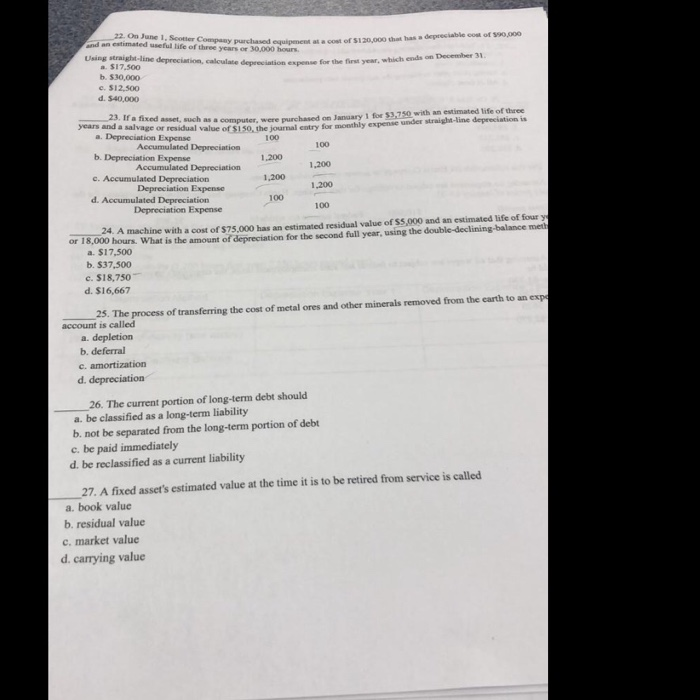

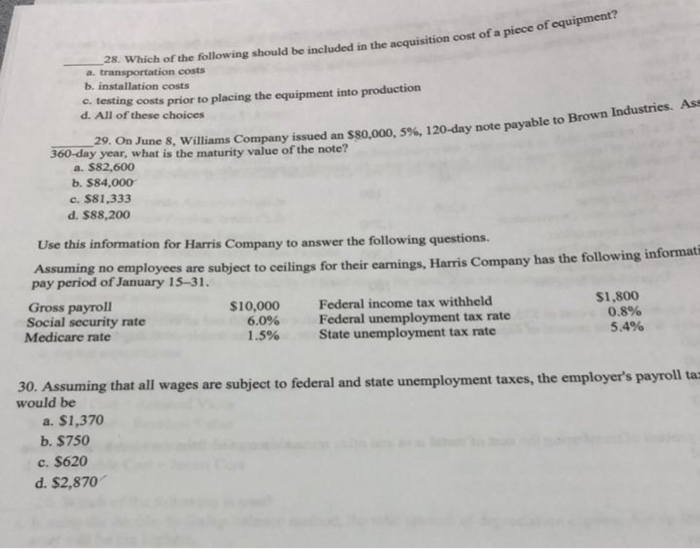

this has a depreciable con of 90.000 22. On June 1. Scott Comey purchased and an estimated and an estimated useful life of three years or 30,000 hours in Company purchased Using straight-line de e , calculate d on 1 b $10,000 c. $12.500 d. 540.000 years and a salvage of residual value of $150, the journa a fixed asset, such as a computer, were purchased on January 1 for $3.750 with an estimated life of three age or residual value of $150, the journal entry for monthly expense under straight-line depreciation is a. Depreciation Expense 100 100 Accumulated Depreciation b. Depreciation Expense 1.200 Accumulated Depreciation 1,200 c. Accumulated Depreciation 1,200 1,200 Depreciation Expense d. Accumulated Depreciation Depreciation Expense 100 100 24. A machine with a cost of $75.000 has an estimated residual value of $5,000 and an estimated life of four ye or 18.000 hours. What is the amount of depreciation for the second full year, using the double-declining-balance meth a. $17.500 b. $37,500 c. $18,750 d. S16,667 25. The process of transferring the cost of metal ores and other minerals removed from the earth to an expy account is called a. depletion b. deferral c. amortization d. depreciation 26. The current portion of long-term debt should a. be classified as a long-term liability b. not be separated from the long-term portion of debt c. be paid immediately d. be reclassified as a current liability 27. A fixed asset's estimated value at the time it is to be retired from service is called a. book value b. residual value c. market value d. carrying value e acquisition cost of a piece of equipment? 28. Which of the following should be included in the acquisition cost of a a transportation costs b. installation costs c. testing costs prior to placing the equipment into production d. All of these choices 9. On June 8, Williams Company issued an $80,000, 5%, 120-day note payable to be 360-day year, what is the maturity value of the note? a. $82,600 b. 584,000 c. $81,333 d. 88,200 76, 120-day note payable to Brown Industries. As Use this information for Harris Company to answer the following questions. Assuming no employees are subject to ceilings for their camings. Harris Company has the following informat pay period of January 1531. Gross payroll $10,000 Federal income tax withheld $1,800 Social security rate 6.0% Federal unemployment tax rate 0.8% Medicare rate 1.5% State unemployment tax rate 5.4% 30. Assuming that all wages are subject to federal and state unemployment taxes, the employer's payroll ta would be a. $1,370 b. $750 c. $620 d. $2,870