Answered step by step

Verified Expert Solution

Question

1 Approved Answer

this has almostn all options please help Required information P8-1 (Algo) Explaining the Nature of a Long-Lived Asset and Determining and Recording the Financial Statement

this has almostn all options please help

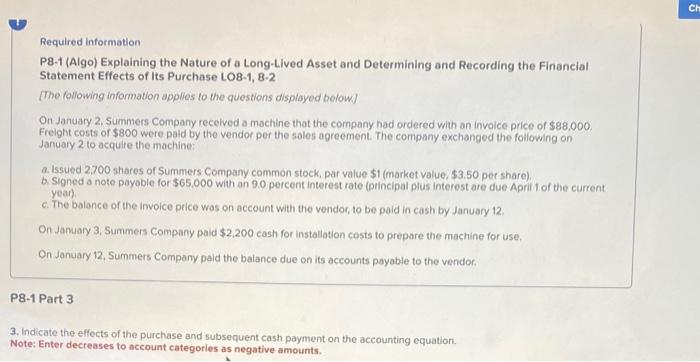

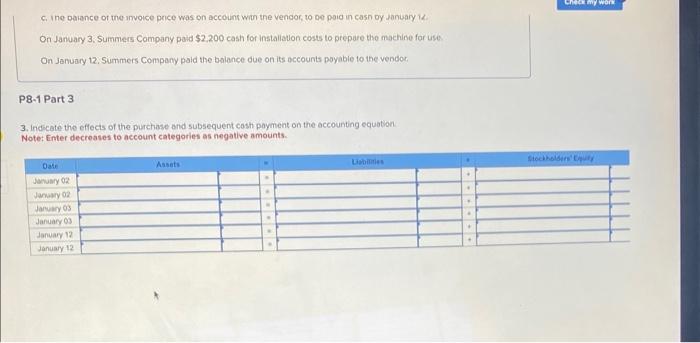

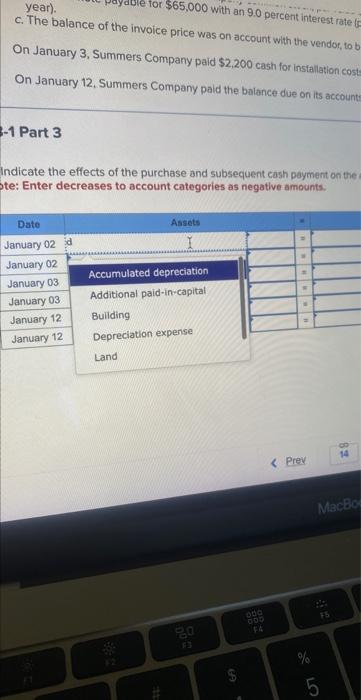

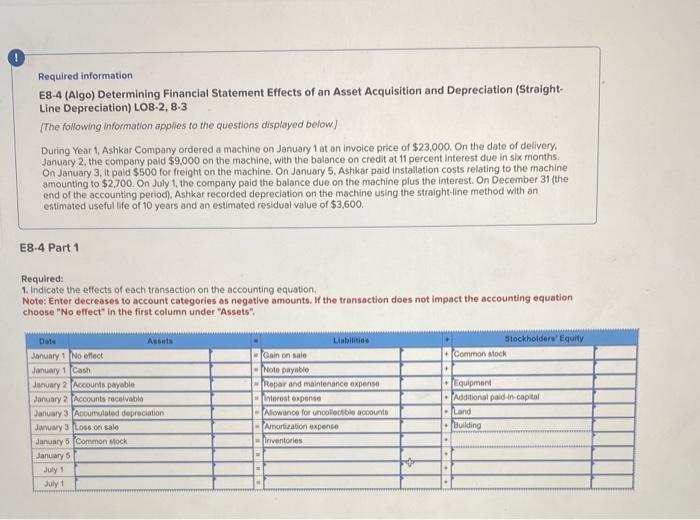

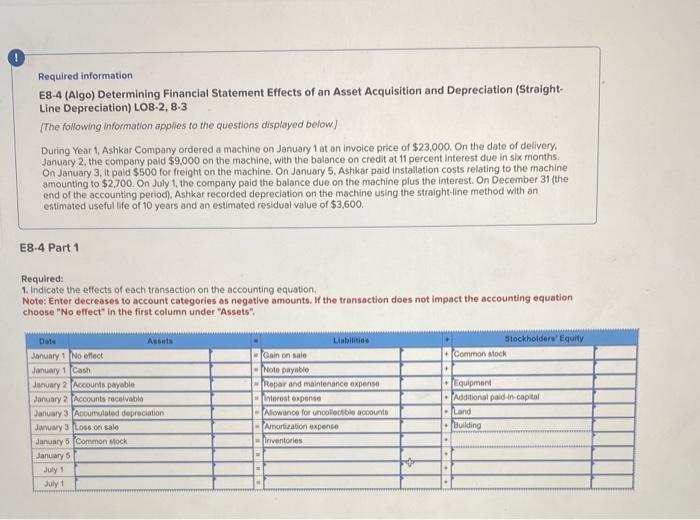

Required information P8-1 (Algo) Explaining the Nature of a Long-Lived Asset and Determining and Recording the Financial Statement Effects of Its Purchase LO8-1, 8-2 (The following information applies to the questions displayed below) On January 2, Summers Company recelved a mochine that the company had ordered with an invoice price of $88,000 Freight costs of $800 were pald by the vendor per the soles agreement. The company exchanged the following on January 2 to acquire the machine: a. Issued 2.700 shares of Summers Company common stock, par value $1 (market value, $3.50 per share) b. Signed a note payoble for $65,000 with an 9.0 percent interest rate (principal plus interest are due April 1 of the current year) c. The balance of the invoice price was on account with the vendor, to be paid in cash by January 12. On January 3, Summers Company paid $2,200 cash for installation costs to prepare the machine for use. On January 12, Summers Company paid the balance due on its accounts poyable to the vendor. P8-1 Part 3 3. Indicate the effects of the purchase and subsequent cash payment on the accounting equation. Note: Enter decreases to account categories as negative amounts. c. Ine patance of the mnvoice peice was on accouns witr the vencor, to oe poic in casn by January 14 . On January 3. Summers Company paid $2.200 casth for installauon costs to prepare the machine for use: On January 12. Summers Company paid the balance due on its accounts poyable to the vendor. P8-1 Part 3 3. Indicate the effects of the purchase and subsequent cash payment on the accounting equation Note: Enter decreases to account categories as negative amounts. year). c. The balance of the invoice price was on account with the vendor, to b On January 3, Summers Company paid $2,200 cash for installation cost On January 12. Summers Company paid the balance due on its accounty Part 3 Indicate the effects of the purchase and subsequent cash payment on the : Enter decreases to account categories as negative amounts. Required information E8-4 (Algo) Determining Financial Statement Effects of an Asset Acquisition and Depreciation (StraightLine Depreciation) LO8-2, 8-3 [The following information applies to the questions displayed below] During Year 1, Ashkar Company ordered a machine on January 1 at on invoice price of $23,000, On the date of dellvery. January 2 , the company pald $9.000 on the machine, with the balance on credit at 11 percent interest due in six months. On January 3, it paid $500 for freight on the machine. On January 5 . Ashkar paid installation costs relating to the machine amounting to $2,700. On July 1, the company paid the balance due on the machine plus the interest. On December 31 (the end of the accounting period), Ashkar recorded depreciation on the machine using the straight-line method with an estimated useful life of 10 years and an estimated residual value of $3,600. E8-4 Part 1 Required: 1. Indicate the effects of each transaction on the accounting equation. Note: Enter decreases to account categories as negative amounts. If the transaction does not impact the accounting equation choose "No effect" in the first column under "Assets

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started